We interrupt your regularly scheduled day with breaking results from SlopeRules!

While Tim and his team are busy working on their next innovation, it’s time to delve into what profitable results your fellow Slopers have found and shared.

(more…)Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

We interrupt your regularly scheduled day with breaking results from SlopeRules!

While Tim and his team are busy working on their next innovation, it’s time to delve into what profitable results your fellow Slopers have found and shared.

(more…)

From a post on gold and silver on Tuesday…

Very simply, if it’s an H&S it’s a minor one with a target to the SMA 200 or short-term lateral support. Gold has curled back up to test the underside of its SMA 50. A takeout of 1310 and then the March high could put yeller back in business. Otherwise, don’t personalize it. A test of the SMA 200 would be normal.

The H&S was not my thing. I tend not to get overly excited about short-term patterns and surely do not announce them far and wide to stir people up. It was a product of the gold community, some members of which have been flipping in head spinning fashion between bullish and bearish views. I note it again because I don’t want that stink on me. The upside and downside parameters above were my stuff.

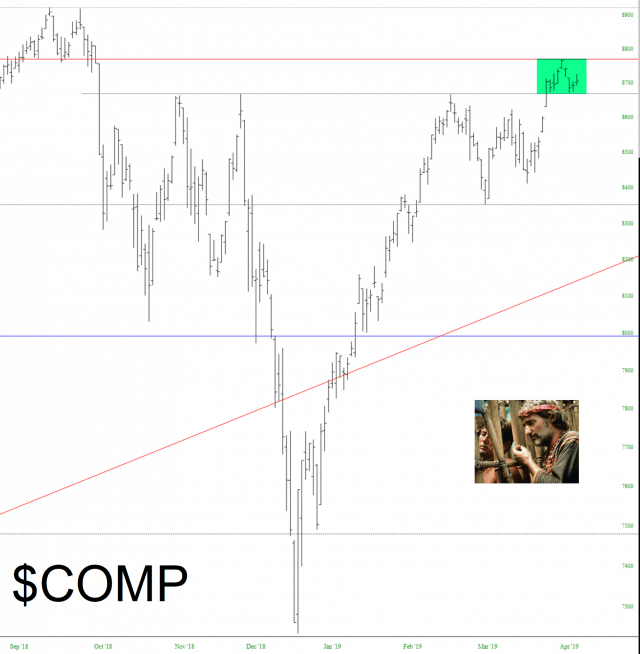

(more…)Dear God, this market is boring. As I type this, the SPY is up eight hundredths of a single percent. If you’re bored out of your mind, you ain’t alone.

We’re range-bound. I guess there’s just nothing to inspire the market one way or the other. Not only are we in a tiny range, we’re exactly in the middle of the range, which is like a boring cake with boring icing on top.

Last year, it looked like interest rates were going to start a sensational bull market of their own. It’s quite clear they’ve utterly sputtered. Just look at what’s happened with interest rates: a nice bullish base, and then, zilch.