Last week I promised that this week would be a doozy. Would I lie to you? And it’s not even over yet! Indeed, tomorrow is the jobs report, and that should just be more sauce for the goose.

In a similar fashion as last night, I wanted to walk through some big cash markets and talk about important levels. In this instance, though, I’d going to err on the side of caution and state where firm support may reside. Yesterday and today were a delightful reprieve for the bears. The sons-o’-bitches in D.C. don’t normally permit such monkeyshines to go in for more than a day or two, so they’re going to try to stop it. Thus, caution and awareness is advised!

We begin with the Dow Jones Composite, which is nearing a critically important “double support” level, with both a Fibonacci retracement level and a supporting trendline on the side of the bulls.

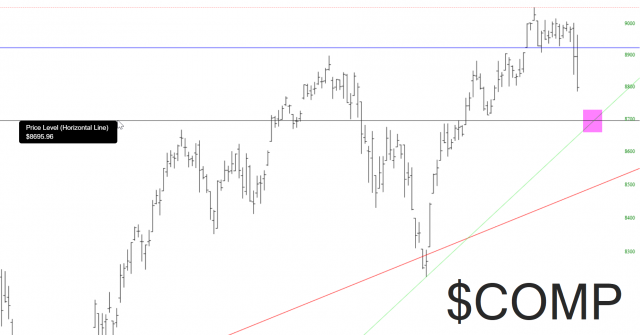

Next is the NASDAQ Composite (which, believe it or not, was up 2% earlier on Thursday!) which has an important price gap looming (I hesitate to remind you again, since I don’t want to insult your intelligence, but clicking on any of these makes them huge).

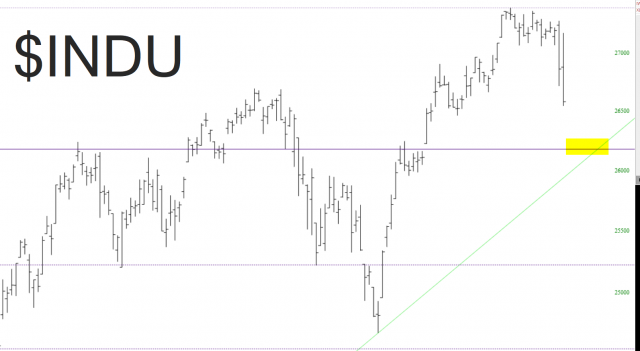

The Dow Industrials, in a similar fashion to the $COMP, is approaching both an important horizontal as well as ascending trendline.

The S&P 500 has been doing a gorgeous job bouncing between the lines defining its wedge pattern. Obviously the supporting lower line is key at this point.

There’s one sector, however, that I believe is even more important than the items above, and that is financials. Simply stated, we’ve already reached support. If we open strong tomorrow, we’ve got yet another bounce on our hands. If we open weak, however, that means the trendline is instantaneously broken, and the uptrend since the Mnuchin bottom in December is kaput.

To flank this financials focus, here is the broker/dealer index, which is still in the final stages of forming what could be a very bullish pattern but, should it break the trendline shown at the yellow tint, you can kiss this one good-bye.