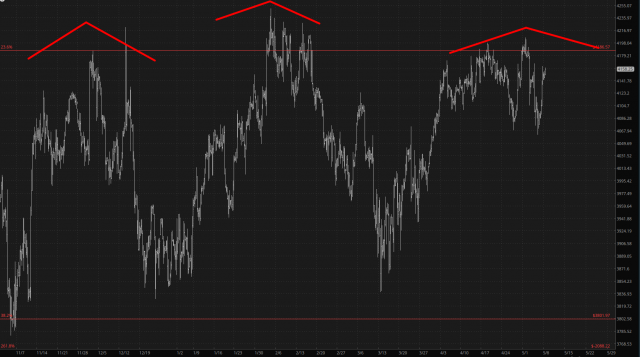

Welcome back from the weekend. We’re still in the throes of the quagmire, or face-off, or whatever other term you want to apply to a market that simply doesn’t know what to do with itself. My most optimistic (that is to say, bearish) point of view is that the resistance at 4200 is still our best friend, and the cyclic nature of the /ES over the past 9 months still suggests an erosion lower.

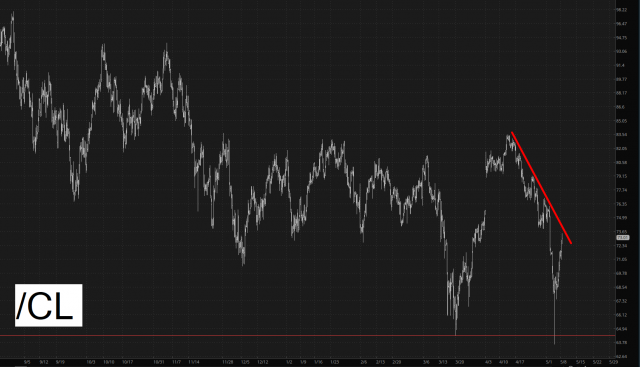

Crude oil had its last mighty plunge late last Wednesday, and since then it’s been on a tear higher. This rally, I believe, has hit a meaningful zone of overhead supply and is probably done.

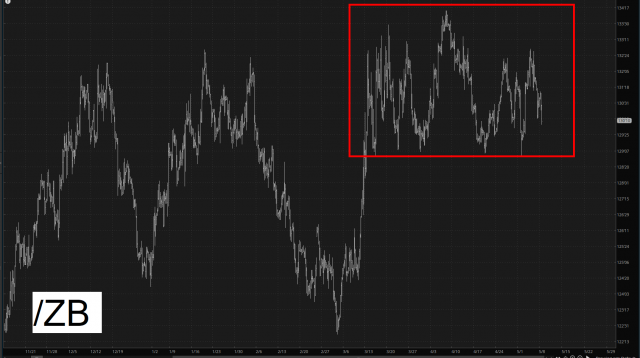

One interesting pattern that has emerged is bonds, which not only have a broad cyclic pattern similar to /ES but is also sporting a well-formed head and shoulders top that I’ve subtly outlined below. Breaking the lower bound (that is to say, the neckline) of this pattern would, in my estimation, help push prices toward the lower portion of the range.

The one huge turd floating in my punch bowl this morning is symbol ZS, which is rocketing about 20% higher. I had seriously toyed with ditching these puts on Friday, but clearly I didn’t toy enough. I’ll almost certainly dump these at a nasty loss, but I at least want to draw your attention to the stock since, in the long-term, is remains an appealing short setup (and at vastly better prices today).