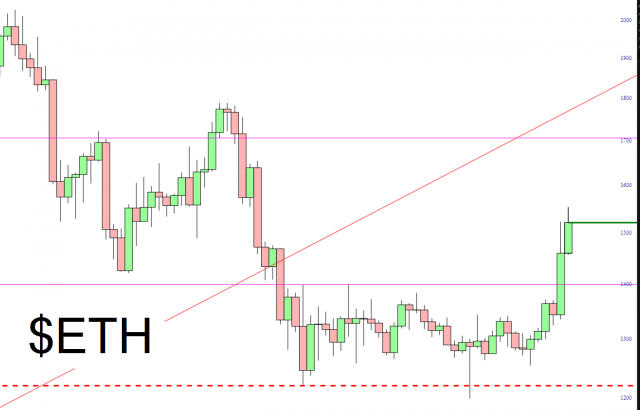

In case anyone needing convincing that, in recent days, just about everything with a ticker symbol has been zipping higher, they need look no farther than crypto, which only two weeks ago looked like it was tumble into oblivion and has instead become red hot once more. The now-permabullish ZH has been singing Bitcoin’s praises (and trotted out yet another buy-everything article this morning).

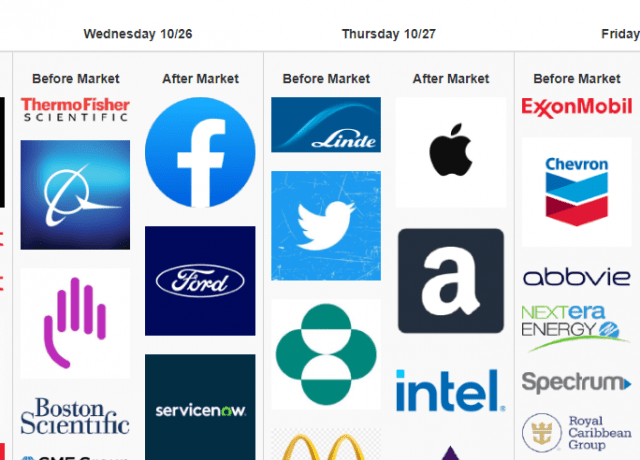

As for equity futures, the big news was, of course, the earnings from MSFT, TXN, and GOOGL, which actually managed to produce a little red. Although the /ES is well off its lows, it’s still down over 30 points as I’m typing this (although God knows how long it’ll last; you saw how instantly the /RTY exploded higher yesterday the millisecond the cash market opened).

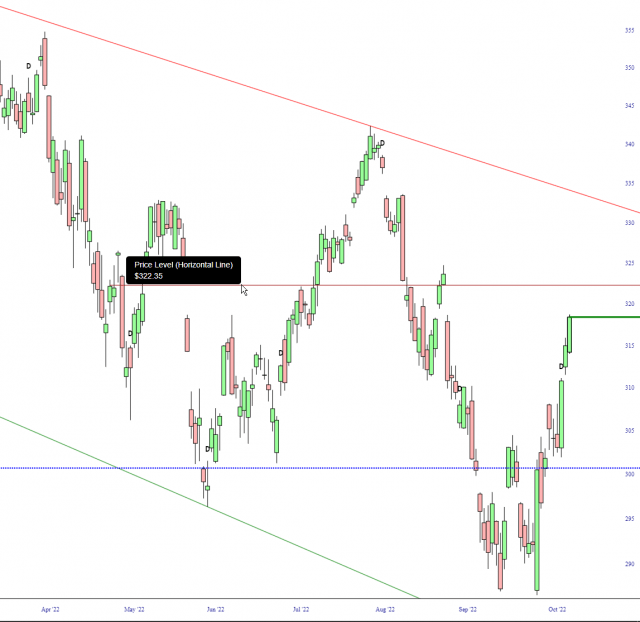

The /NQ is down more deeply, a little over 200 points and nearly 2%. We are going through, of course, the mega-sweep of earnings this week, with today being a bit of the eye of the storm (I mean, seriously, who cares about META, which reports this afternoon, as opposed to the likes of AAPL and AMZN?) Anyway, the /NQ has held on to most of its shave from yesterday evening:

As I mentioned in my video, what intrigues me most is what’s going on with the Dow Industrials, which have been relatively strong for many weeks. We are within spitting distance of a major price gap.

The market’s tone, however, won’t really be decided until AAPL and AMZN report tomorrow afternoon. The bulls have, understandably, acquired massive amounts of bravado and confidence over the past seven trading days, and it’s entirely possible this little nick from last night is just a forgettable bump in the road. I sure hope not, of course. I can’t take much more of this, to be honest.

I remain sickeningly long cash, although I’ll probably timidly re-enter a few positions today if the market stays relatively weak. As long-time readers know, I have a perfectly negatively-correlated relationship between what the market is doing and how I’m feeling, so the shrewder Slopers out there should probably take my utter lack of confidence with an appropriate sense of gravitas