Don’t let my Herculean physique fool you. I’ve never been an athlete. Not even once. In fact, I don’t even like perspiration. The only exercise I get is swimming, and that’s because I don’t have to deal with sweat, which I find sort of ewwww. So, yeah, I’m a man’s man.

My beloved children, however, are all top-notch fencers, and they tour internationally. We travel as a family, the gallant Knights and their swords, which on occasions like this pulls me somewhat away from my normal prolific nature.

During a bout today, my daughter’s coach yelled out from the sidelines, in his thick Ukrainian accent, “Who’s winning??” It isn’t the first time I’ve heard this. What he’s telling her is that she needs to change her behavior. Because she was already ahead by so many points, she needed to change her strategy. More confidence. A slower pace.

I’m reminded of this because of how this quarter has been going. In spite of the best efforts of those whose interests are tied directly to the equity markets (including a certain somewhat who, months ago, threatened the “beautiful, beautiful 401ks” of the public if they ever turned against him), worldwide markets have been falling to pieces. Thank God.

Long-time readers know I don’t just consider this a mathematical curiosity. This isn’t just because I like to dabble in charts. This, to me, is an epic point in history about light versus dark. Truth versus lies. Good versus evil. You can probably guess which side I consider myself (and non-dissenting readers) to be on. So here we are. This is my passion play.

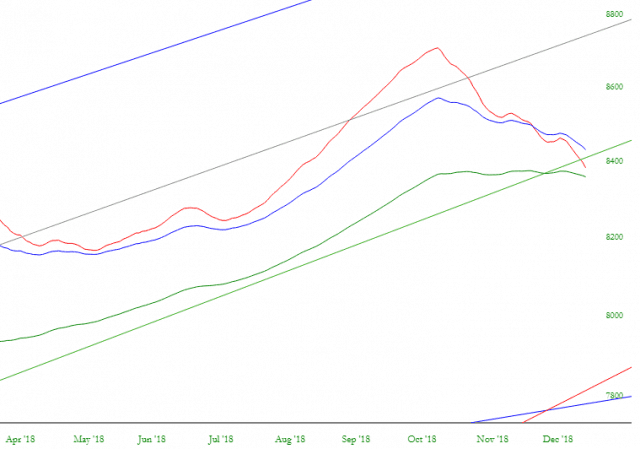

Last week was a comic tug-of-war between these two respective sides. There would be some baseless rumor, or ridiculous tweet, or some ostensibly encouraging press dispatch, and prices would get bid up. But then, inconveniently, some kind of truth or facts would manage to leak out, and prices would scuttle down again, as God intended. And so we wound up with a Dow Jones Composite that’s looking an awful lot like this:

And, consequently, moving averages which weren’t exactly screaming “buy me, because this is a very safe market that will make you a fortune….”

Naturally, I am seeing more and more protests and howls amongst the investing talking heads about how Cheap this market is and how the Bears Are Wrong. It’s the same sort of mindless chatter that the crypto-creeps have been spouting for an entire year, as their ridiculous Bitcoin, Ethereum, and Ripple have slumped almost all the way to $0.00, their true value.

And so we have it with equities. Any time things start to get rather weak, some chowderhead will screech about how a “Face-Ripping Rally” is just around the corner.

Out of all the metaphors and sayings bandied about in the world of trading, I find this one the most abhorrent. For one thing, it is directly against my beloved bearish brethren, whom I adore. And secondly, it is a violent image, which also reveals the vicious and sadistic nature of equity bulls, whose only clumsy response to sensibility is a vile pontification about the physical woes that are about to befall the bears. The raw intellect of the bears has to grapple with the mindless welfare queens on the opposing side.

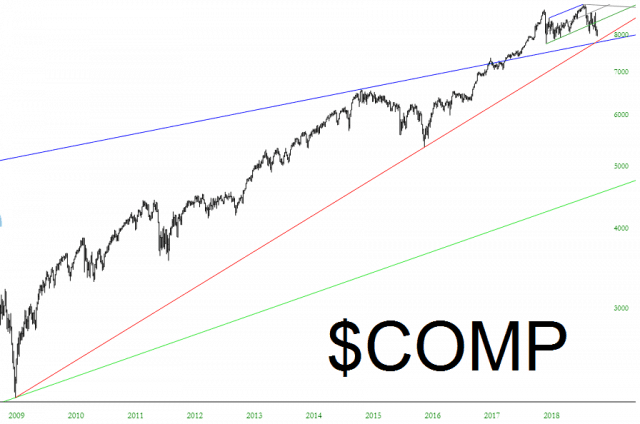

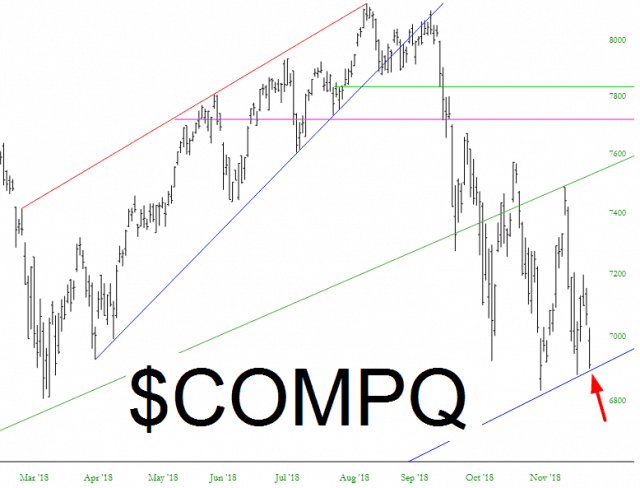

We are down to the final ten days of the trading year, and I’ve got to say, things are starting to get awfully interesting. The NASDAQ Composite is a good sneeze away from a total ten-year trendline failure.

And the Volatility Index looks poised to potentially explode back into the 30s.

Of course, some cash indexes have already broken their long-term trendlines. The S&P 500, for example, has done so, and if heavenly father smiles upon his ursine children, we will take out this year’s lows.

Taking a much longer view of the S&P 500, we can see the importance of the trendline failure. Unlike the massive “coordinate global response” launched by central banks in February 2016, this breakdown was not aborted. Take out the lows of early February 2018, and all holy hell is going to break loose.

The Russell 2000 small caps has likewise broken its long-term trendline. It is also sporting the best head and shoulders pattern I’ve seen in at least ten years.

So maybe my own inner coach needs to be screaming “Who’s winning??” to me as well. I am aggressively positioned, to be sure, but not pedal-to-the-metal. In truth, the crowd persistently calling for the aforementioned “face ripper” probably plagues my soul and restricts me from going 300% short instead of merely 200%, as I am now.

But I think we have a perfectly good chance at looking back at 2018 at the year that everything changed. And the tens of trillions of dollars which have been poured into this illusion – – this fantasy – – this phony phantasm – – is going to yield nothing more than a historical footnote about a brief span in time when asset valuations hit record levels just before the earth was subsumed by chaos, mayhem, and fury.

And there will be no one enjoying it more than one man and his $35 Dell laptop.