As we wrap up quadruple-witching week, let’s take a fresh look at five important cash indexes.

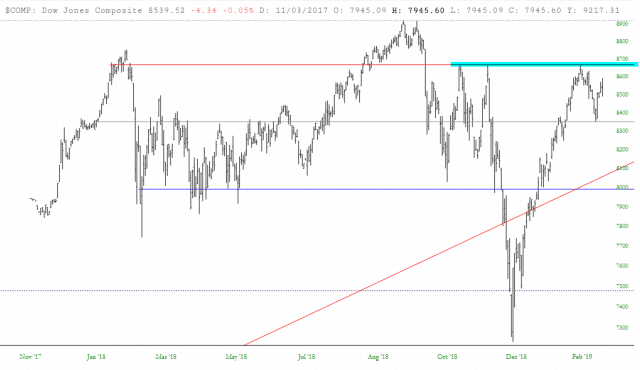

We begin with the Dow Composite (also known as the Dow 65). It’s all about that tinted line, folks. Cross above it, and the bulls are going to take this decade-long bull market to new highs. Continue to be repelled by it, and the countertrend rally that start on Christmas is going to crumble.

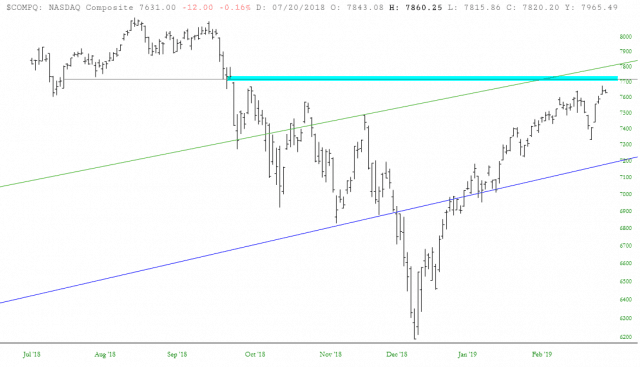

The NASDAQ Composite is in a similar situation. I would particularly point out that the similar horizontal line is anchored to the price gap that took place on October 10th of last year. This gap has yet to be closed, although it has become terrifically close.

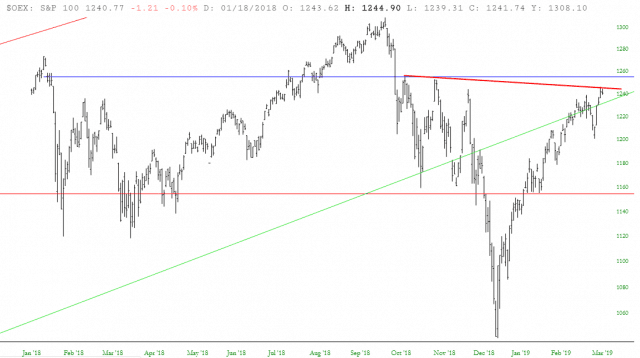

The S&P 100 has been slowly – – almost imperceptibly – – losing momentum, as the (very slight) descending trendline in red indicates.

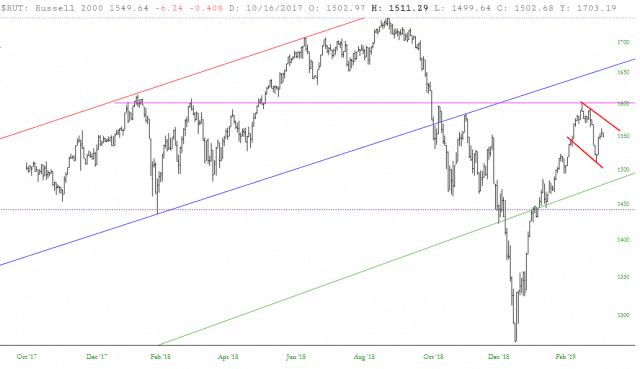

The Russell 2000 has been particularly weak, relatively speaking, although it is still sporting the threatening looking inverted H&S pattern that almost every other index is.

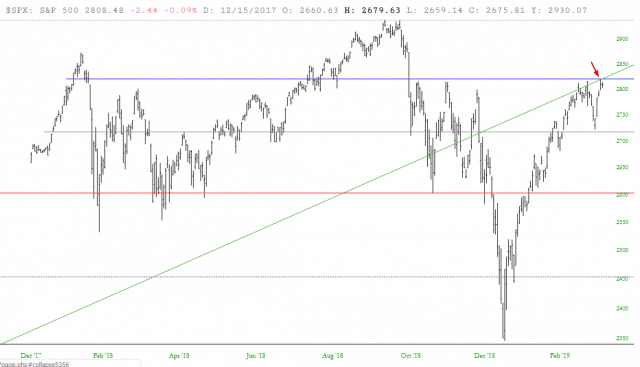

The most potent repulsion right now is the decade-long trendline for the S&P 500, whose prices (as of this writing, at least) are precisely beneath. The trendline was broken months ago, and this historically strong rally has mashed prices right back up toward resistance.