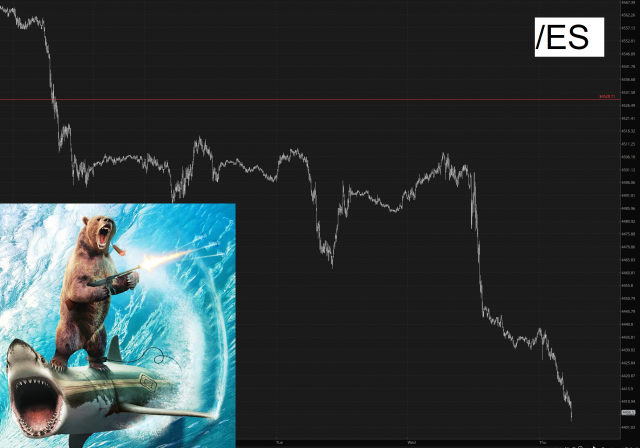

This is starting to feel tremendously fun, and that should probably scare the hell out of me. If you’re ever curious what kind of market I enjoy, it looks an awful lot like this:

Permabull shills for Goldman Sachs like Zerohedge are already calling for the “end of the bear market”, even though we were at goddamned 12 on the VIX just a few days ago. If the market blows to pieces, you’ll see ZH pretending it’s been bearish the whole time. Nope. They went full permabull a year ago and have been pissing in bearish faces ever since.

We see here a tremendous diamond pattern on the NQ futures. The game’s over. This isn’t 2020 anymore, people.

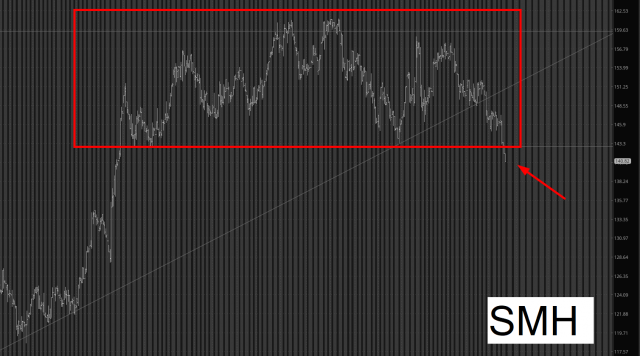

VASTLY more exciting to me is what has happened to semiconductors, which I haven’t been able to shut up about. THE PATTERN IS COMPLETE.

Naturally, I have felt the permabullish sentiment acutely. Slopers are, shall we say, a tight-fisted lot, with some folks hanging around here for over a decade without every contributing a cent. More dismal, I’ve had a complete washout in subscriptions from summer of 2022 until just a couple of weeks ago, as shown below.

That, to me, is illustrative of just how persistent the fall is going to be, because I’m an actual contrarian and believe all of these {colorful characterizations redacted} who cancelled are going to be kicking themselves and will sign up again at the WORST possible time, whenever that happens in the future.

Oh, and so as not to end this post on Olivia Jade and her weird-looking legs, I offer one more delicious chart, which is the bonds. This is almost in its 5th year of its own bear market, and the failure of this latest support is going to cause global calamity. Yay!

The morons and thieves in D.C. (notably Powell and Yellen) will try to come up with some new scheme to combat reality, but at some point it’ll be bigger than they are, and they are going to be shamed, humiliated, and despised, just as I’ve been recommending since time began. We can agree I’m ahead of my time.

When I’m popular, that’s the time to cover. I’m not. So I’m not.