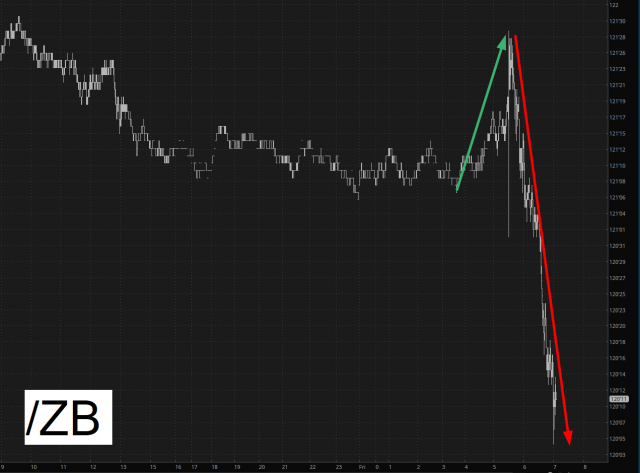

After the weak jobs report came out, all assets exploded higher. As I type this, about an hour into the trading day and about two hours after the data, every single stock index is still green (with the small caps up well over a full percentage point), but I’m intrigued by what’s going on with the bonds, which are NOT buying the “new bull market” schtick. Yes, they had a pop at first, but it was followed by a fairly meaningful drop.

We can see this reflected in the TLT (the ETF for bonds) which has an absolutely dynamite right triangle topping pattern.

Before the market opened, I looked at my NVDA puts and thought, “Well, fellas, yer gonna get shot”. However, their peak was at the opening bell, and it was a free-fall since then. They are nicely profitable again, and I’m glad not to have been hasty!

I’m down a little today, but only a little, and considering this jobs report what EXACTLY what the bulls wanted to see, I’m confident we’re going to shake this nuisance right off.