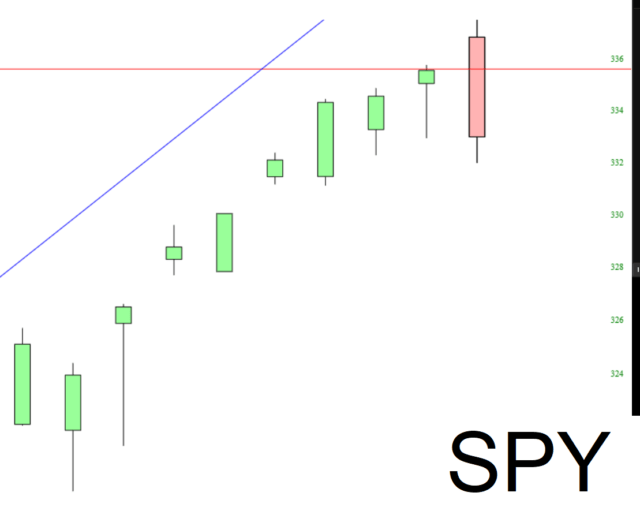

Today, the S&P 500 reached its highest point in human history. Perhaps to give the 3 bears left on the entire planet a wisp of hope, things went south later in the day, and we wound up with a bearish engulfing pattern, thus aborting the chance of having ten freakin’ green days in a row.

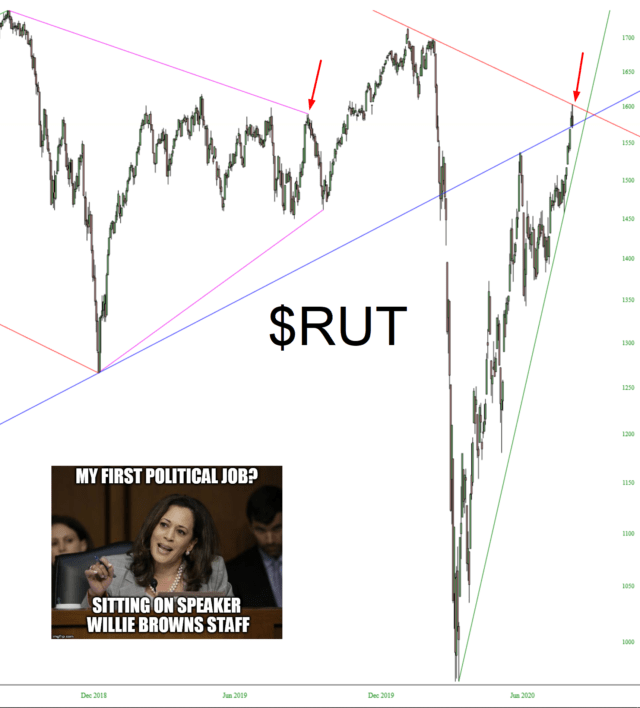

I have had special contempt lately for small caps. I abandoned my IWM put position a few days ago (committing myself heart and soul instead to my EWZ puts), yet I still watch it closely.

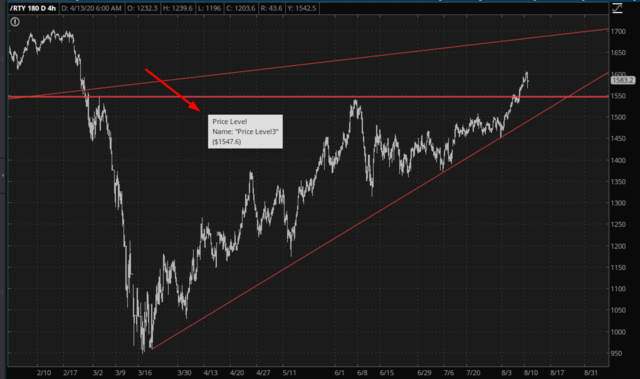

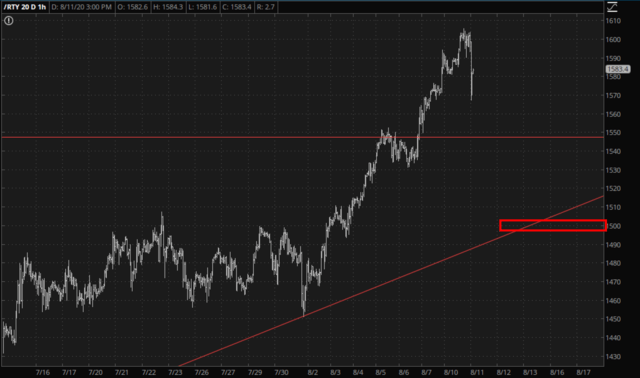

There are two important levels we’d need to break on the small caps to get things kosher for the bears again. The first would be a failure at 1547 on the /RTY:

If we manage to do that, thus, negating the cup-with-handle breakout, then we’d need to do something even tougher, which is bust below 1500, which is roughly where the ascending trendline support is. This line is intact since the mid-March bottom.

Things are sky-high and stupid expensive right now. It would do my soul good to see some serious selling resume.