Swimming To The Surface

If you’re underwater in the current market, this post includes a concentrated portfolio that can put you back in the green if current trends continue. Before we get to that though, let’s quickly review what the current trends are and why they’re likely to continue for the next several months.

In our previous post (Avoiding Head Fakes), I wrote about keeping an eye on the big picture, i.e., current market trends:

[T]he big picture is high inflation and rising interest rates to counter it. So you want to fade the rips higher, and focus on that, as I noted a few months back:

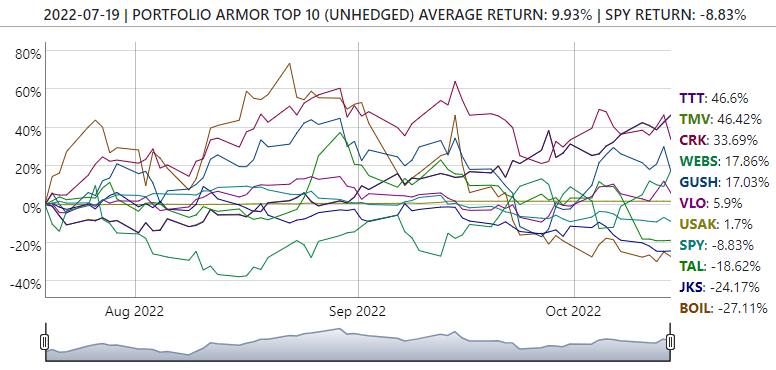

In that post from July, I wrote that bearish names consistent with that big picture/current trends appeared in our top ten names then: the Direxion Daily 20+ Year Treasury Bear 3X Shares ETF (TMV), the ProShares UltraPro Short 20+ Year Treasury ETF (TTT), and the Direxion Daily Dow Jones Internet Bear 3X Shares ETF (WEBS). And in Saturday’s post, I pointed out that those bearish bets had done well since:

Our top names on Friday included new bearish bets, but before we get to those, let’s consider why the current trends are likely to continue. A lot comes down to when the Federal Reserve will pivot from its rate increases.

When Will The Fed Pivot?

Over the weekend, ZeroHedge shared Bank of America strategist Michael Hartnett’s latest prediction that the Fed would pivot (and the market would bottom) some time next year, with the S&P 500 at about the 3,000 level. We’ll see, but it’s worth remembering there were observers earlier this year who predicted the Fed would have pivoted already. One reason I didn’t think they would was the political environment heading into the Midterm elections: I thought that, since most political analysts predicted Democrats would suffer big losses this year, that would give the Fed the freedom to raise rates aggressively without being blamed for Democrats’ electoral losses (since they were predicted to happen anyway).

Using the same political lens suggests the Fed will keep tightening until they’re sure they’ve driven a stake through the heart of inflation. That way, they can pivot to easing–or at least stop tightening–before the 2024 election campaign gets in full swing. Consider an alternate scenario: the Fed pivots in early 2023, inflation heats up again, and then they’re forced to start another tightening cycle and get blamed for interfering in the elections by doing so.

The bearish bets in the portfolio below ought to do well if the Fed doesn’t pivot within the next six months

