Well, folks, this completely captured market is staying true to form. The entire trading day was absolutely snooze-worthy, with literally a 2 point range on the ES enveloping almost the entire normal trading session.

This is NOT a day that lends itself to commentary, but I’ll say a few things about the six-month charts below. I normally show multi-decade charts, but in this instance, we’ll just zoom in on what’s happened thus far this calendar year.

Below is the real estate fund, symbol IYR. Can anyone here spot the trend? This is what can happen with 2% mortgage rates, folks.

The S&P 100 fund, symbol OEF, is “off to the races” just like everything else. Virtually every major index and ETF I looked at was up 1/3% today, just like clockwork. They don’t need explosive moves every day. Just a new lifetime high. It doesn’t take much.

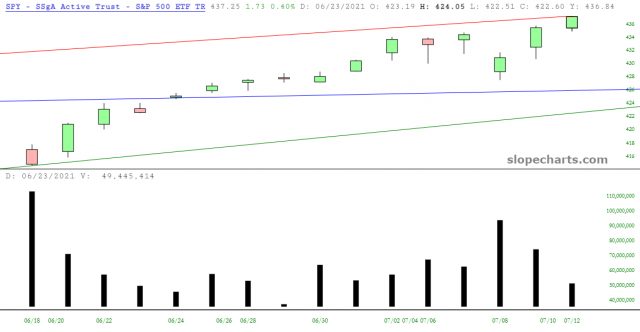

Looking closer at its big brother, the S&P 500 SPY, you can also conclude that you don’t need volume to goose these markets higher, either. Just look at the past three days. The volume just withers away, but it takes zero difference to ringing the New High bell.

I’m holding out hope that energy will resume its breakdown, which provided me such good profits last Thursday.

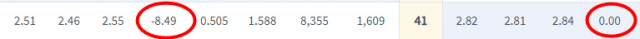

One last amusing tidbit – – witness the Power of the Greeks – – here is the net change for SPCE options today. The $41 calls got destroyed (see left circled item) while the puts were unchanged!