After a very quick trip to Boston over the weekend, I’m back where I belong. The markets aren’t exactly riveting this morning: on the whole, equity futures are up about half a percent, based on the spurious notion that stocks are “cheap” since they sold off a little last week. To my eyes, these are mere delusions, and the only thing that really counts is our friend the October 13th trendline shown on this chart of the S&P 500 /ES futures. We have broken this line, and the bounce right now is nothing more than an attempt to reclaim that line as support instead of its new role as resistance.

The only red on my screen right now is crude oil, which in recent days has made a series of lunges higher, each with diminishing strength.

This is just going to be a continuous grind until such time as this right triangle top is complete. My sense is that there is no financial instrument more heartily defended as un-shortable here on Slope as crude oil. Perhaps the world seems too dangerous a place right now for such a precious thing as energy to be vulnerable. Maybe. That would immediately change with the failure of that simple horizontal line.

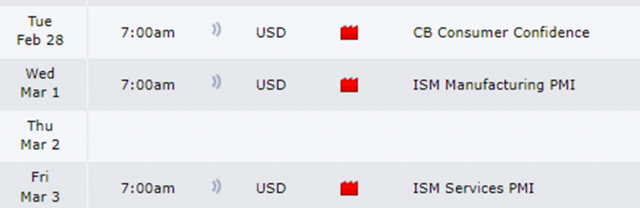

As for this week’s events, there’s nothing especially outsized, but FYI………