Given the title, I want to make clear at the outset that this post has nothing to do with gun violence, particularly prompted of the events of this weekend. I’ve been thinking about this post long before those events, and even though I am loudmouthed to a fault about my points of view, the whole issue of guns is something I’ve never, nor will ever, touch. No sense is alienating the handful of readers I haven’t pissed off already.

No, this is about something far more psychological and long-term. I am speaking of what I view is the correlation between social mood and justice. Specifically, the forgiving nature of the public during prosperous times and the vengeful disposition it takes during times of hardship.

Let’s take an example from almost a quarter-century ago: back in 1996, Bob Dole famously lashed out on the campaign trail against Bill Clinton, rhetorically asking: “Where’s the outrage?” Well, in the autumn of 1996, things were actually pretty spiffy in the world. The Cold War was over. The economy was strong. The Internet had just burst on the scene, with the IPO mania started by Netscape over a year in the running. Simply stated, people didn’t really care about whatever shortcomings Clinton had, because for most people things were just fine and dandy. So Dole got trounced.

In sharp contrast, look at President Bush in 1992. Just a year earlier, he was one of the most beloved political figures in history. Yet a modest recession was all it took to make those 92% approval ratings (literally!) collapse and lose to a youngster named Bill. When people are feeling pain on the home front, it pisses them off, and they want to take it out on someone, including incumbent politicians.

Since I write about financial markets, not politics, let’s turn our attention to a financial example. Specifically, Bernie Madoff, who for years executed a Ponzi scheme measured in the tens of billions of dollars.

Even though his methods of fooling the authorities were, in retrospect, far from perfect, the public zeitgeist wasn’t in a prosecutorial mode. Even when the man was audited in person by the SEC, nothing came of it.

That is, until the financial crisis, and then, blammo, he gets dragged off in handcuffs and thrown into prison for the rest of his life. The public wanted blood, because even though 99.99999999999% of them weren’t directly affected by Madoff, a lot of people were feeling financial pain, and they wanted someone at the top to suffer.

Sadly, though, the fury coming up from the 2008 financial crisis was tamped out, and quickly. At first, the anger from the public was sweeping through in waves, as tales of malfeasance from the likes of AIG, Merrill Lynch, and Lehman Brothers came to light. In my opinion, The Powers That Be did two things to suppress any meaningful change:

- They slit the throats of a couple of sacrificial lambs: Bernie Madoff (as a person) and Lehman Brothers (as a corporation);

- They threw trillions and trillions of dollars of new money, a sliver of which went to “shovel-ready’ projects but the vast majority of which, in the end, wound up as larger net worth balances of the richest of the rich. But the news of all this government “help” kept the sheeple placated.

In the heat of the crisis, even Congress (typically the best friend of billionaires) floated ideas for issuing a special 100% tax on all the bonuses from AIG, but those ideas never went anywhere. Sort of how like the “carried interest” 15% tax break for hedge fund managers has been publicly scandalized for years, yet no one does anything about it. A combination of public ignorance and apathy blends together into a soothing broth that seems to calm everyone down so that nothing ever really changes unless things have gone utterly and totally off the rails, such as 1929-1932. In America, things have to be absolutely on fire for years before anyone does anything about it.

From the 2008 financial crisis, all we got was the Dodd-Frank legislation, and in the QE-fat years following its passage, the law has been gutted to the point of irrelevancy.

Let’s turn our attention to the modern day. There are three examples of elite, famous, well-connected individuals who thrived and flourished during the anything-goes era of the past decade whose forthcoming fate may differ, depending on what happens with society as a whole.

By no means are these the worst-of-the-worst people, but they represent different targets of what I believe will be an increasingly vengeful society. Specifically, Lori Loughlin and her bubble-headed daughters……….

…….former multi-billionaire fraudster Elizabeth Holmes………

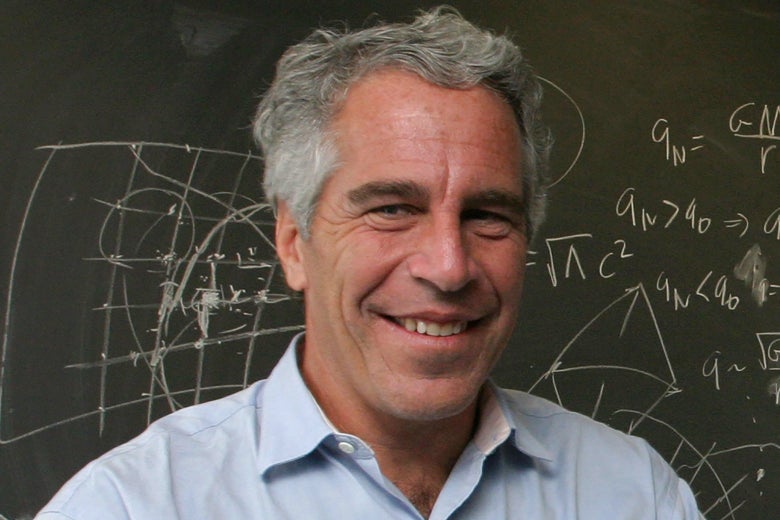

And perverted pedophile and rapist Jeffrey “Anthony Weiner and Alan Dershowitz and Harvey Weinstein have nothing to do with me!” Epstein.

In all of these cases, in the relatively giddy, everyone-is-getting-richer atmosphere of the past ten years, these people were left alone to do whatever they wanted to do. Epstein molested, raped, or did God-knows-what-else with whomever he wanted, even though he was already a convicted pedophile. Elizabeth Holmes raised nearly a billion bucks for a completely fake product, even with incontrovertible evidence that it didn’t work. And rich parents (not Loughlin particularly, since her dimwitted daughters had to get old enough) bribed their way into desirable colleges so their sub-par kids could attend a good school.

It all went on without question or complaint. The public looked the other way. And yet, just recently, things have started changing. And I think it’s because we’ve already reached an inflection point.

The fate of these people is really at the mercy of the markets. It may seem like Loughlin, Epstein, and Holmes have little or nothing to do with the financial markets, but I contend the correlation between the fate of stocks and the fate of these phonies is absolutely tethered at the waist.

Because when markets do this………….

…………society is too busy getting rich, buying stuff, and gawking at people richer than themselves to worry about such trifles as laws, morals, and decency. Enforcing laws and time-consuming and boring. It’s more fun just to live it up. As we say in my native Louisiana, laissez le bon temps rouler.

On the other hand, when financial markets look like this……

……..the public is going to be out for vengeance. This manifests itself in all kinds of ways:

- Calls to “soak the rich” with higher taxes;

- Demands for lengthy prison sentences for white collar criminals (think back to the S&L crisis of the late 1980s and the Internet bubble bursting in 2000, Enron, Worldcom, and so forth);

- Demands for draconian new laws to stop malfeasance in the future, and in cases of wrongdoing, brutal prison sentences;

- Insistence of financially gutting the wrongdoers through confiscation;

- Civil and shareholder lawsuits galore

The next 15 months is going to settle a lot of scores, including the election of the President, and it’s all going to depend on social mood. (reflected principally by stocks).

If somehow the economy gets a new lease on life and truly begins thriving, the folks mentioned above may get off scot-free.

On the other hand, if things flip lower, you can kiss every one of them – – and dozens more no one has even thought of yet – – good-bye. Because the general public is going to have had it up to the proverbial “here” with the rich and the powerful, and they’re going to be seeing nothing but red in their eyes.