First Half Performance Update

Happy Independence Day, fellow Slopers. As we head into the second half of the year, here’s an update on how our top names and hedged portfolios handled the first half.

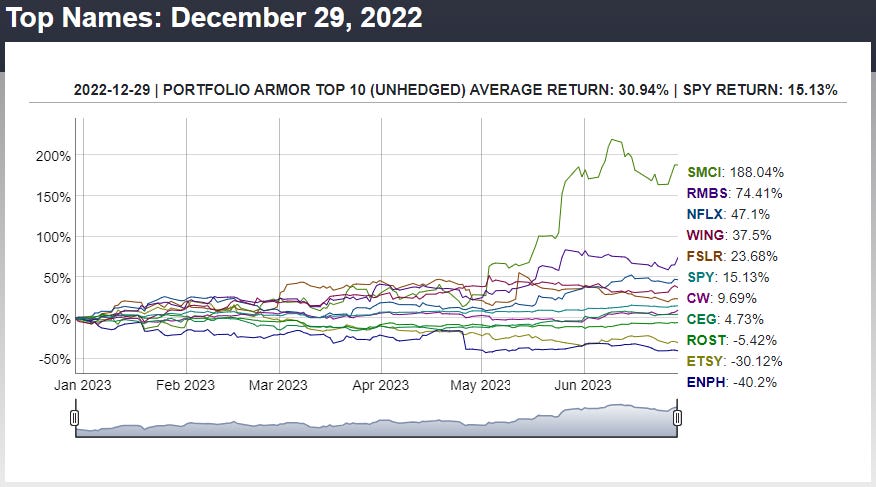

Top Ten Names Performance

On the Portfolio Armor website, we track performance of our top names and hedged portfolios over six-month periods. Here’s how our top ten names from December 29th did over the next six months:

As you can see, they more than doubled the performance of the SPDR S&P 500 Trust tracking ETF (SPY 0.09%↑) over the time period, led by picks & shovels AI names Super Micro Computer (SMCI -0.99%↓) and Rambus (RMBS -1.10%↓).

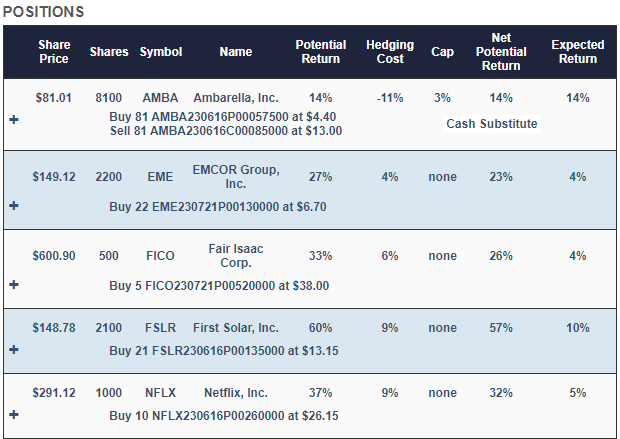

Hedged Portfolio Performance

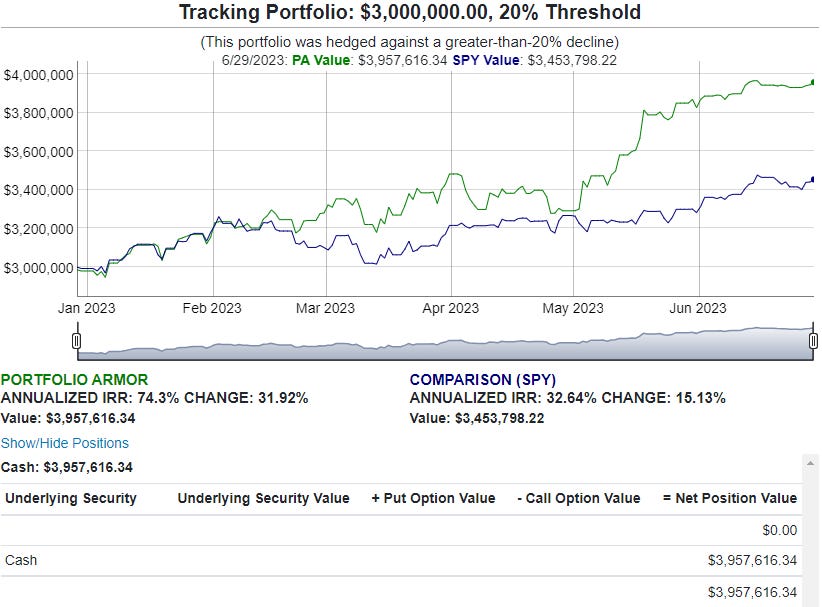

On the PA website, we use these top ten names as starting points when creating hedged portfolios for investors. This was a hedged portfolio created on December 29th for an investor with $3 million who was unwilling to risk a decline of more than 20% over the next six months:

The bottom seven names in this hedged portfolio were selected because they were the ones with the highest estimated potential return, net of hedging costs, when hedging against >20% declines. Our site started with equal dollar amounts of each, and then rounded them down to round lots (numbers divisible by 100), to lower hedging costs. Then it used a tightly collared position in Ambarella (AMBA 1.27%↑) to absorb most of the leftover cash from that rounding-down process.

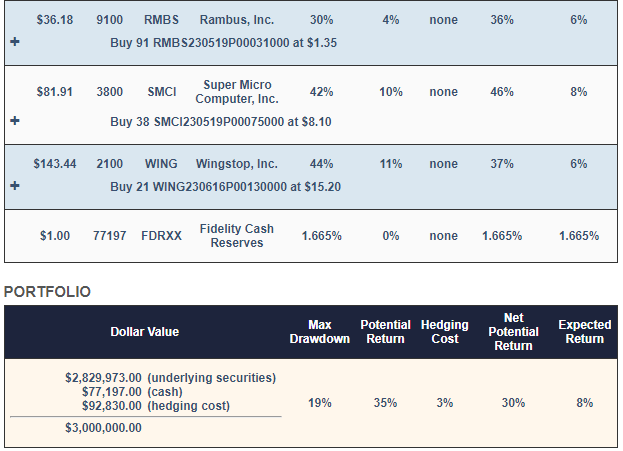

The expected return, as you can see in the portfolio summary at the bottom of the image below, was 8%, and the “net potential return” (estimated maximum return, net of hedging cost) was 30%. Here’s how the portfolio actually did:

Net of hedging and trading costs, this portfolio was up 31.92%, versus a 15.13% return for SPY. You can find an interactive version of the chart above here.

And if you want to create your own hedged portfolio (for dollar amounts as small as $30,000), you can subscribe to our website by clicking the image below (a website subscription includes complementary access to the Portfolio Armor trading Substack–just email me after you subscribe).