Many Slopers gathered last night to watch the House pass the debt ceiling bill, and the vote wasn’t even close. For all the bluster and hoo-ha, the vast majority of Congress voted for it, and now it moves on to the Senate. I daresay this thing is going to be law by Saturday. Good. I’m sick of hearing about it, and even sicker of writing about it.

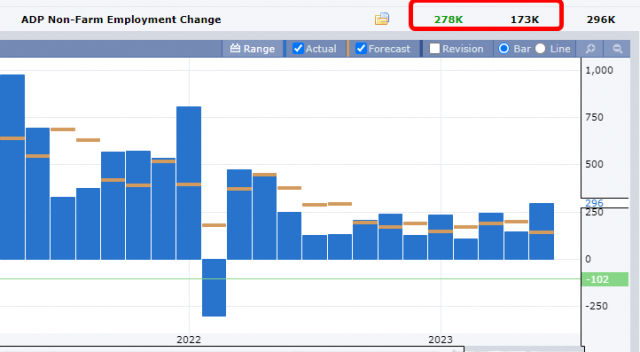

This morning, some minor employment data came in, and jobs seem to be quite strong, with the employment change far more positive than anticipated.

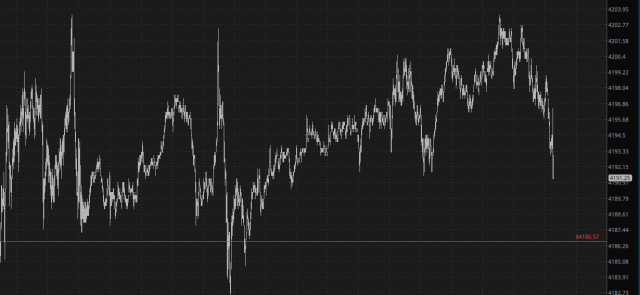

This managed to push markets slightly red, although the range has been super-tight for the past twenty hours or so. Maybe after this weekend this entire debt ceiling nonsense will be 100% behind us, and we can move on to the important business of the markets withering away for the next few months until the next ridiculous bailout.

A strong sign that the bears were fully in charge again would be the failure of support on the /RTY. This range is a full eight months old at this point.

I also suggest keeping half an eye on crypto, which is teasing a possible top as possible but, as with equity markets in general, seems stubbornly intransigent.

I am very comfortable with this being a stock picker’s market. We have been hanging out here at 4200 on the /ES for God knows how long, but my positions are doing just fine. Long-life times such as OKTA are getting absolutely nuked, and meme stock AI is the biggest loser after hours out of all the stocks in the nation. It’s nice to see this AI farce fall flat on its face.

I’ve said it before, and I’ll say it again: ChatGPT is beyond useless, AI isn’t going to amount to even 1% of what is being screamed from the mountaintops, and NVDA (which is already down 10% in just a day) has a long, long way to go. Trillion dollar market cap my ass.

Anyway, I’ve got 17 positions and 10.8% cash, and I’m ready to put the whip cream and nuts on this banana split now that D.C. is about to STFU about their insane debt deal. Onward and downward!