Over the years I have been dogged like a junk yard dog latched onto a bone about trying to show entrepreneurs, business people and a like insights as to help work through the clutter and get about creating, formulating and running their enterprises in a manner that helps them reach their objectives.

One of the hardest things (as well as potentially business curtail of my own business for after all I am in the motivation business) is pointing out that what is being shown as “a rose” is not a rose. And as a matter of fact if you looked closely not only could you see, but you would see for oneself the scent is anything but “sweet.”

I do this for many reasons, but the (and by that I do me The) main reason is: I believe with all my being that if and when the ugliness of this painted picture economy does show its true face – it will be the prepared entrepreneurs, as well as anyone else in business that will reap rewards not seen in maybe a generation.

But (and it’s a very big but) that means exactly that – the prepared. i.e., The ones that understand true business fundamentals, economics, net profit, as well as others such as; that there are times to accumulate debt (yes I said that) times to shed debt, and times to maintain debt. It’s in the knowing of the when’s, and the why’s that separates the successful from all the rest.

All that said (for I could go on, and, on) let me use today December 23, 2014 as empirical evidence to make my case.

Many of you may have already heard (for it is being cheered everywhere) that the U.S. economy for Q3 just posted a print of 5%. That’s not a typo, that is the highest Q3 print since (wait for it….) 2003!

That would mean that Q3 of this year is better, more spectacular, than any other Q3 in 11 years. That proposes during the boon of the 00’s where people could get a loan just for lying.

Housing and everything entailed within it was off the charts with construction, new home sales, all those construction jobs, and much more. Yet, this Quarter, was better than any single one of them? Think about that in honesty. Do you think with what you know today, and what you that lived and worked through those past 11 years; do you believe today is “the best?” I believe you see my point.

Now let me show you 3 screenshots I took as I was writing this to illustrate. First is the front page of Bloomberg’s™ web site. What I would like you to do is read the headline, then look below and read the lines I underlined in red and see if it helps square the circle – or just leaves a hole.

First line is the consumer spending within the GDP that beat the forecasts (remember this beat it’s important)

First line is the consumer spending within the GDP that beat the forecasts (remember this beat it’s important)

Second is New home sales “Unexpectedly fall to a four-month LOW” ( But this GDP beats when we had the absolute best, so why do we need housing to go up at all if we can do 5% without it? Right? It doesn’t fit.)

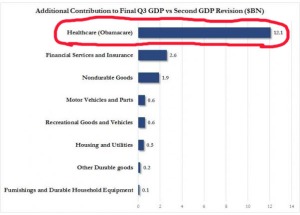

Third line is durable goods (what was the most important item in the GDP report to make a good report) Increased? Nope, surprisingly – Declined! Again, if we don’t need housing, nor a durable good to make a great giddy styled print in the GDP you must be asking – then what did? To Wit:

See that top line circled in red I drew? That is the reason, the category, the only input that made it possible for a GDP print of 5%. Spending for healthcare aka Obamacare. You can read the original article and breakdown here at ZH if you wish.

That means because of forced increases in peoples expenditures because of healthcare costs rising (which is now considered a “consumer spending.” Remember earlier when I said for the first line where this figure came from was important? Now you know. If you’re healthcare costs go up, that’s now considered great for the economy. This line of thinking leaves no issue with considering if your tax burden goes up, that is also “good for the economy.”

Currently as I type I am listening to one financial analyst after another along with commentators touting the 5% number as if they were 14yr old’s discussing boys and girls. And just when I think I’ve heard it all I hear some market maven tout how “this proves the fundamentals in the market are sound.”

I keep looking around to see if a chaperone will come on the set and escort the kids off and bring on the adults. But alas, not only are they the adults, they’re touted as “the smart crowd!”

If you don’t think these headlines are going to be force-fed on the general public all week-long from everywhere; I’ll leave you with one last screen shot. It’s from the Drudge Report™.

Just remember, if you are reading this – you are leaps and bounds more informed to take advantage of opportunities when they arise than I would estimate 90% of anyone you may consider your competition.

And that’s a first mover advantage worth it’s weight in gold in my book. If not possibly – priceless.

© 2014 Mark St.Cyr MarkStCyr.com