Over the long Easter weekend, I wanted to share a few excerpts from my financial history book, Panic, Progress, and Prosperity. Here’s today’s piece:

No other commodity in the modern age has affected the world stage as much as oil. As a basis for any modern economy, crude oil is second only to water as the liquid perceived as vital to life, and the global political stage – particularly since 1970 – has been largely shaped by the price movement of oil in the financial markets. No wars have been fought over corn, pork bellies, or gold. In modern rhetoric, oil has been made the figurative equal of blood.

The popular perception of OPEC is that it is an all-powerful cartel of Middle Eastern countries that has unilaterally set the worldwide price of crude oil to maximize profits, to the chagrin of industrialized Western countries beholden to its decisions. The truth is far afield from this set of common assumptions.

The model for OPEC is actually an American creation called the Texas Railroad Commission, which was established late in the 19th century in order to, as the name suggests, regulate railroads. As the 20th century dawned, and the decades passed, the domain of the TRC began to spread far beyond just rail lines, particularly with respect to energy resources. In spite of its name, the modern-day Texas Railroad Commission holds sway over many local industries with one notable exception: railroads.

The TRC’s control of production levels in the oil industry gave it tight control over oil prices for most of the 20th century. Although it was established in Texas, the TRC was a crucial arbiter for the “Seven Sisters” – the big U.S. and Dutch oil producers – since no other body was so influential in controlling the price of crude oil. The countries outside of this domain closely studied the TRC’s practices and effectiveness, since they had ambitions of their own about being bigger players in the global energy markets.

For much of the 20th century, oil was a relatively cheap, plentiful commodity, and the focus of the TRC was to suppress production levels to avoid a repeat of the crash in oil prices that Texas suffered in the 1930s, when a barrel of oil could be had for as little as twenty five cents. The principal oil-producing states of the U.S. (Texas, Louisiana, Oklahoma) had excess oil capacity, and the TRC had to regulate the flow in order to keep the price high enough for industry profitability. This was not always an easy task, since it is always tempting for any member of a cartel to break ranks and increase their own profits by selling more of the product in question, but the TRC had been a consistent-enough enforcer of production ratios to garner the obedience of the oil producers in its domain.

After World War II until the end of the 1960s, the nominal price for oil remained within a relatively narrow band of $2.50 to $3.00 to barrel, which in inflation-adjusted terms spans from $17 to $19. Oil and its by-products was typically American, and always cheap, which led to a boom in large, gas-guzzling American automobiles. There was little need for energy efficiency on either the road or in gas-heated households. America had more oil than it knew what to do with.

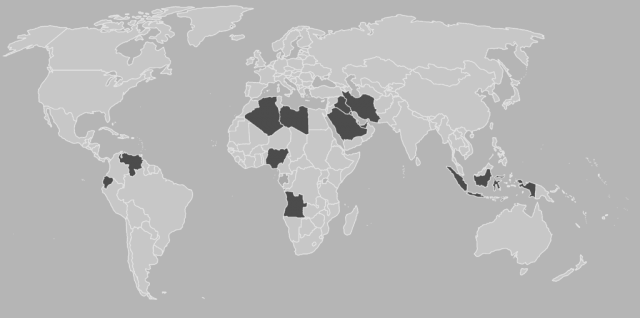

Around this time, in 1960, OPEC was founded by five member countries: Iran, Iraq, Saudi Arabia, Kuwait, and Venezuela. So even from its inception, OPEC was not an entirely Middle East entity. In the decade that followed its founding, other countries joined the organization: Algeria, Libya, Nigeria, Qatar, Indonesia, and the United Arab Emirates. So while OPEC had a strong Arabian presence, it actually spanned three different continents.

It was also not omnipotent. On the contrary, OPEC was itself largely at the mercy of the TRC’s price-setting, and infighting among OPEC’s own member-nations did nothing to boost the selling price of their oil. Throughout the 1960s, a barrel of oil was very consistently about $3 per barrel in nominal terms, but taking inflation into account, OPEC members were getting less and less for their commodity.

