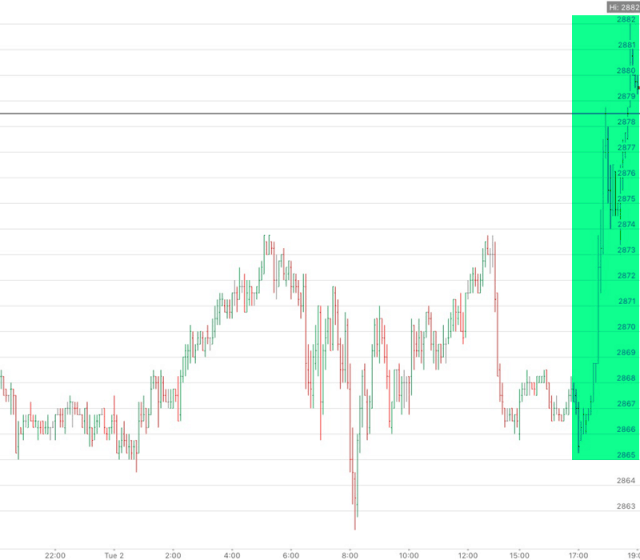

The short term resistance on the SPX 5dma and 50hma that held for much of last week eventually broke and delivered the high retest and marginal higher high that I was looking for in the event of that break. So what now?

Well I’m expecting this to be the second high of a double top or possibly making the head on an H&S. 15min sell signals have fixed on SPX and an hourly sell signal has fixed this morning on ES. This high could already be in, and the rising wedge on ES from the last low has now broken down, which is promising. A small double top has broken down slightly towards a possible H&S neckline in the 2854 area, and there is now a substantial double top in place which on a sustained break below 2789 would look for alternate targets in either the 2728 or 2706 area.

(more…)