Gauging the right time to enter a trade is always a key concern.

With the metals markets, I portend the right time is now [or very near].

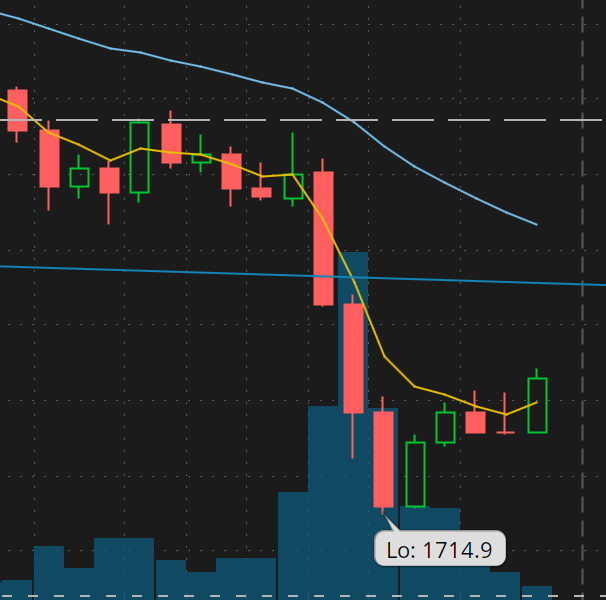

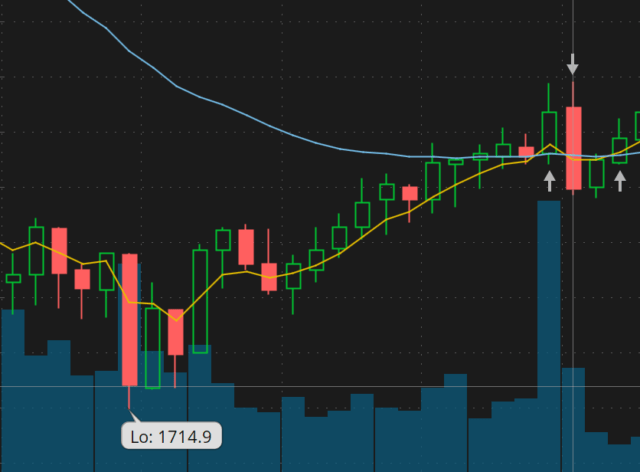

As one way to illustrate Timing, here are two snapshots from Friday’s Think or Swim chart of /GC. The first chart is a 1-hour timeframe, the second is a 5-minute timeframe.

If you paid attention to MovinFwd’s comments last Friday about Missy2Bars, you would see that’s what we have here on /GC. [I am taking the liberty of calling the 5-min chart a Missy3Bars.]

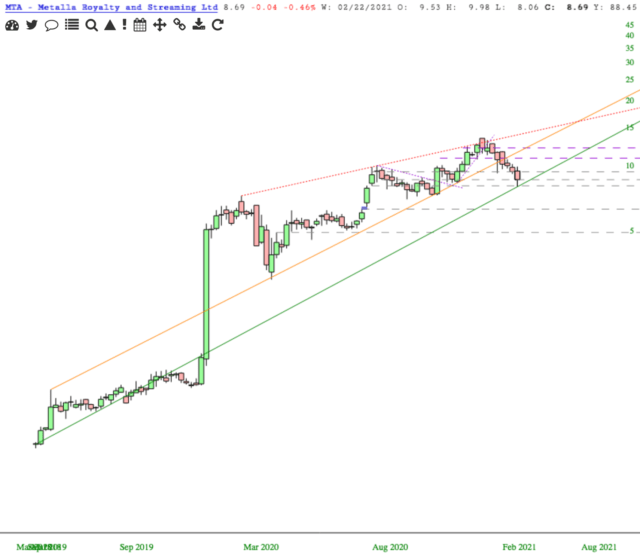

There are hundreds of stocks in the Basic Materials sector from which to choose. I am offering a handful of Mining companies that I think will serve you well to consider. It may not be time to back up the truck on each of these right now, but I am suggesting that it’s time to pick your stocks and plan your trades.

First up is the weekly chart of Metalla Royalty and Streaming [MTA].

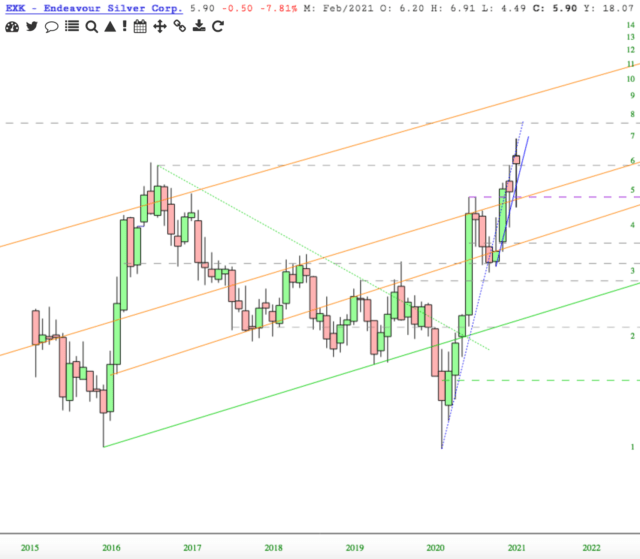

Endeavor Silver Corp [EXK] fared far better than many other Miners since the infamous August 2020 high. Look at the ratio chart of GDX:EXK.

