Some people have accused me of being smart. I fervently disagree. I’d like to offer into evidence something which the Virtual Trading system has taught me. Plus, I’d like to encourage you folks to use the system not so much for the ego-gratifying chance to get onto the Top Ten list, but to learn something about yourself, as I have recently done.

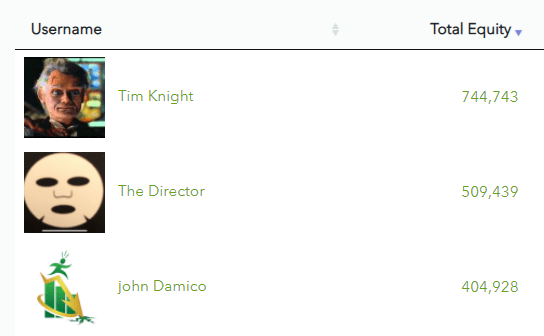

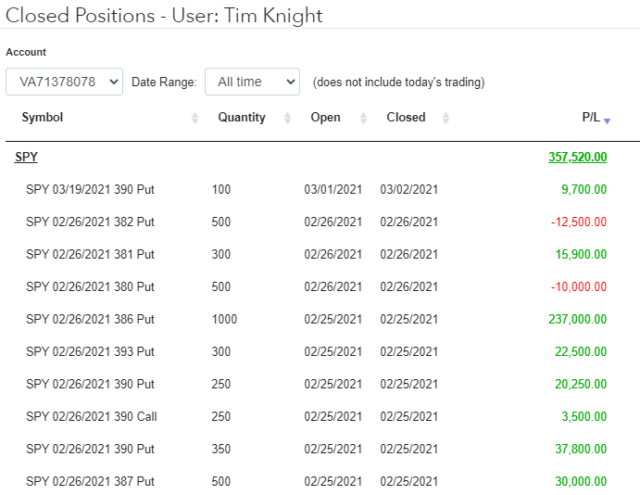

It was only two or three weeks ago that I wasn’t even in the Top Ten anymore. I decided to take a different approach. Instead of focusing on long-term ideas (e.g. buying long-dated puts on stocks I believe would, over a period of months, sink in value) I took more of a – – God forgive me – – YOLO approach – – and aggressively bought very short-term puts on high-volume ETFs.

This change has been quite fruitful…………..

Indeed, the fact I have rocketed from “not even visible” to “way, way up on top” in such a short span of time is kind of chilling to me, since in my real life, my actual options trading account has been pretty much picking its nose.

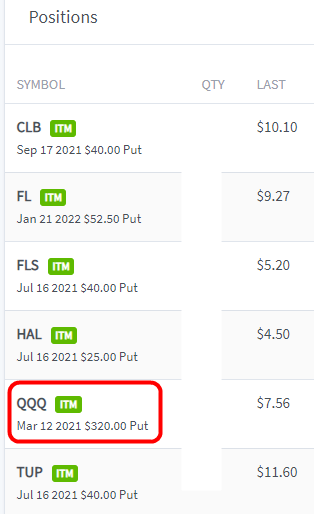

Added to which, the only aspect of my real-life options portfolio which has been profitable has been………………..shorted-dated puts on high-volume instruments, such as QQQ. I mean, looking at my positions, you can see these options don’t expire for months — once not even until next year!! – – and they are pretty much just sitting there, with the one ‘performer’ being my QQQ puts.

It seems to me that if one believes a stock is going to slowly move much higher or much lower, a simple equity position (long or short) makes the most sense. As for this options trading, virtual trading has opened my eyes to the fact that it’s the quick, short-term moves that make the money (or, alternately, lose it swiftly).