Well, I am now in New Hampshire, safe and sound. I appreciate everyone’s patience with my travels. As I’ve said repeatedly, things will return to normal, such as they are, on Monday morning.

I wanted to talk a bit about Apple, which has been dropping hard lately. I certainly am no permabear on Apple. Back on November 14th, I told my Slope+ readers that I felt Apple was headed to a “triple nickel” price figure (which it did, and a bit more), and on December 2, I suggested it was time to take profits. I personally don’t trade AAPL much myself, even though it’s one of the most heavily-traded instruments on the planet.

Over the years, I’ve observed Apple is a very news-driven company, and when some particulary gigantic event strikes, it’s typically a great time to short the stock. I remember vividly that everyone in the Silicon Valley was jizzing their jeans when Apple won a multi-billion dollar judgment against Samsung. Following that news, I believe Apple reached its lifetime peak that very week.

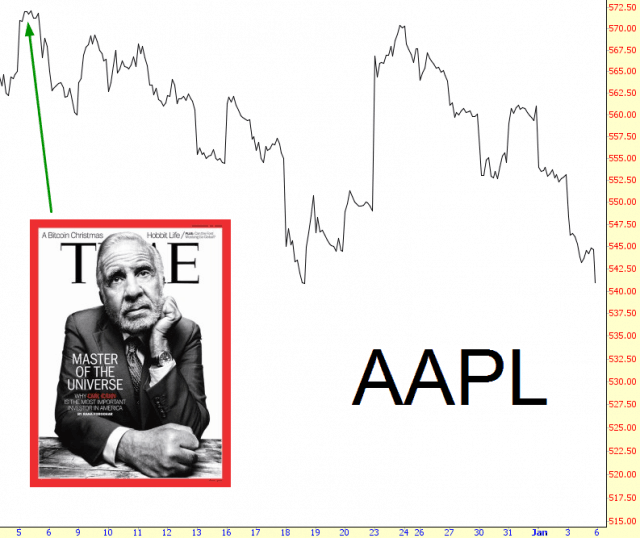

More recently, early in December, there was the news that they was a deal to get into the huge mobile market in China. The news was over the weekend, and the stock zoomed higher first thing Monday. At the same time, Carl Icahn’s hideous, ogre-like face appeared on Time magazine. The “cover curse” from Time is well-known, and the moment I saw that cover (swiftly averting my eyes afterward), I knew that anything related to this grotesque individual should be shorted.

I suspect Apple will find stability again at about $510. But my long-term belief about Apple is that their best days are behind it. Tim Cook, while surely a capable technocrat, strikes me as a charisma-free manager that will just keep nudging the company along as a profitable, yet no longer visionary, behemoth. For those looking for the great company of tomorrow, I’d suggest peering elsewhere. Particularly if Icahn’s face has anything to do with it.