am·bi·gu·i·ty

/ˌambəˈɡyo͞owədē/

noun

- the quality of being open to more than one interpretation; inexactness.

Learning to deal with ambiguity is a key skill for the trader and investor. We like certainty. It makes us feel good. The first time when something we are certain of in the market goes the opposite direction it can be wildly jarring. Growth is possible here, the results of which can be very profitable. This is where learning to identify and manage ambiguity is key. Understanding this about your inner makeup is a key first step.

Most of the time we want to be doing something. Our brains get an emotional release in the form of dopamine when we do something. It makes us feel good. Being able to “do nothing” is just as much a skill to develop, as when/how we “do something”.

Understanding when it’s time to slam the gas down and go when the setup exists that we are genuinely excited about, and when to pause or look for better opportunities elsewhere is one step. Another step is finding another outlet to fill the “dopamine gap” of doing something. I’ll investigate the psychology and neurochemical connection in future articles.

I say all that to say this… I’m not in love with GDX at the moment. I want to be. I want to get down on one knee, propose, and make babies with GDX. (Editor’s Note: Go, Rev!) But, it’s just not right at the moment. No, I’m not breaking up with that fiery GDX minx of a volcano. We’re just going to take our time and get to know each other a little more with an open mind.

What is making me hesitant? Let’s take a look at some charts, and three possible scenarios for November.

The first chart is a weekly chart of /GC. After the powerful move higher from May-Aug, /GC has yet to fully consolidate its gains. From the perspective of the Keltner channel, I would continue to like to see a move down to the bottom red Keltner line, while the overall channel continues to move higher.

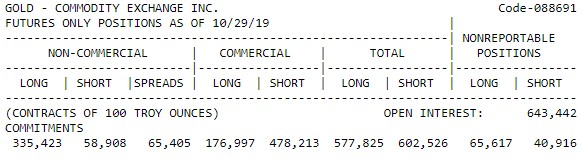

Another factor that continues to give me pause is the CoT report for gold. The report continues to show commercial traders continuing to lean heavily short, as mining companies look to lock in what they perceive to be good prices. Commercial traders in this position are generally proven to be correct over time.

The last chart shows GDX on the daily chart. It was good to see the strong gains of the summer correct in September and October. The question is whether the correction is done and the bull market in the miners is continuing from here. Corrections can either happen through price or time.

From the perspective of time, the May-Aug move has corrected 50%. If GDX is going to correct through time, remaining above the July POC support, I would prefer to see another month of consolidation above that level. If GDX is going to correct through price, we need to see a break of the July POC, and allow GDX to find its bottom for this correction.

Most likely:

Over the course of November, GDX continues its correction/consolidation back down to the July POC again at 26.09. This level which has already shown itself to be support holds again, and allows GDX to continue to digest the strong gains from the summer. GDX remains in its uptrend and continues to prepare for its next leg higher.

Next likely:

When /GC fell below its Aug/Sept POCs, it fell into a volume/price gap. The next logical decline down to its July POC at 1424 has yet to matierialize. Another reversal lower here could lead to that decline. The resulting decline in GDX could see a move down to -SD1 at 24.68 or filling the price gap at 24.

Least likely:

After testing the July POC in October, and finding support there, GDX breaks through the September POC at 28.15, opening up further upside and a continuation of the larger bull market. Upside targets for the month would be the August POC at 29.58, retest of highs at 30.96, and SD1 at 31.62.