Good morning, Slopers! Isn’t this market a blast? And I say that on a morning when the quotes are ALL green. Doesn’t matter……….this is the most enjoyable and most CHARTABLE market I’ve seen in years.

Of course, the mainstream media, which is 99.99999999% permabullish, is spending all its energy looking for reasons for the market to bounce and stating just how insanely oversold things are. Here’s a favorite (take note of the headline……..):

I am fairly well loaded up on puts right now, with just 5% cash, but I’m probably going to be doing a little profit-taking here and there, just so I can add to the mountain of regrets I’ve experienced over the past couple of weeks and the smattering of triple-digit gains I’ve managed to avoid.

Admittedly, the market has gone down a lot, and the exuberance has vanished. Looking at the /ES, the Fibonacci (red line) did an AMAZING job of providing support, and the price gap level (green line) is serving as higher support as I am typing these words about an hour before the opening bell.

Looking at the /ES longer-term, you can see what a jaw-dropping top exists, but you can also see there could be as much as 75 points of upside before we hit any kind of important resistance. Not an appealing prospect for someone with so many puts, is it?

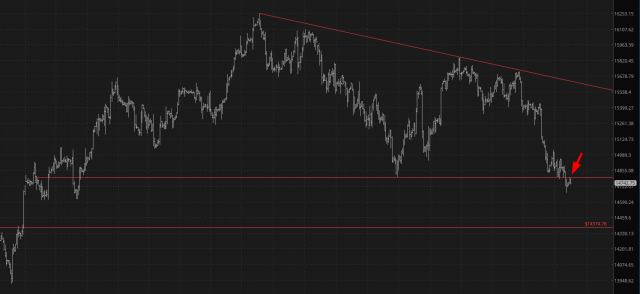

Interestingly, the NASDAQ provides a little more hope. In this instance, the price actually is below resistance.

The resistance line I am referencing is the neckline of a massive H&S top.

Remember how, over the course of the 2009-2021 bull market, there was a steady stream of market forecasters (on the fringe) who would post charts showing the market going STRAIGHT DOWN from whatever level we were at? It never transpired, but it always managed to get the dwindling population of bears briefly excited.

I’m beginning to see precisely the opposite these days. For instance, ElliottWaveClub (which has three times as many followers as I do) tweeted out the chart below, which shows the market magically, and for no required reason, ripping to 5300. Who am I to argue with this? But such an outcome would be simultaneously surprising and disappointing.