The monthly chart of EXK shows price well over the Aug 2020 highs, closing just $.05 below the 2016 highs. Compare that to GDX.

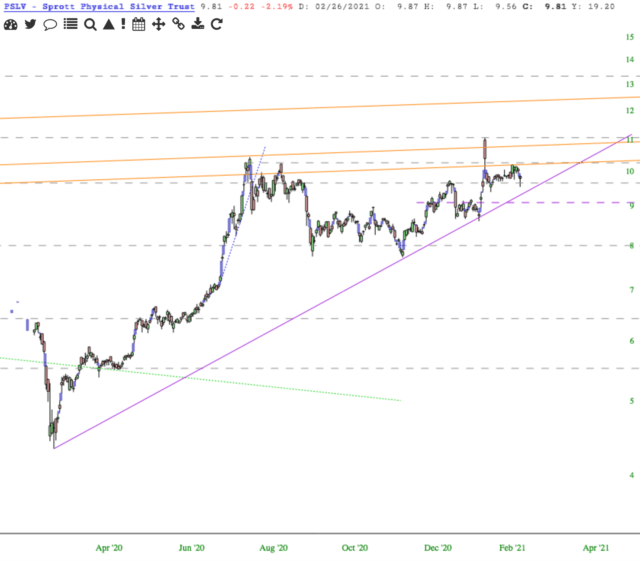

Likely some of you bought Sprott Physical Silver Trust [PSLV] around $5.50; I wish I had. PSLV is a closed-end fund created to invest and hold substantially all of its assets in physical silver bullion.

The daily chart of PSLV displays a nice saucer bottom developed since August 2020.

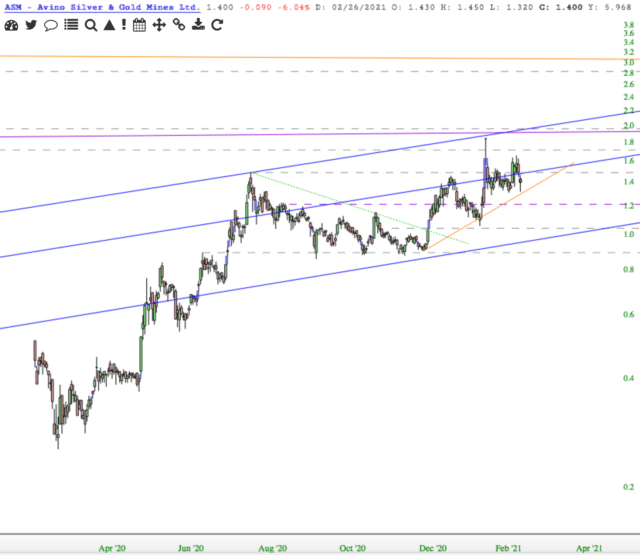

With a market capitalization of 125.40M, Avino Silver and Gold Mines [ASM] is small, but one that I’ve enjoyed trading. This is the daily chart of ASM.

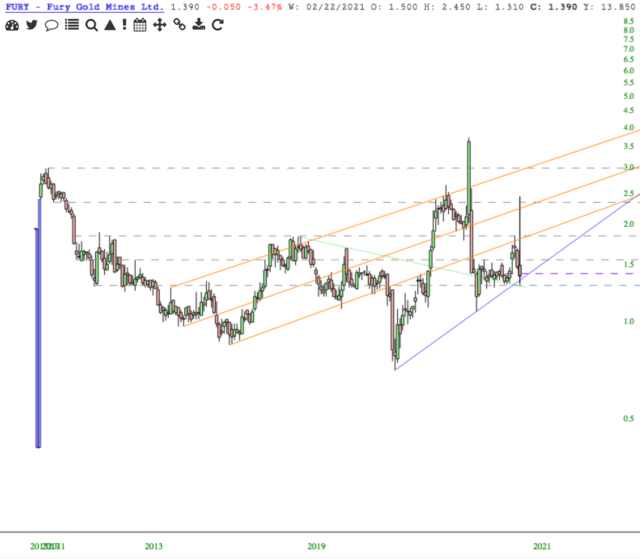

Fury Gold Mines [FURY] is another small company with a market capitalization at 163.78M. This is the weekly chart of FURY. I don’t know what’s up with Friday’s funky candle, but the daily closed dab smack between the top and bottom of the Ichimoku Cloud.

As reference on the charts herein, any purple horizontal is marking the top or bottom of the Ichimoku Cloud.

Each of the stocks mentioned here is contained in the shared Watchlist on SlopeCharts, Miners.Shared.

One might say, “Put your money where your mouth is, LittleMissy.” That’s fair. I have.