Equities bottomed early on Wednesday the 26th and rocketed higher, partially undoing the damage for the Christmas Collapse. The Dow managed to tack on about 1500 points to its low, and I suspect equity bulls will enter 2019 limping but relatively optimistic.

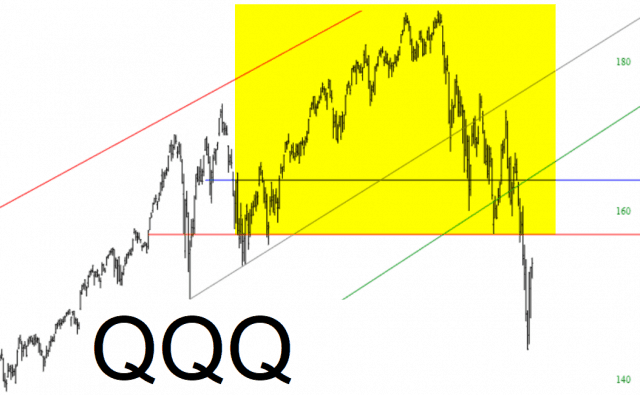

As I look at the charts, some of them make me wonder “is that all they’ve got?” In other words, it only took a few trading days to push prices back up to shortable levels, such as with the NASDAQ:

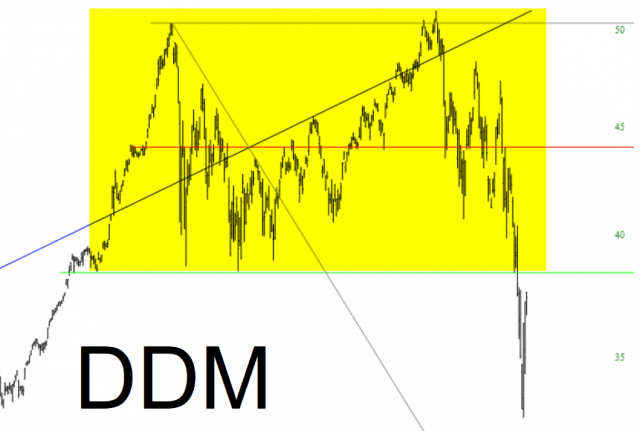

Or the “Ultra Dow” (this is a two-times leveraged fund against the Dow 30):

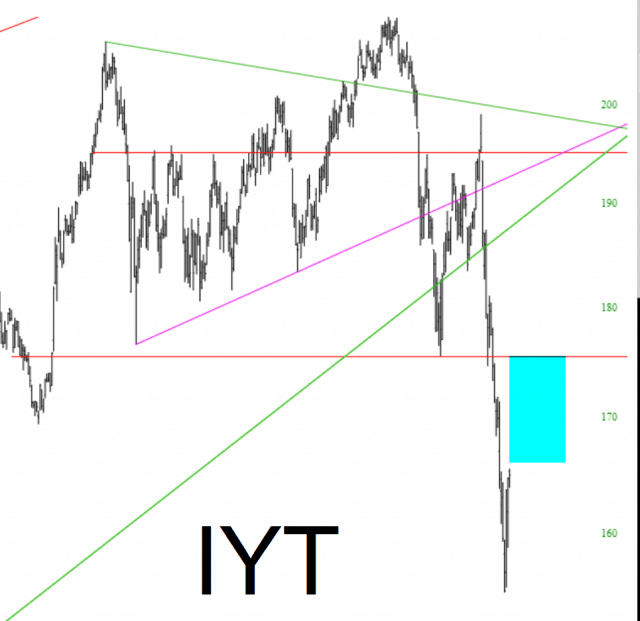

But I’m inclined to be patient. “Three days does not a recovery make”, as the sage might say, and there are plenty of other charts that look only “half-healed”, such as the Dow Transports……..

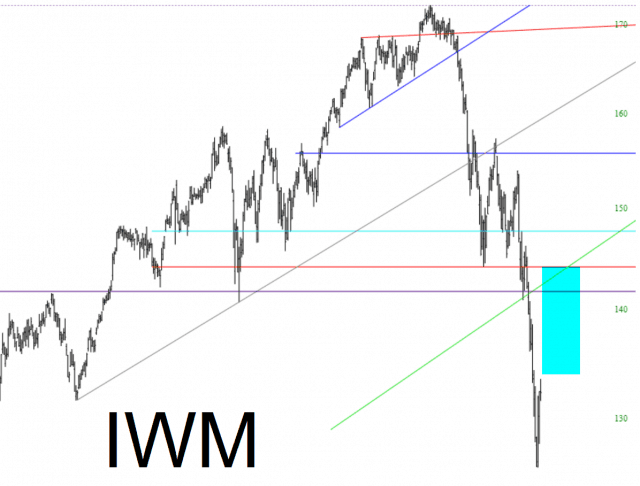

…..and the small caps, by way of the Russell 2000 ETF:

I tried on both Thursday and Friday to get cute and try to short some stocks that seemed they had a chance to weaken, and I got burned on every single attempt. I decided to just keep life simple with my “one and only” short of TLT, whose purpose is largely to be a governor against my impulses to get bearish on equities again.

In closing, the entirety of my positioning is as follows: in my big account, I’m short TLT, and that’s it. In my little “just for fun” account, I remain long GUSH (triple-bullish on energy producers), long FAS (triple-bullish on financials), and long TLT puts. I also am long QQQ puts (small starting position) and EWZ puts, although I suspect those are going to stink for a little while. They don’t expire until March, however, so I’m OK with them.