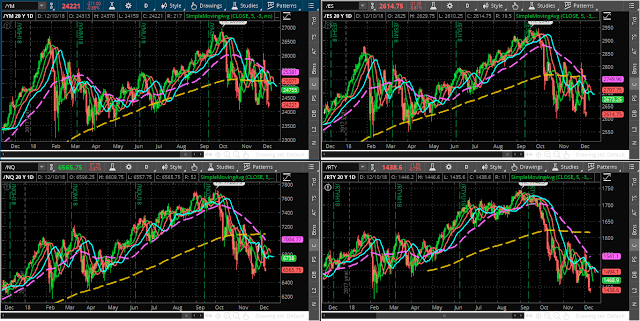

Further to my post of December 2, it’s evident from the following daily charts of the four U.S. E-mini Futures Indices that they all broke and closed below both their “chaos zone” (the trio of future-offset 5, 8 & 13 MAs) and their 50 & 200 MAs, respectively, last week…a failure to hold above those major support levels.

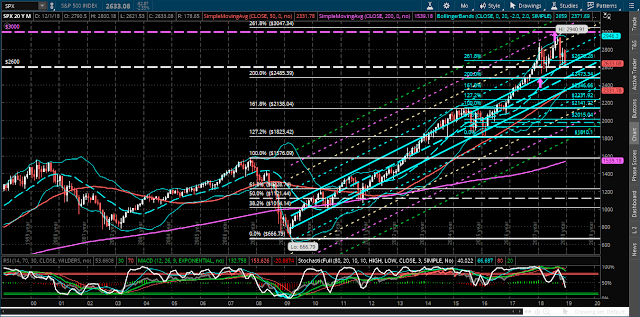

Price on the SPX is currently hovering above 2600, as shown on the following monthly chart.

It’s clearly a major inflection point for a couple of reasons…namely, it’s a major price support level, and it’s right along the upper edge (+1 standard deviation level) of a long-term regression channel from the lows of 2009.

As I stated in the above-mentioned post, the SPX is now in danger of dropping to its next major support level around 2400, as more fully illustrated in my post of August 6.

In fact, 2400 is…

- slightly below a confluence of two external Fibonacci retracement levels around 2473 and 2485

- just above the lower monthly Bollinger Band at 2372

- above a convergence of a -1 standard deviation level of the regression channel with a 161.8% external Fib level at 2347, and the 50-monthly moving average at 2332

Extreme weakness on accelerating downside momentum may just see price reach 2400, or lower, before, possibly, stabilizing.

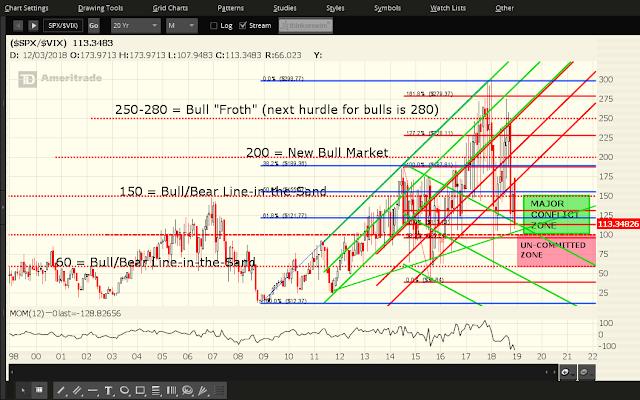

Furthermore, price on the SPX:VIX ratio is well below the Bull/Bear Line-in-the-Sand level and is approaching the 100 level, which represents an extremely volatile zone, as shown on the following monthly ratio chart.

The momentum indicator closed at its lowest historic reading on this timeframe last Friday, confirming that extreme volatility is already present in this ratio.

A drop and hold below the 100 level on the SPX:VIX ratio, together with a drop and hold below 2600 on the SPX could very well see the SPX drop to somewhere around 2400 in short order.