Hedging Foreign Currency ETFs

For this post, I looked at the hedging costs of a basket of foreign currency ETFs. Something that jumped out of me when running the numbers on them was the hedging cost of the CurrencyShares Aussie Dollar Trust ETF (FXA). Not only was it the most expensive of these currency ETFs to hedge; it was also more than twice as expensive to hedge as the CurrencyShares Euro Trust (FXE). Given the continuing crisis in the Eurozone, I found that interesting.

The table below shows the costs, as of Thursday's close, of hedging FXA, FXE, and 4 other foreign currency ETFs against greater-than-15% declines over the next several months.

A comparison

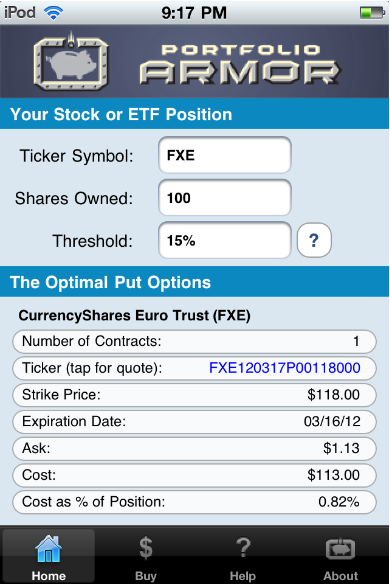

For comparison purposes, I've also added the cost of hedging the PowerShares US Dollar Index ETF (UUP) against the same decline. First, a reminder about what optimal puts are, and a note about decline thresholds; then, a screen capture showing the optimal puts to hedge one of the currency ETFs listed below, CurrencyShares Euro Trust (FXE).

About Optimal Puts

Optimal puts are the ones that will give you the level of protection you want at the lowest possible cost. Portfolio Armor (also availabile as an Apple iOS app) uses an algorithm developed by a finance Ph.D. to sort through and analyze all of the available puts for your position, scanning for the optimal ones.

Decline Thresholds

In this context, "threshold" is the maximum decline you are willing to risk in the value of your position. You can enter any percentage you like for a decline threshold when scanning for optimal puts (the higher the percentage though, the greater the chance you will find optimal puts for your position). I usually use 20% thresholds when hedging ETFs, but I've used 15% thresholds for these currency ETFs.

The Optimal Puts For FXE

Below is a screen capture showing the optimal put option contract to buy to hedge 100 shares of FXE against a greater-than-15% drop between now and March, 16, 2012. One note about these optimal put options and their cost: to be conservative, Portfolio Armor calculated the cost based on the ask price of the optimal puts. In practice an investor can often purchase puts for a lower price, i.e., some price between the bid and the ask.

Hedging costs as of Thursday's close

The hedging data in the table below is as of Thursday's close.

|

Symbol |

Name |

Cost of Protection (as % of position value) |

| FXA | CurrencyShares Aussie Dollar | 1.71%* |

| FXE | CurrencyShares Euro Trust | 0.82%* |

| CYB | WisdomTree Dreyfus Yuan | 0.98%** |

| FXY | CurrencyShares Japan | 0.23%* |

| FXB | CurrencyShares British Pound | 0.96%* |

| FXF | CurrencyShares Swiss Franc | 0.86%* |

| UUP | PowerShares US Dollar Index | 0.14%* |

*Based on optimal puts expiring in March, 2012

**Based on optimal puts expiring in April, 2012