It’s been a while since I’ve posted so I thought I’d throw my 2 cents into the mix. We’ve had quite a year so far. The bulls snatched the ball in March and really haven’t let go since then. We’ve rallied quite hard on a) bets against the Fed raising rates much further and b) the belief that AI will lead us into a new utopian future (my own cynicism perhaps keeps me too grounded to let that thought run too far in my mind, however). And after 3 full months of nonstop bullgasm, we finally see a potential breather occurring. Looking at the indices:

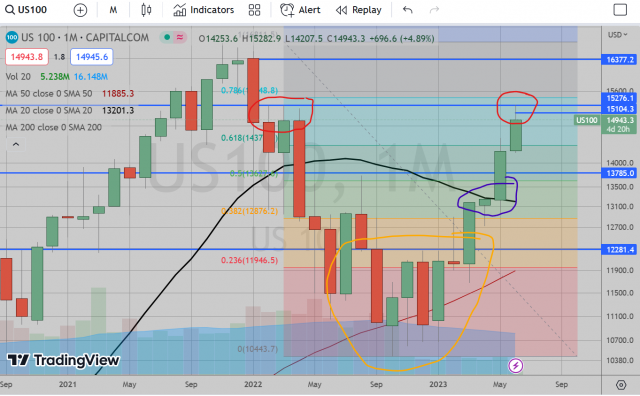

This index managed a massive bottoming pattern in the last quarter of 2022 (orange circle) with a false breakout in February (see that large wick for February which managed to close back beneath the prior month close?) followed by a false breakdown in March which then rallied straight up towards the 20 Month MA. Then, lots of chop and consolidation there in April (purple circle) leading to May’s further breakout above this key average. These are two quite bullish moves which, of course, leads to further FOMO and further buying to be expected.

However, we did manage to stop exactly at the prior resistance level from 1Q 2022 at 15,275 (See red circles. We actually eked above it at 15,282 this past month). So far, we’ve seen a very short-term pullback just slightly from here last week with the first red weekly bar since February. The question is, does this index react further to this level and reject or just continue on marching through this level? Only time will tell. I will say that it is important to consider the skewed nature of this index.

As of this weekend, the top 7 stocks in the Nasdaq make up 50% of the entire index by weight (in order of weight MSFT, AAPL, NVDA, AMZN, META, TSLA, GOOGL). A lot of this is due to those two letters “AI”. Which tells me one thing. Either the rest of the market will suddenly “catch-up” to these 7 stocks (perhaps by saying they are using AI to flip burgers and mop floors I guess?) or these 7 stocks slip on a banana peel and the pebbles holding up this rally will give way a bit. Either way, I think we are due for a bit of a pullback. July should give us at least a retest of the June candlestick low around 14,200. Should this recent pullback be done, however, and we start the march higher, then this breakout will take us to retest all-time highs by mid-July at 16,600.

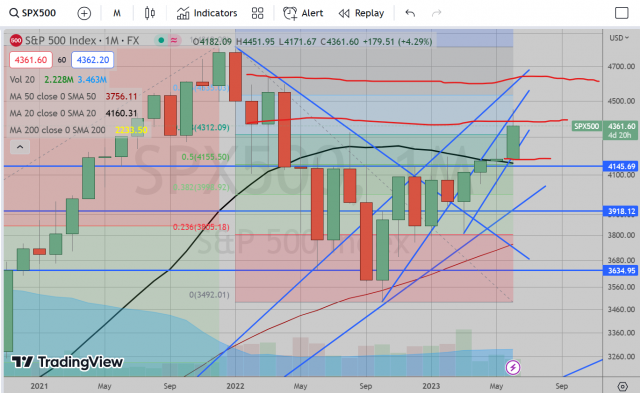

Much like the Nasdaq, the S&P 500 has also managed a fantastic basing pattern in late 2022 to breakout in 2023. This entire month is the breakout bar above the breakout level of 4180 from this entire basing pattern. If we manage to see any faltering/pullback as I was mentioning in the Nasdaq section above, then there is potential to retrace this candle and give this breakout its key test of this level as prior resistance-turned-support. However, if the march continues on, then we slice through this most recent high of 4450 and should be able to test 1Q 2022 highs of 4640.

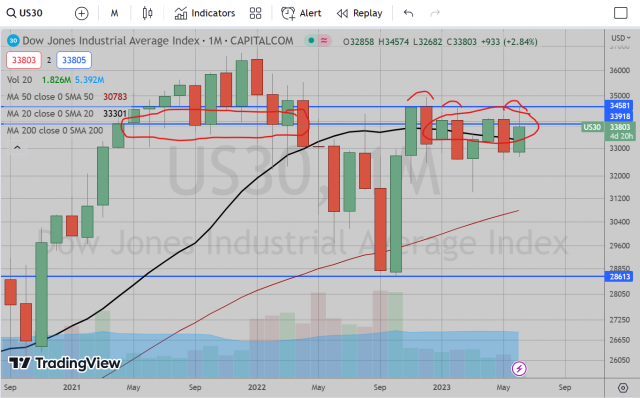

Throughout this bear market, this index seemed to have the shallowest drawdown and quickest bounce back. In an unusual turn, however, this bounce back completely stalled and has not been able to make any real gains beyond this 33,800 level. There was an attempt to escape in November 2022, a second weaker attempt to breakout in February this year, and finally this past month. So apparently, the further we get from tech the weaker the index.

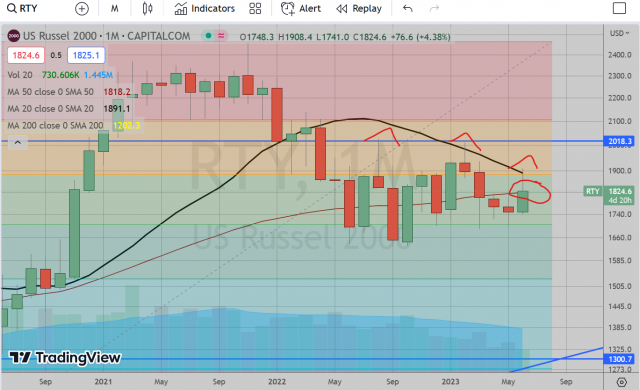

This, perhaps, is the best representation of the actual performance of the majority of stocks simply because there are no “AI” stocks to skew the weighting. While we haven’t managed to actually collapse, we have managed 2 failed breakouts on the monthly chart (which both stalled just slightly above 2000). The most recent basing pattern seems more like a short squeeze attempt to push off the lows which is already failing and can potentially close beneath the 50 Month MA. This should be set up to head downward and break the past year’s lows by the end of this year.

So putting all this together, the story I am hearing from the charts and headlines is that AI is the hotness which will lead us to the next phase of humanity. Excluding the AI stocks, however, there is little rally to be had. In fact, when we boil this down to reality, the BANKS are performing quite shitty, and with good reason. The regional banks were hit this past year due to poor money management (ain’t that always the story). There will be more of these as interest rates continue to be jacked up. Big banks, while well capitalized (theoretically since they have stricter capital allocation requirements than regional size banks), there has been talk about increasing those capital requirements. This would be very detrimental to bank profitability as they need to allocate more capital to remaining liquid. So while the bulls awe at the advent of Artificial Intelligence in the sky, their money is slowly burning the ground under their feet.