This post is courtesy of our friend Ophir from TradeMachine Pro.

Today we use the new and improved version of a pre-earnings momentum strategy. This goes beyond just naked long a call, and gives the opportunity for two shots at momentum with one trade.

This custom strategy has shown higher win rates per stock across the constituents of the NASDAQ 100 over the last 10-, 5-, 3-, 2-, and 1-year than the straight down the middle bullish momentum call. Let’s take a look at the pattern in Salesforce.com Inc (NASDAQ:CRM) .

Logic Behind the Trade

The logic behind the test is easy to understand — in any market there can be a stock rise ahead of earnings on optimism, or upward momentum, that sets in the two-weeks before an earnings date. That phenomenon has been well documented by Capital Market Laboratories in our seminal webinar on market patterns.

Further, if this initial custom diagonal strategy fails due to lack of bullish momentum in the stock, it has a second chance built in without making another trade — let the short-term leg expire, and keep holding the longer dated leg. Let’s see it in action.

The goal is higher win rates than a straight down the middle naked call speculation.

The Bullish Option Trade Before Earnings

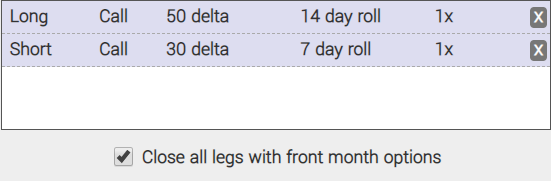

We will examine the outcome of going long an at-the-money (strike price is set to the 50 delta) call option that has 14-days to expiry, and short an out-of-the-money (strike price set to the 30 delta) call option with 7-days to expiry. But we do all this starting 14-days before-earnings with the additional following rules:

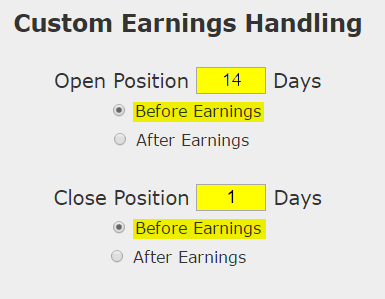

* Custom Earnings Timing

This call time spread opens 14 calendar days before earnings:

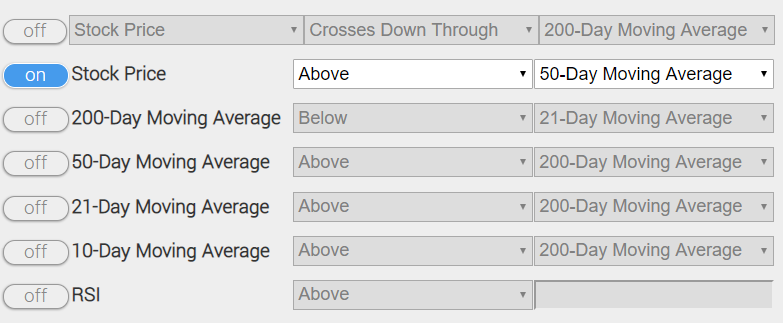

* Use a technical trigger to start the trade, if and only if these specific items are met.

* The stock price is above the 50-day simple moving average:

Here it is in an image from Trade Machine — only focus on the settings where the filter is turned to “on.”:

You can set an alert in Trade Machine®, which will track all of these moving parts for you, and message you when it triggers. In fact, you can do this with a portfolio of stocks for a portfolio of bearish and bearish triggers.

* Finally, here is how the custom strategy looks in Trade Machine:

Again, the set-up is opening the at the money call option that is closest to 14-days to expiry (but expires after the earnings date) and selling the out of the money call option that is closest to 7-days to expiry (but expires before the earnings date).

This entire trade closes after the 7-day options expire as it has been backtested.

Results of the Options Trade

Here are the results over the last three-years in Salesforce.com Inc:

| CRM: Long Diagonal Call Spread | ||

| % Wins: | 71% | |

| Wins: 5 | Losses: 2 | |

| % Return: | 158.2% |

The mechanics of the TradeMachine® are that it uses end of day prices for every back-test entry and exit (every trigger).

This entire trade closes after the 7-day options expire as it has been backtested. But, there is an opportunity, if the trade fails, to hold the longer dated calls right up to the day of earnings and sell it right before, for those that want to take a second swing at the bullish pattern.

Checking the Moving Average

You can check to see if the 50-day MA for CRM is above or below the current stock price by using the Pivot Points tab on www.MovingAverages.com.

Back-testing More Time Periods in Salesforce.com Inc

Now we can look at just the last year as well:

| CRM: Long Diagonal Call Spread | ||

| % Wins: | 67.00% | |

| Wins: 2 | Losses: 1 | |

| % Return: | 90.7% |

We’re now looking at 90.7% returns, on 2 winning trades and 1 losing trades. Click here if you’re interested in getting a discounted subscription to TradeMachine.