Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

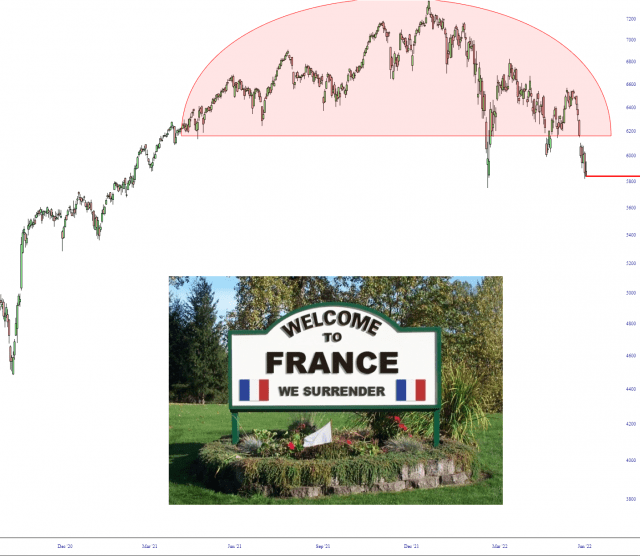

Oh, Merde……

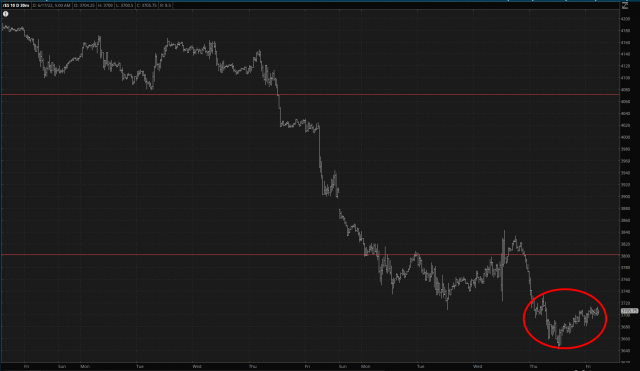

Blood In The Streets

I wanted to talk a bit this morning about big highs and lows on SPX. Obviously the economy may well be going into recession, interest rates will likely rise a lot further over coming years, and that has to happen really because examples in history where inflation has been brought under control without interest rates higher than that inflation are rare. The world is also particularly vulnerable to high interest rates because after so many years of very low interest rates, levels of both public and private debt are extremely high, and rising interest rates over time will likely force many people, companies and governments into defaulting on their debt. It is going to be rough.

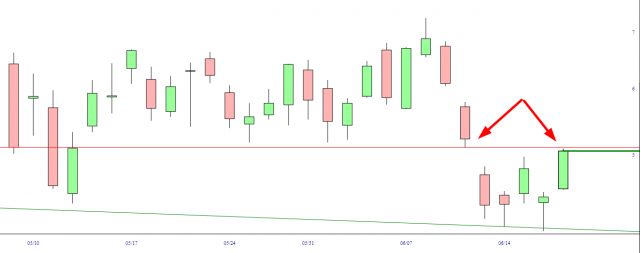

(more…)LABU Gap Bang

The first half hour of trading today was madcap for me. I trimmed from 30 down to 19 positions and am now at an awkward 40% cash again. More interesting, in my personal account, I took on a HUGE long position in LABU yesterday and got out – – in a true rarity – – at almost precisely today’s top when it sealed that gap up. Huzzah! Anyway, that account is again at 100% cash now.

Let’s Wrap This Up

The past six trading days have been absolutely bonkers. Starting a week ago, I started to get freaked out that we were going to go into some kind of counter-trend rally. God knows, everyone has been predicting it. And this morning’s no different. My Twitter feed is slathered with “we’re going to 4,400′ type predictions. Such predictions have cost me staggering sums of foregone profits recently.

Of course, the bears have absolutely owned this market for 2022, and this week in particular. For all the dramatic hoo-ha about the $3.2 trillion OpEx, equity futures are picking their noses with about 1% price gains pre-market.