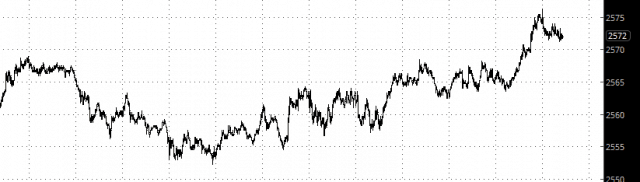

You’re going to hear a quintet of words many times over the next day: “All Eyes On The Fed“, as the bloodied financial world prays that Jerome Powell will have absolutely no backbone at all and, out of fear of getting a mean tweet from the President, will cease raising interest rates. This morning, we can also see the hope that he will in fact wilt built into a saucer pattern on the ES:

I am acutely aware of the risk that Powell may have absolutely no character and will fold, thus causing equities to eke out some kind of countertrend rally in celebration. I am thus being terribly picky about what positions I am going to permit to be subjected to that kind of risk.

However, as I said yesterday, if on Monday morning I basically said “damn the risk” and turn the computer off, my profit would have been Super Obscene instead of merely Obscene, because things are falling apart with such hearty verve.

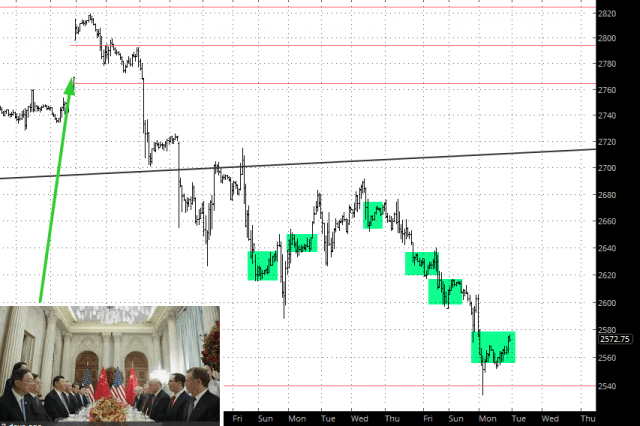

The aforementioned saucer may seem like a “Buy Everything” kind of event, but ever since the so-called Trade Truce, there have been declarations that This Is The Bottom for every…………single……………..day.

I lived the better part of 2018 with a knot in my stomach, announcing on my tastytrade show on a near-daily basis that indexes were “once again at the highest points ever seen in human history.” I am delighted and relieved to know that the only chart I can point to now with that characteristic if the number of Slope of Hope premium subscribers. It’s quite heartening after all the hard work and expense that went into it.

I’m going to play Tuesday morning pretty much like I did Monday. One chart at a time. One stop at a time. And try to keep my wits about me. Sometimes, that actually works.