The zero sum game of competitive global currency devaluations is on like Donkey Kong. Anyone still sleeping comfortably, confident that all will end well, best brace themselves for a resounding wake up call. Be alarmed, Japan just jacked the joint, and the jerry rigged monetary jig is up. Moving forward, all the other Asian export economies will promptly be forced to keep up with their FUBAR neighbor, the juiced Japanese Joneses.

Each Nation State in the Far East is now completely compelled to competitively devalue in tandem, in order to maintain export market share, in a desperate attempt to avert their outbound container super ship cargoes from running westwards on empty.

Each Nation State in the Far East is now completely compelled to competitively devalue in tandem, in order to maintain export market share, in a desperate attempt to avert their outbound container super ship cargoes from running westwards on empty.

Throughout the new millennium, China has made great technological strides, repositioning itself away from a predominantly low tech manufacturing economy, towards a value added high tech producing exporter. In this capacity it has converged with Japan. The Japanese, on the other hand, over the same time period, have seen both the Chinese and the Koreans, as well as the other Asian Tigers, ravenously devour more and more Hamachi and California rolls, promptly snatched from their stale sushi shop lunch box.

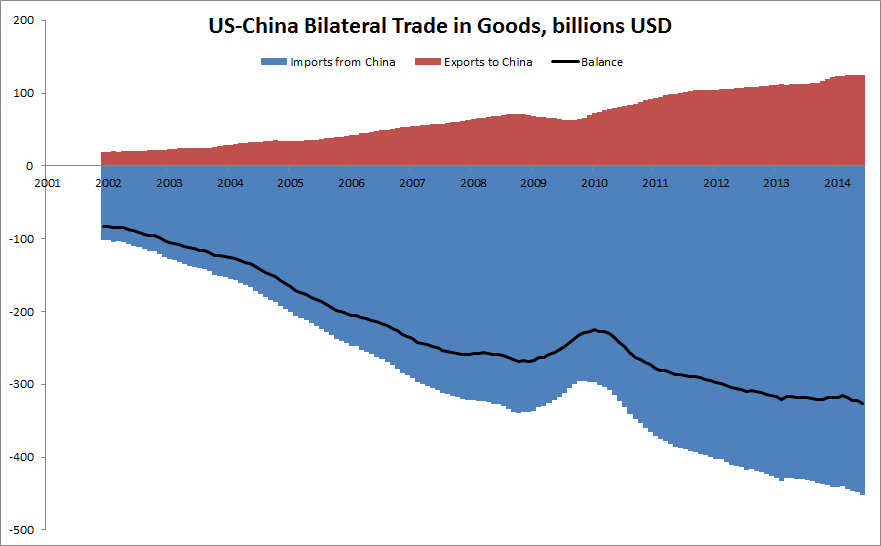

Take one look at the above chart and the official photo op below. You tell me why Mr. Xi nearly gagged when shaking hands with Mr. Abe the other day.

The following excerpt from a Bloomberg article titled; Japan’s Export Reach Three Year Low as Recession Looms, published shortly before Abe’s December 2012 election, clearly outlined the sagging soggy sushi state of affairs:

Japan is suffering its worst year for exports since the global contraction in 2009 as Europe’s crisis, China’s slowdown and a diplomatic dispute with the Chinese hurt manufacturers and deepen the risk of a recession.

Shipments totaled 53.5 trillion yen ($653 billion) for January through October, down 2.3 percent from the same period in 2011, according to data compiled by Bloomberg from Finance Ministry figures released in Tokyo today. The trade deficit for 2012 so far is a record 5.3 trillion yen.

The so-called hollowing out of Japan’s export champions, highlighted by a cut in Panasonic Corp. (6752)’s debt rating to one step above junk status by Moody’s Investors Service yesterday, underscores the urgency of kindling domestic demand. Japan’s political parties are facing off ahead of an election next month on how hard to press the central bank to boost stimulus.

Japan’s exports fell for a fifth month, hampered by trade tensions with China and weak demand in Europe, pushing the world’s third-largest economy closer to recession ahead of December elections.

No wonder the hapless Captain Abe, slipping on his sinking sashimi ship, immediately pulled the ripcord releasing the emergency currency life boat, in a desperate effort to rapidly inflate the fiat rescue raft with fresh Yen air. Can you really blame him? After all, the Chinese have been buying a gazillion dollars’ worth of U.S. treasuries in order to suppress the value of their own Yuan for years now. Although, lately the politically charged Yuan soft peg to the dollar has become a real problem for them, acting as a straightjacket for the Chinese, who will have to renegg on the peg in short order, as their currency has now appreciated 50% against the Yen since mid-2012.

This from Ambrose Evans-Pritchard at the Telegraph last week:

……………..no country can stand idly by as neighbours dump toxic deflationary waste on their front lawn. Korea has threatened to force down the won, pari passu with the yen. The central bank of Taiwan has been intervening.

These skirmishes are happening in a region of festering grievances and territorial disputes, with no Nato-style security structure – or for that matter EU-style soft governance – to damp down fires. The spokes of the diplomatic wheel connect by a perverse geography to Washington, a city retreating from Pax Americana……………

………..China is in effect strapped to the rocketing dollar through its quasi-peg, increasingly a torture machine. George Magnus from UBS says this cannot continue. “What is happening in the property market is the tip of the iceberg for the whole economy. China will have to resort to monetary reflation over the winter, and I think this will include a lower yuan. We are heading into a currency war,” he said.