As the 1960s came to a close, the United States had its own “peak oil” moment. The amount of oil that U.S. producers were able to take from the ground started dropping, and restricting the output from U.S. oil producers disappeared as a concern relevant to commodity pricing. In March 1971, the TRC made a surprising announcement: for the first time in its history, it would place no restrictions on the amount of oil that producers could sell.

The implication was clear: the United States was putting as much oil on the market as it could find, and the rest of the oil-producing world now had a golden opportunity to fulfill a need for the remaining demand.

A series of unrelated events in the early 1970s conspired to sent prices for oil skyrocketing to levels never seen, and at a pace no one could anticipate.

The first event was TRC’s abandonment of production restrictions. It would render the Texas Railroad Commission largely irrelevant to energy prices from that moment forward.

In 1971, the Nixon administration abandoned the direct convertibility of U.S. dollars into gold. This abandonment of the Bretton Woods gold standard meant the value of the U.S. dollar begin to fall immediately, setting off asset inflation across the board. In just a couple of years after the decoupling of the dollar from gold, lumber prices increased 42%, food prices nearly doubled, and oil would make an ascent that would completely alter the geopolitical world stage.

When the Nixon administration took the U.S. off the gold standard, it also put into place a number of price controls, including a government-sanctioned selling price for domestic crude oil. One curious twist to this was that the U.S. enforced the pricing mechanism only for “old” domestic oil – that is, oil that had already been discovered. Newly-discovered oil would be permitted to float in price with the rest of worldwide crude oil market. United States oil producers were thus compelled to simply not sell “old” oil, creating a scarcity in the market that normally would not have existed.

Nixon’s price controls distorted the normal mechanisms that allow a free market to function, and early in 1973, everyday Americans were already starting to have trouble filling their gas tanks. Some stations could not find any wholesale gasoline. As the New York Times reported it:

With more than 1,000 filling stations closed for lack of gasoline, according to a Government survey, and with thousands more rationing the amount a motorist may buy, the shortage is becoming a palpable fact of life for millions in this automobile-oriented country.

Crude oil was about to get a shock much greater than what the United States had already inflicted upon itself with inflation: on October 6, 1973, Syria and Egypt commenced an attack on their neighbor, Israel. Not only was it a surprise attack, but it was scheduled on the holiest day of the Jewish calendar, Yom Kippur.

Israel frantically scrambled their aircraft, equipped their planes with bombs and missiles, and went on full nuclear alert. The United States voiced its support for Israel and made clear it would continue to supply Israel with the arms it needed to defend itself.

In retaliation, the Arab subset of OPEC, named OAPEC, announced an embargo on oil exports to specific countries that, in their opinion, supported the Israeli state. The sudden elimination of imported oil from these major producers meant that over 7% of regular oil output was now unavailable. This, coupled with the tension that surrounded the war, pushed crude oil prices much higher that Autumn. Making the situation even worse, the Persian Gulf countries announced on January 1, 1974 that the price at which they would be selling their oil would now be doubled.

It is no coincidence that the oil shock of the autumn of 1973 pushed the U.S. into a recession, which officially commenced November 1973. Between October 1973 and January 1974 – a mere four months – oil prices quadrupled. With worldwide economies depending upon energy as the basis for day-to-day functioning, an unexpected 300% increase in a daily expense was a terrible blow.

The Yom Kippur War was very short-lived, but its effects were long-lasting. Secretary of State Henry Kissinger negotiated with Israel and got them to agree to withdraw from politically-sensitive parts of Syria. Although negotiations were still ongoing in early 1974, the prospect of a settlement with Israel was sufficient for OAPEC to lift the oil embargo in March 1974.

Although the war itself was done, the impression that OPEC had made upon the world – – and, in turn, upon itself – – was permanent. Only recently had OPEC felt largely helpless in its role on the world energy scene. Now it found it could singlehandedly cause a massive upward shift in oil prices and provide itself a powerful position at the bargaining table. The resentment Western countries and their citizens felt toward OPEC’s actions would shape the political landscape for decades to come.