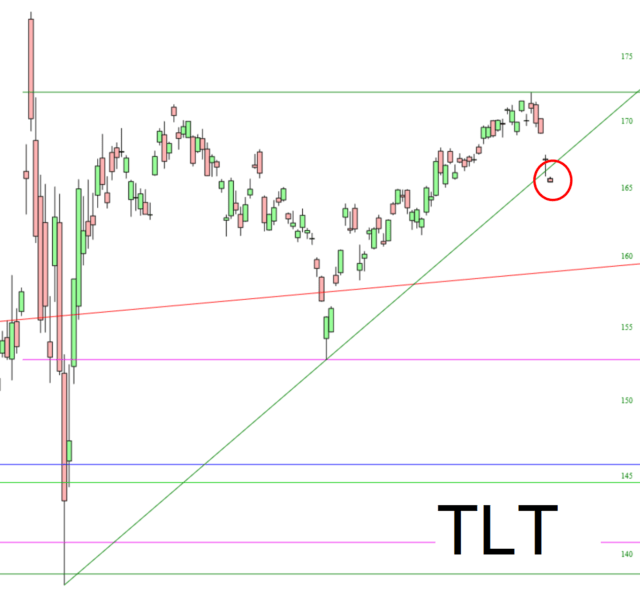

After climbing steadily for months, bonds (by way of TLT) have broken their intermediate-term uptrend.

Falling bonds means, naturally, rising interest rates. It’s hard to conjure a world this deeply in debt being able to live side by side with rising interest rates.

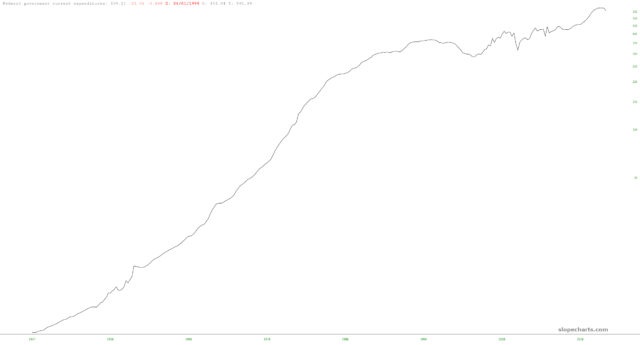

The fact is that the U.S. government has been able to “get away with” $26 trillion in debt thanks to rates that are almost zero. The interest rate expenses of the Federal Government is shown below, and in spite of exploding debt, the interest expense has been much flatter than decades prior. Should this change………...game over, man.