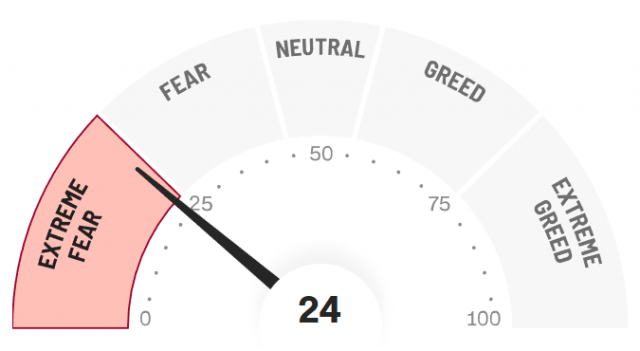

The weakness for most of this month has definitely spooked our bullish friends, as the sentiment gauge has quickly drooped into fully scaredy-pants.

But the buyers will come back, and in greater numbers.

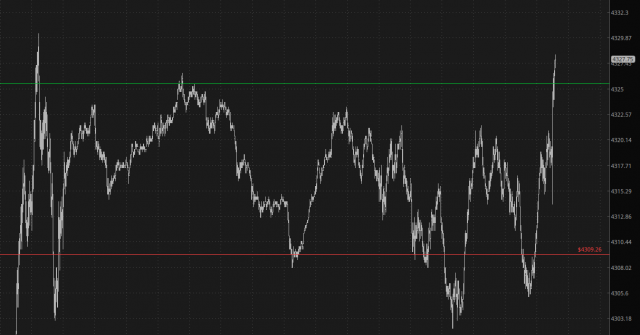

In the meanwhile, we have been locked in recent days by two two potent lines: the green one representing the price gap, and the red one representing the Fibonacci. We’re just banging in between these things like something banging in between two things.

If the bulls (which is virtually every human on the planet) manage to conquer this quagmire, we could be in for an approximately 75 point rally on the /ES. Painful as that would be, it would be the Setup Of The Year for the bears, so, yeah, I’m kind of hoping for people to lose their senses again and buy stocks because they’re, ummm, on sale.

My present portfolio configuration is:

- 27.9% cash (the highest in a long time);

- 11 bearish equity positions with puts ranging from January to May of next year;

- 3 bearish ETF positions EWZ (March exp), QQQ (expires tomorrow!), and SMH (January)