I got an interesting email from a Sloper (who has given me permission to share his charts). He pointed out that looking at interest rates over the long term had cracked their descending trendline.

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

I got an interesting email from a Sloper (who has given me permission to share his charts). He pointed out that looking at interest rates over the long term had cracked their descending trendline.

The annual Consumer Electronics Show (CES) rolled around as it always does in January, and this video hits on some of the highlights:

(more…)(Note from Tim: Long-time Sloper Market Sniper contributed this post seven years ago, but it’s just as germane today as it was back then. He suggested I re-publish it, so here it is. I’d also like to remind you options folks that Slope has plenty of options-relevant content, so take a peek here for a quick guide).

I promised a post on just one thing that I use in my trading. This is but one very small piece of the “puzzle” but I find it VERY useful and you may as well.

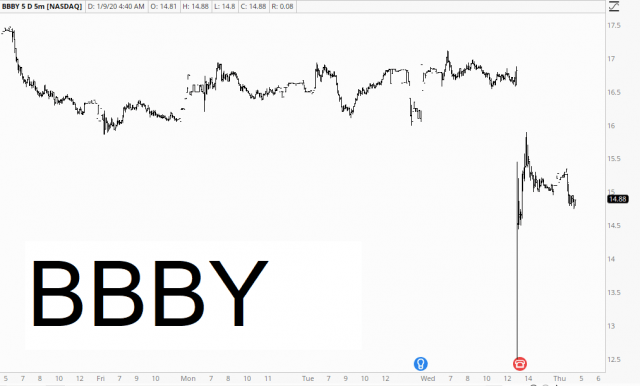

(more…)Welcome to another day of lifetime highs for equities, courtesy of Jerome “I’m doing it for the little guy” Powell. I have 45 short positions, 43 of them in the green, and 2 of them in the red. Those losses are 0.2% and 0.1%, so pray for me. My standout, pre-market, is Bed Bath and Beyond: