For decades, Japan was a value trap. That changed in March when the Tokyo Stock Exchange launched a plan to unlock value in Japanese stocks. Companies trade at discounts to their net cash in many cases and have for years, but that’s changing. PDF: Action to Implement Management that is Conscious of Cost of Capitaland Stock Price

Now that the TSE wants companies to focus on cost of capital and capital efficiency, the long nightmare of value investors in Japan may finally be over, and the charts look good too.

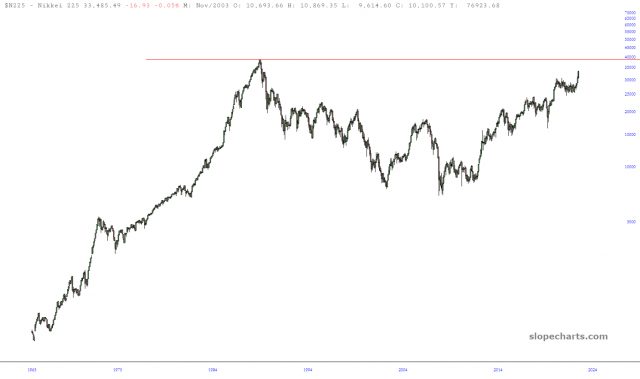

First is the Nikkei. I see a massive 40-year base. In context with where I see the U.S. market, I expect a pullback that forms the handle rather than a runaway breakthrough.

However, there is the currency variable.

EWJ is the main Japan ETF. It has the same pattern as the Nikkei, but has underperformed because the yen has depreciated.

My favorite Japan ETF is DXJ. It is not only currency-hedged, but also tilts the portfolio towards stocks that should benefit from a weaker currency.

Finally, here is the ratio of the Nikkei to the S&P 500 Index. It double bottomed, going slightly below the 2012 low last year.

The dream setup from here would be as follows. Japan continues its recently launched stock market reform. The currency devalues during the nasty global bear market that many Slopers have been expecting, but the Nikkei-SPX ratio (or at least the currency-adjusted ratio) doesn’t make a new low. Then it will be time to go long Japan without currency hedged exposure and ride what could be a major bull market that runs for the better part of a decade, if not longer.

Shorter term, the best strategy lies in buying the many small-cap stocks trading below their net assets. One such portfolio can be seen here.