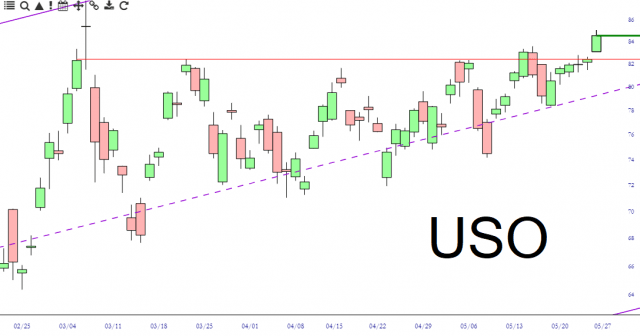

The title of this post doesn’t refer to the lack of volume in the market. It has to do with the fact that I’ve scurried away from my energy shorts over the course of the past few days. It used to be the most dominant sector in my portfolio. Now it doesn’t even exist. The main reason is, not to put too fine a point on it, that energy simply Kept Going Higher. For one thing, oil itself basically goes up every day now, and it completed this clean breakout on Thursday:

As such, every one of my energy picks was a loser – – APA, MRO, OXY, and so forth. And, obliquely-related, the Brazil country fund EWZ. The energy sector fund XLE tells the story plainly – – almost nothing but green:

Between the fact that (a) I’ve given up on energy shorts and (b) I have an insanely high cash position of 43%, it probably means energy will instantly go into one of the fastest plunges in financial history. Joking aside, though, now that I have no dog in this fight, I can at least say that the XOP fund is looking awfully richly-priced, considering its position within its extremely long wedge pattern.