This is great fun for any Trek fans out there; my favorite bit is William Shatner’s Doberman circling the set, protecting his master.

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

The SPX All Time High Retest

At the end of every year Stan and I do a public webinar where we look at the more likely options for price moves on indices, bonds, forex, metals, energies and other commodities over the coming year. At the one we recorded on 30th December 2018 we were asked a question as to what could invalidate the scenario that SPX was in an ongoing bear market and I gave the reply below talking about the important resistance at the monthly middle band in an ongoing market.

Excerpt from 2019 Outlook public webinar recorded 30th December 2018 looking at the SPX monthly middle band in bear markets. :

(more…)Goldilocks Now, But She’ll Be Vanquished

Just one look at the daily chart of SPX tells us – in hindsight – that this may have all been about gap acquisition. I was completely right and righteous to be bullish on the Christmas Eve massacre low, right on up to the 50 day moving average, which was the original target.

After that I was compelled by the market’s technicals to be bullish for a drive to the SMA 200, and then 2815 resistance, and then… a top-test. I not only felt not righteous with these compulsions, I felt a little soiled. Hey, it’s just a human (as opposed to a newsletter writer/market commentator) talking about human feelings.

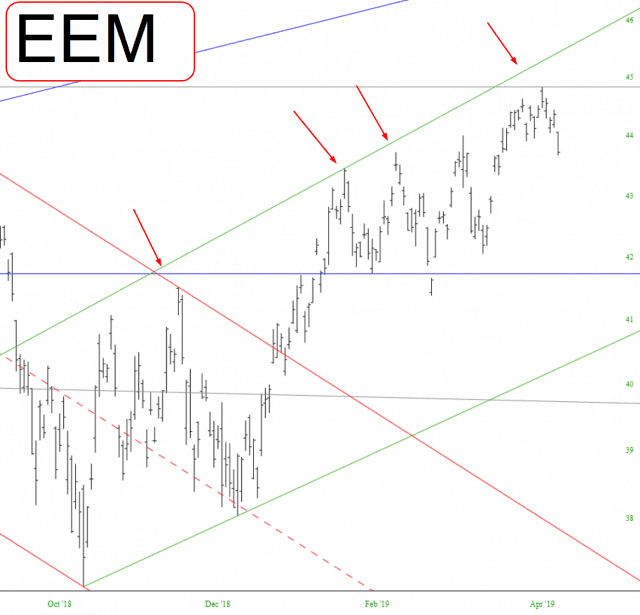

(more…)Emerging About-Face

For over half a year, the emerging markets have been following a relatively steady ascending channel. About a week ago, they got close to the top of the channel, and they’ve started seeing some meaningful weakness.

Just Be Normal

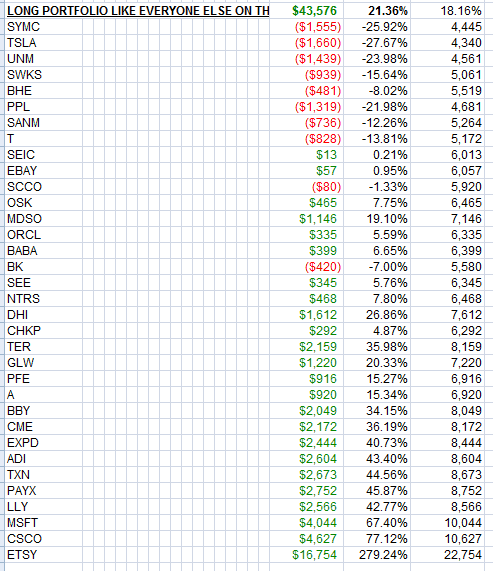

In the autumn of 2017, just for the hell of it, I decided to put on my bull outfit and choose what I considered were the best patterns for long positions. I then bought a pretend $6,000 of each one of them and left it in my spreadsheet ever since. Here is where the portfolio stands right now (the rows show the symbol, the net dollar change, the net percentage change, and the present value compared to the original $6,000 investment):

(more…)