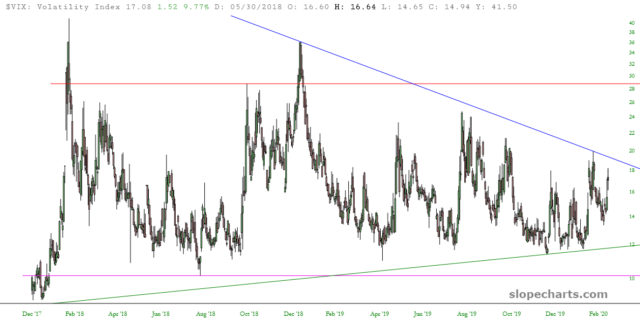

As we approach what promises to be a dynamic trading week, let’s take a look at the VIX:

Here are a few observations about this chart:

- The blue trendline is key; a break above that would line us up for a push into the mid-20s;

- Considering how severe this Covid-19 panic is, it’s breathtaking that the VIX is still lingering in the mid-teens

It’s that second point in particular that prompted me to write this post.

My view is that the so-called fear index is based on two main components: one of them is whatever endogenous circumstances and events are taking place (or not……….) as a basis for the public’s risk appetite. The other, perhaps even more important, is the exogenous zeitgeist, or the contextual atmosphere, at the time.

If you think back to the world in the weeks following 9/11/2001, everyone was completely on edge. If a news report came out about some envelope being sent to Dan Rather with some white powder in it, people would freak out about anthrax attacks, and fear would go ripping higher, because the public was terrified. After all, this massive attack had been perpetrated on the United States, both literally and figuratively out of the clear blue sky, and uncertainty was in the air.

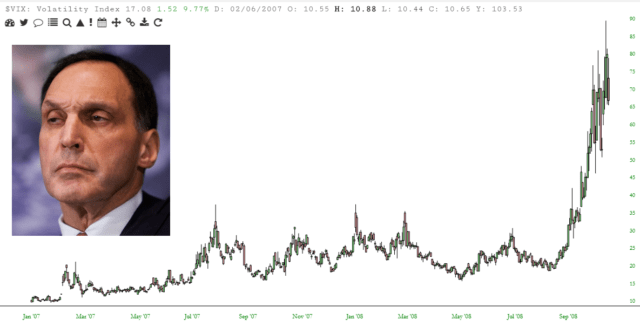

Or, more recently, consider the financial crisis. The VIX had ascended from its normal resting place in the lower 20s (which itself is double what “normal” is these days) up to almost 100, people it seemed every hour there was some cataclysmic news. More important was the environment of fear in general. People were primed and ready to be spooked.

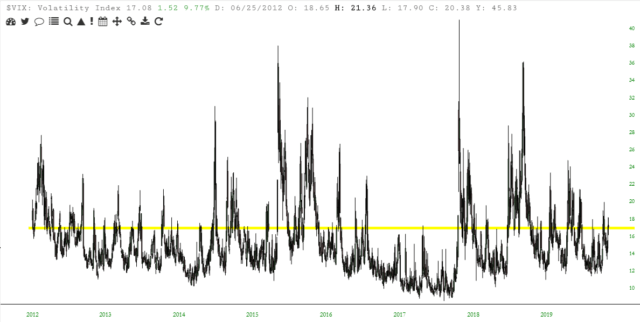

Yet what do we have these days? Well, one would think what is clearly a global pandemic that has brought worldwide trade to a virtual standstill would be causing some true terror. However, all that’s happened with the VIX is that it has strolled from about 12 to about 17 with all the speed and verve of Harvey Weinstein approaching the courthouse using his walker.

From the headlines, you would think the VIX was at 60, but as the yellow tint indicates, present levels of the VIX are still quite low. The reason? Obviously, because the public has had a pandering Fed ready to throw however many trillions of dollars it wants to shut the complaining up and get back to the important business of making Jeff Bezos even richer. Fear isn’t needed anymore. Jerome Powell has your back. Promise.

So it’s really all about context. If Covid-19 had struck out of the blue in, say, October of 2007, the reaction would be far more dramatic than now. To date, unless you hang out on ZH all day, the reaction has been rather muted. I mean, let’s get real: the market was at lifetime highs just three days ago, and we’re down, what, two percent or so from the highest levels in human history? Not exactly the stuff of terror. And the reason is context.

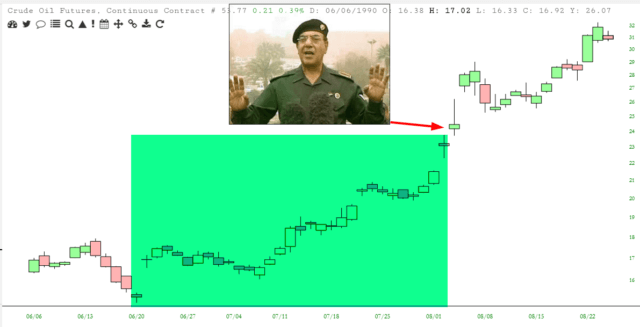

One last thing, unrelated to the above but mildly curious to me. Time and again, when looking at the effects of “events” on price data, I’ve noticed that the market seemed to know what was going to happen before it even happened. For instance, if you look at the August 2, 1990 invasion of Kuwait, you’ll see that crude oil had gone up smartly well before the invasion. It’s like the market had a sixth sense.

As a specific example that I just encountered this morning while pulling together charts for this piece, take a look at the VIX below, from the autumn of 2001. The spike was because of the 9/11 terror attacks. However, the majority of the ascent took place days before the planes were even off the ground. Curious, isn’t it? It’s almost like the market knew what was about to happen before anyone else did.