Hedged Bets On Higher Rates

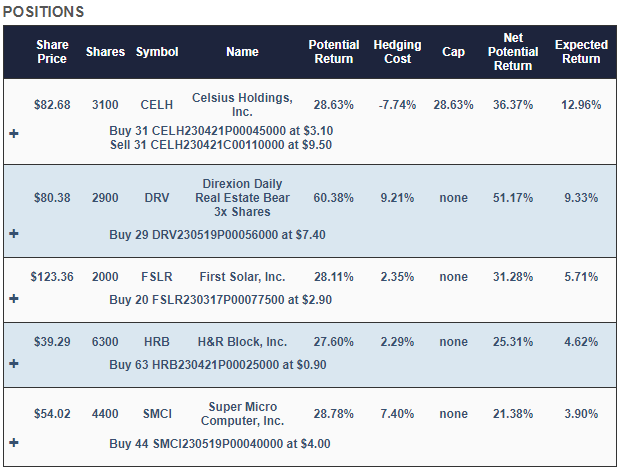

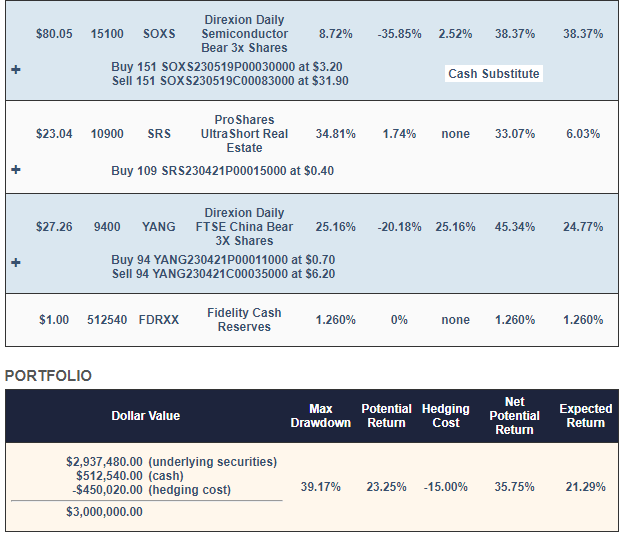

This was the aggressive portfolio our system created on Friday. The new bearish bets here were on real estate, the Direxion Daily Real Estate Bear 3x Shares ETF (DRV) and the ProShares UltraShort Real Estate ETF (SRS). Real estate is likely to continue to suffer if interest rates keep rising, driving mortgage rates up.

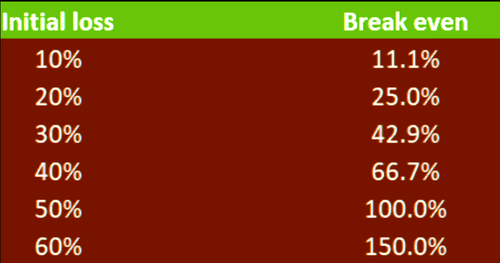

All the positions in that portfolio were hedged against greater-than-40% declines. That’s aggressive, as I said, but it’s less aggressive than not hedging, as the table below illustrates.

A Less Aggressive Hedge On DRV

Since DRV was hedged against a >40% drop over the next several months in the portfolio above, it was possible to hedge it with optimal puts. DRV is too expensive to hedge with optimal puts against a >20% decline, but it was hedgeable with the optimal collar below on Friday.

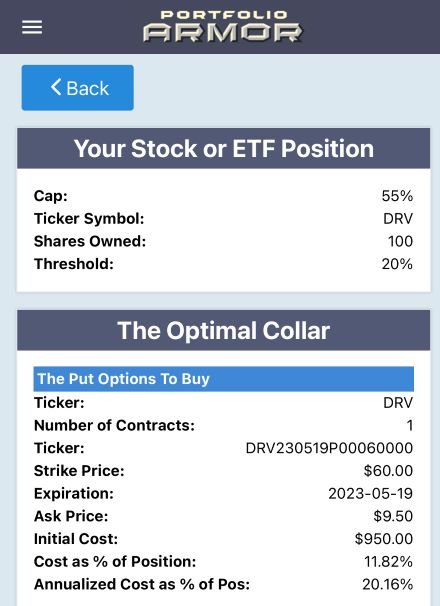

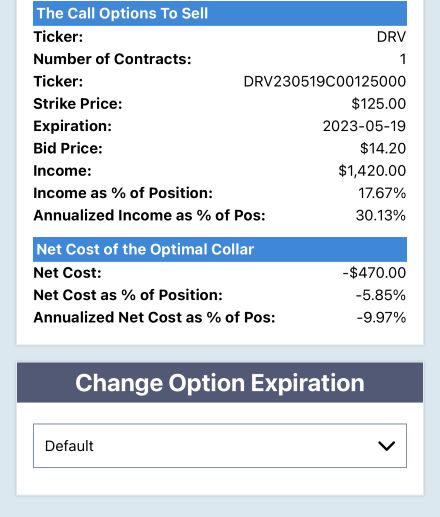

This was the optimal collar, as of Friday’s close, to hedge 100 shares of DRV against a >20% decline by May 19th, while not capping your possible upside at less than 55% by then.

The net cost of that collar was negative, meaning you would have collected a net credit of $470 when opening on Friday, assuming bought the puts and sold the calls at the worst ends of their respective spreads (buying at the ask and selling at the bid).

DRV Will Likely Drop On Monday

As I type this early Monday, futures are green; if that holds during market hours, DRV, as a bearish ETF, will likely drop, so if you’re thinking of buying it on a dip, be sure to scan for an updated optimal hedge on it. You don’t want to hold a triple leveraged ETF long if you’re not hedged.