This looks all too like a replay the East Asia storm of 1998, when a tumbling yen triggered a Chinese banking bust and pushed Beijing to the brink of devaluation. Washington defused the crisis by stabilizing the yen, and by promising China membership of the World Trade Organisation.

It will be harder to repeat that trick in these deflationary times. The clear danger is that China will feel compelled to defend itself, throwing its huge weight into a beggar-thy-neighbour battle across East Asia.

Should that happen, the mother of all deflationary shocks will roll over Europe before the EU authorities have even got out of bed.

It was all good while Uncle Sam’s force fed extreme global trade imbalances were rocking and rolling on seemingly endless cheap U.S. credit, but that free ride has been bouncing along the bottom of the ocean these days, and may well be about to hit some very jagged rocks. Be assured, extreme trade imbalances are not a good thing. As Aristotle once said; Extremes are bad”. The massive capital and current account imbalances that global trading partners have been irresponsibly running over the past 25 years are coming home to roost. The end result will be nothing short of shock and awe.

Ok, so we get the picture, all the nations on the Pacific rim side of the globe are now locked into a monumental mortal martial arts fiat food fight for the ages. As world’s GDP continues to falter, the gloves will come off, plates will start to fly, and eventually the zero sum situation will end up in crazed Kamikaze currency raids battling for each others industrial export capacity. The trouble with all of this, of course, is that for the overall world economy it’s nothing short of committing Hari Kari. Let’s move on to the west, and check in overthere, shall we.

Ok, so we get the picture, all the nations on the Pacific rim side of the globe are now locked into a monumental mortal martial arts fiat food fight for the ages. As world’s GDP continues to falter, the gloves will come off, plates will start to fly, and eventually the zero sum situation will end up in crazed Kamikaze currency raids battling for each others industrial export capacity. The trouble with all of this, of course, is that for the overall world economy it’s nothing short of committing Hari Kari. Let’s move on to the west, and check in overthere, shall we.

Europe is certainly mired in what can only be viewed as a structurally cemented recession bordering on a depression. And guess what, the largest economic block on the planet exports a ton of stuff around the world. So, like China, they too will get swamped by Admiral Abe’s crushing counterfeit currency wave. In fact, the Eurozone actually exports more to the USA than China does. Last year, the EU sent us a whopping total of just under $600 billion worth of merchandise, whereas the Chinese came in at a distant $440 billion. Make no mistake, as the Pacific rim fake fiat food fight heats up, you can bet your bottom EURO that the Frogs and assorted Eurotrash will join right in, heaving their devalued moldy Camembert and debased wienerschnitzel right over the counter towards the others.

Where’s the end game in all of this you ask? Well, so far, the USD seems to have dodged the flying currency cup cakes. The strict adult monitor in the mess hall is not partaking in the flying fiat food fest. As such, many macro mavens are touting the second coming of king dollar as a sure sign of the rebirth of the renown American exceptionalism which has brought about yet another economic renaissance, fantastically fueled by an endless reservoir of ingenious technology and new found shale energy. Myself, I wouldn’t break out the pompoms quite so fast.

The last thing the U.S. needs is more hot money capital piling into the dollar from overseas, and the last thing faltering overseas economies need is massive capital flight due to the unwind of the gratuitous carry trade racket. Talk about the potential for an out of control capital flow velocity vortex. These thing have a tendency to pick up intense momentum all at once as they unwind themselves from years of being systematically methodically built up over time. Think of it as the mad rush for the exits at a packed MLB stadium right after the opposing team hits a grand slam, tacking on another 4 runs in the top of the Ninth having already led the game 3 – 0.

An appreciating dollar has several very serious unintended consequences. Clearly, one issue is that it will create headwinds for the newly revitalized export sector which had been one of the substantive bright spot for the U.S. economy over the past few years. Another prickly problem is as the devalued overseas capital flows seek refuge in the USD from the deliberate debasement abroad, it will serve to only exacerbate the already frothy asset bubbles which have been steadily forming in most asset classes (Stocks, Bonds, Real Estate, Art, Collectibles….etc).

Finally, and most importantly, it will create a massive deflationary wave, which is the last thing the largest debtor Nation in the history of the planet needs. In fact, this is the Fed’s worst nightmare. Not only does it increase the real cost of our massive external sovereign debt loads, but also, the subsequent strong dollar deflation will further depress the velocity of money which already sits at historic lows. And therein lies the rub. How is the Fed going to achieve its wet dream of 2% inflation that it deems to be so crucial to generating the escape velocity that is essential for self sustaining economic growth? I’m afraid, my friends, that the only answer the FED has in store for us will be more of the same.

I’m afraid, my friends, until we pry the printing press from their cold dead hands, the only answer the FED has in store for us will be more of the same. Can you say QE 4.0?

Welcome to the Keynesian circle jerk end game. Picture a dog chasing its own tail until it finally drops from exhaustion, let’s call our dog “Fido Fed”.

Les jeux sont fait, let the games begin. Got Gold?

Bonsoir from la belle France mes amis

Bonsoir from la belle France mes amis

The StealthFlation Blog