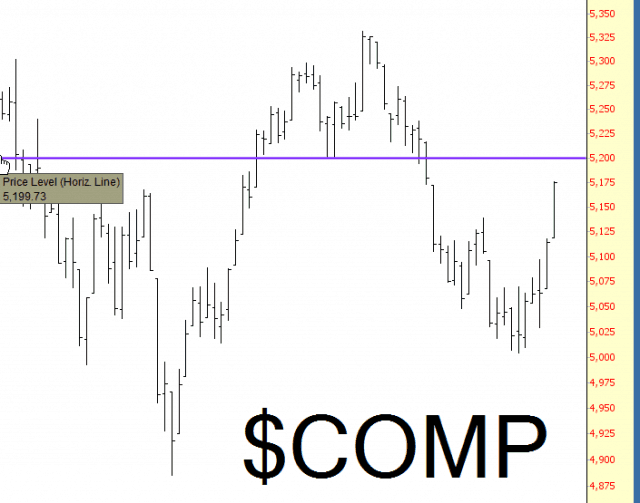

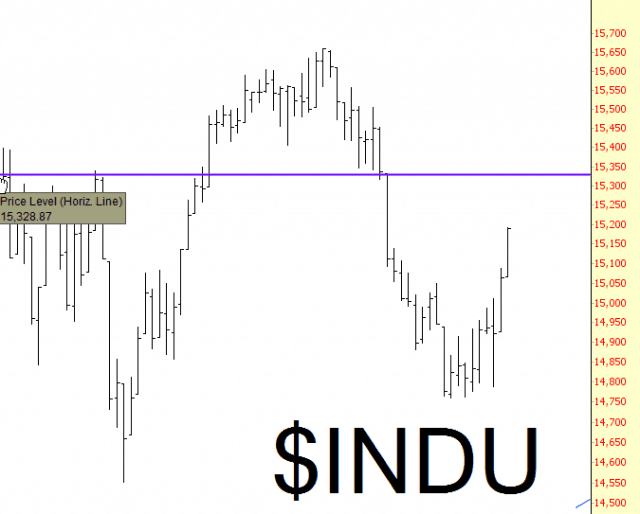

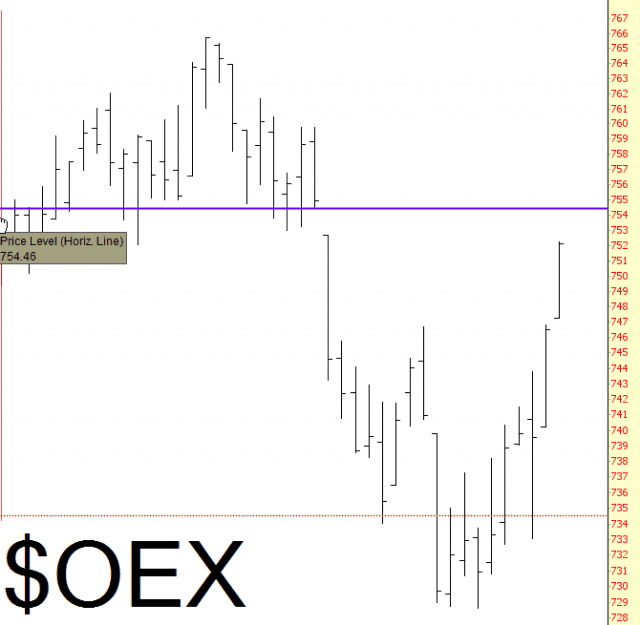

The bearish case for September is still intact, but pretty badly damaged by the six trading days we’ve had thus far. I’m actually kind of glad the whole “Syria” thing seems settled; the last thing this market needs is something else muddying the water. Now we can all obsess about next Wednesday. Anyway, these are the levels that I think represent important lines in the sand for the big indexes:

I would also point out that the continued ascent of interest rates doesn’t appear to be a one-day wonder. We are making continued headway above the red trendline, and if TLT can really start tumbling this week, the Fed is going to have an ugly problem on its hands.

I’ve bumped up my portfolio commitment from 66% to 80%, with particular exposure on the short side in the real estate sector.