Both this Monday (that is, today) and last Monday had, for me, some singular and very nasty losses. I wanted to share the story of each of them, since the contrast between what led to those losses is worth noting. In short, one of them was a royal screw-up on my part, and the other was just plain bad luck. Let’s review, and in doing so, we’re going to look at the Friday preceding each of the aforementioned Mondays.

A couple of Fridays ago, the market was falling to pieces, thanks to the Corona virus scare. All my positions were doing great, and I was just about fully committed with respect to buying power. Egged on by this success, I decided to get cute and put the last of my buying power into some weekly SPY put options.

Let me stop right here and say I don’t think I’ve ever done such a thing. The few times that I do anything with options, they tend to be relatively conservative, particularly with respect to time. I typically buy options that don’t expire for at least two months. In this instance, though, I bought something with a lifespan measured in just days.

During the calm of the weekend, it started to dawn on me what a stupid decision that was. When Sunday’s trading opened, it was especially clear, because the ES and NQ were both quite strong. The moment the market opened on Monday, I dumped those sucks for about a 50% loss. Good thing, too, because they just kept sinking until they expired a few days later.

What kinds of words would I use to describe that trade? Well, let’s see: Foolish. Greedy. Irresponsible. Wrong-headed. Illogical. Impulsive. And, dare I say, Shameful. It was a stupid decision, borne of nothing but greed and excitement, and I hang my head to have ever done it.

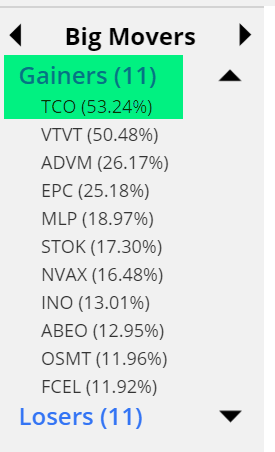

Fast forward to the Friday of the same week. Among my 61 short positions, I had just added a new stock I hadn’t shorted before: Taubman (symbol TCO). Allow me to show you where it appears this morning on the SlopeCharts Big Movers list……

That’s right. I had (past tense) a short position in the stock which is up more than any other stock in the United States today. Lucky, lucky me!

How do I feel about this? Pissed off? Yes. Unlucky? Absolutely. Cursed? Oh, maybe a little. I mean, thousands of stocks are out there, and I’m short this son-of-a-bitch. It happens every year or so that I get a huge blow-up like this. It sucks.

But how mad am I at myself? Hardly at all. Why? Because of what went into the decision. Looking at the chart, it made complete sense to do what I did. There was no greed. No impulse. No recklessness. Just analysis and execution.

Plus, more important, risk management. No one position ever accounts for more than two or three percent of what I have. So a 55% explosion higher is a real kick in the balls, but it’s not the end of the world. It just kind of wrecks this one trading day. But it isn’t devastating. Were it not for this one fucking position, I’d be having a nice profitable day at this very moment. Instead, it’s a loser. But by tomorrow morning, it’ll be ancient history.

And that’s the lesson. Two Mondays. A wretched loss on each day. But completely different circumstances. The first was foolish. The second one was just representative of the risk we all take here. I blame myself for the first. I shake my head at the second. But there’s only wisdom to be gained from the first.