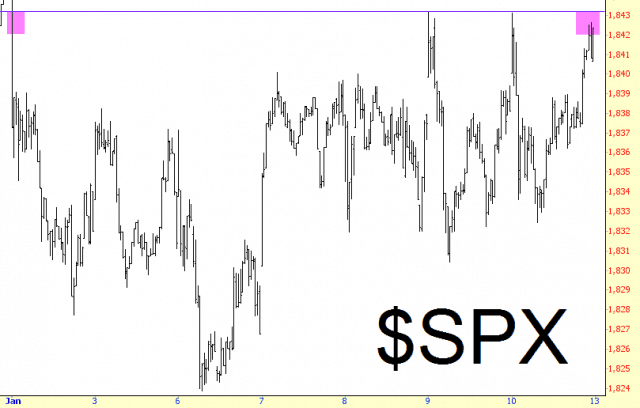

Seven days into the trading year, things are hardly off to a well-defined start. The NASDAQ is down five hundredths of a percent. The Russell 2000 is up hundredths of a percent. In other words, it might as well be the opening bell on the first of the year again. There’s not a damned thing happening. One glance at the S&P 500 year-to-date shows how aimless the market is:

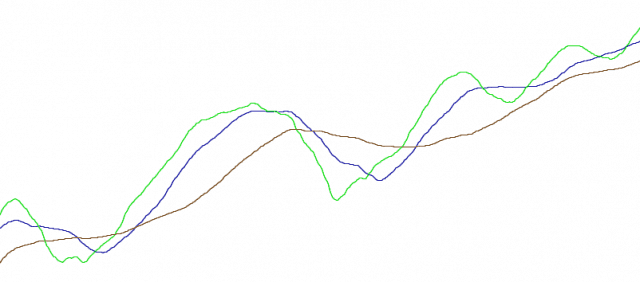

I never thought I’d yearn to get back to the likes of 2010 and 2011, but at least back then we had some dynamism left in the market. Look at the moving averages from back then, without the price data:

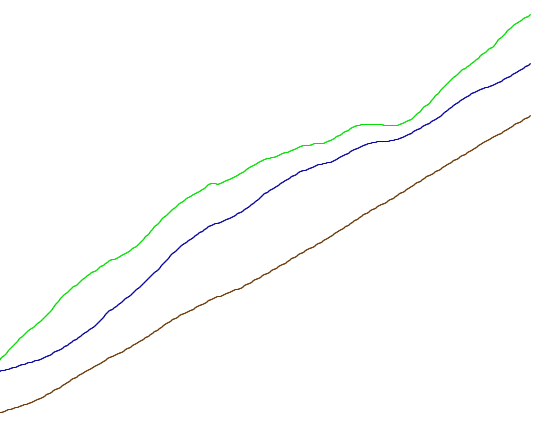

Now look at the same information, except over the past year:

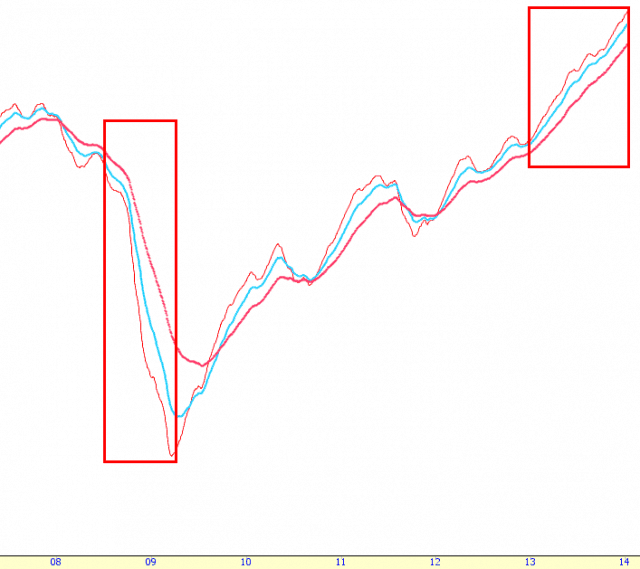

Not a single crossover! Looking over the past ten years, it seems the market is in one of two given phases: either steadily trending (boxed below) or stumbling around to align itself for the steady trend forthcoming. Of course, “steady trends” end at some point. I only hope the current one reverses before the first Martian colonies are inhabited.