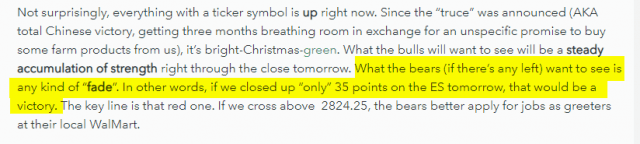

On Sunday, after the Globex markets had exploded in a bullgasm, I wrote this:

Well, the bears (if I dare use the plural noun) got their “victory” today in the form of an ES up about 31 points or so. The peak bullgasm was in the middle of the night, when it was up 50+ points. I’m glad I was sleeping soundly through that. A couple of hours into the regular open, it was looking pretty exciting (red arrow), but some bastards decided to be cute and save the market, so everything closed green across the board today.

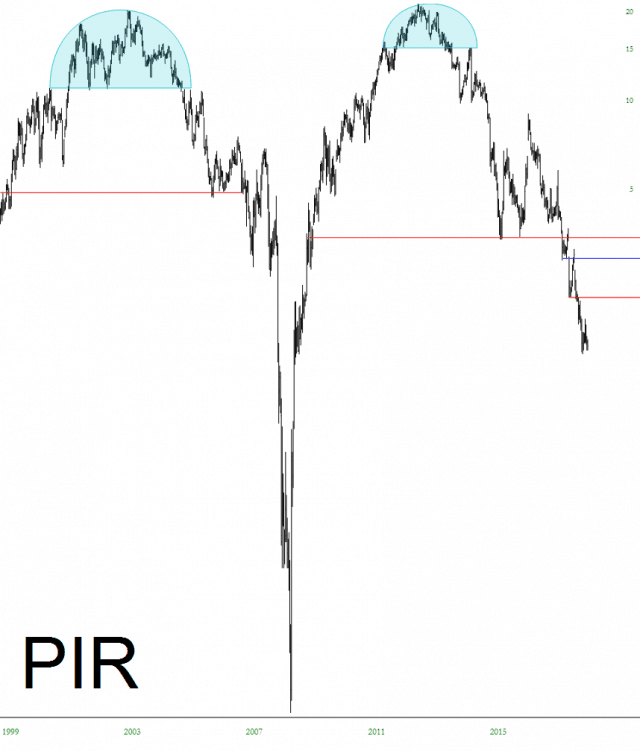

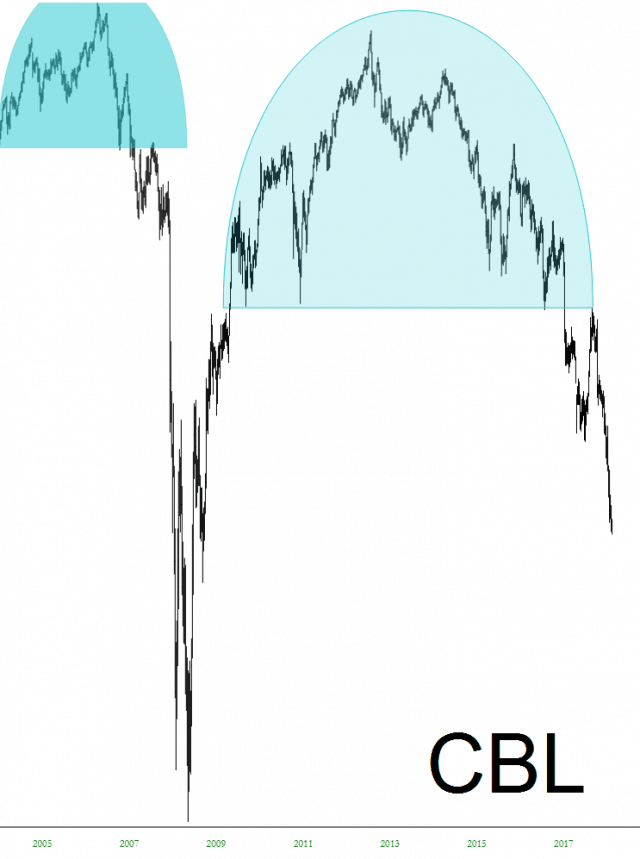

It’s peculiar, because there are some stocks which are independently reliving the 2008 financial crisis all by themselves………it just takes some patience…….

The overall market, however, remains annoying robust. The overall Dow Composite is only about 3.5% beneath its highest level in human history. But the good news for me that this G20 nonsense is over and the good news (“We surrendered to China! Hurray!!”) is fully baked into the market now.

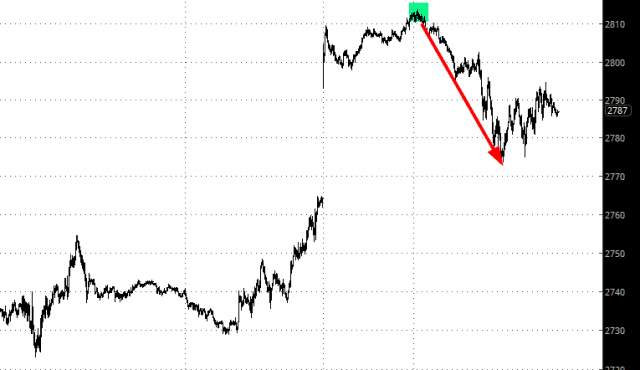

So let’s take an updated look at the Dow Jones Composite:

What I see above is:

- Another “lower high”;

- An approach to the midline (which it may well still reach, although I’d prefer it not bother);

- A CCI which has gone from oversold to overbought………..again.

In a similar fashion, let’s look at the NASDAQ Composite:

Sort of the same conclusions:

- Another lower high;

- A CCI ripping from oversold to overbought;

- Most interestingly, an absolutely perfect tag to the underside of a multi-year trendline

For my own positions, I am still not super-crazy-committed to this market. I have 53 live positions and 50 “waiting in the wings”. I am about 150% committed, up from 86%. So, yes, I’m putting my feet back into the water, but not too deeply.

I have some pretty strong feelings about this market and what is going to happen next, but I think I need to unwind a little. I hope you good people managed the day all right, and I appreciate all the very kind emails I’ve been receiving.