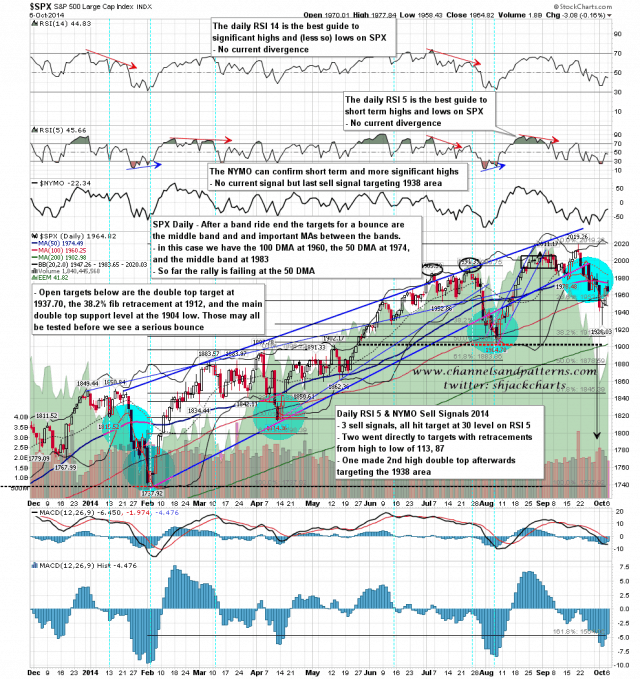

At the end of a band ride the targets for any move away from that band are firstly the middle band, but also any important MAs that lie between the two. The middle band is at 1983, in my ideal target zone for this rally, but between the bands are the 100 DMA at 1960, and the 50 DMA at 1974. The high so far is a fail at the 50 DMA and it’s possible that was the rally high. If so we will most likely find out today. SPX daily chart:

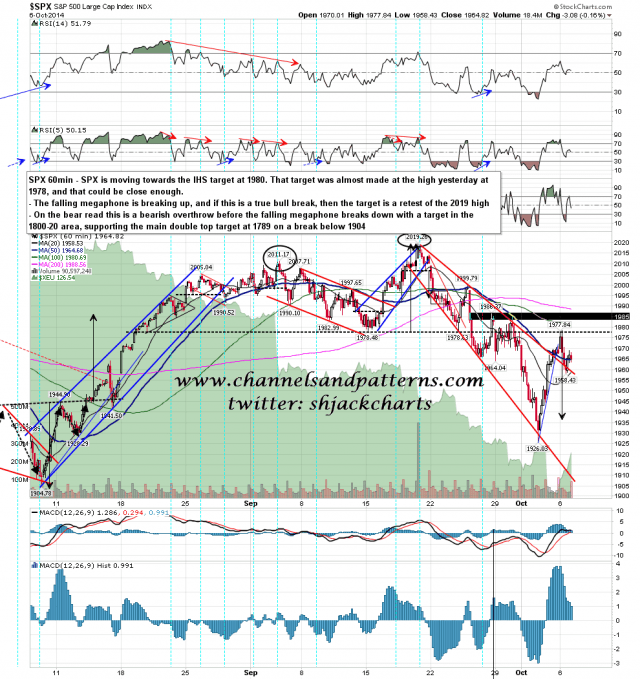

On the 60min chart the IHS target at 1980 was almost made at the high yesterday. I’m favoring at least a retest of the highs today or tomorrow morning, but that could be close enough. SPX 60min chart:

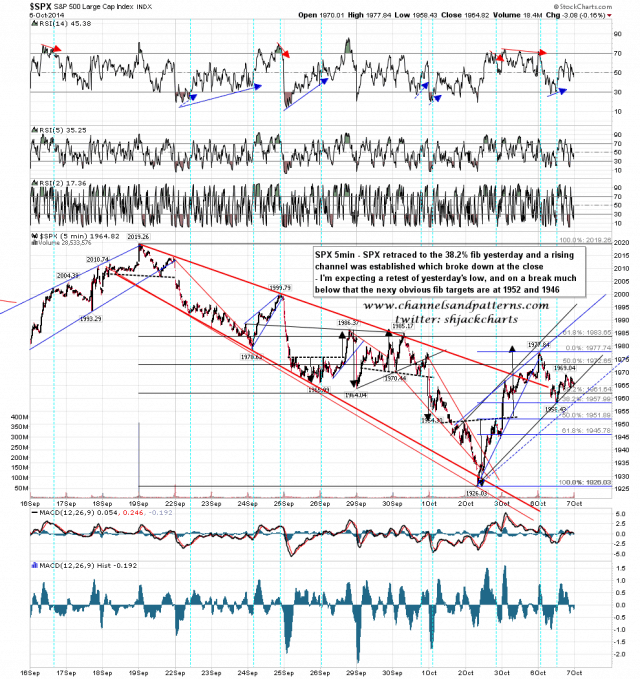

If this rally isn’t yet over, then the 38.2% fib retracement was hit at the low yesterday, and a rising channel from last week’s low was established there, though that broke down at the close. If that was a bear flag then the A=C target would be the 50% fib retracement in the 1952 area. If that should break then the 61.8% fib retrace target would be in the 1946 area, and on a break much below there I would increasingly be leaning towards thinking that the move to test main double top support at 1904 had started. SPX 5min chart:

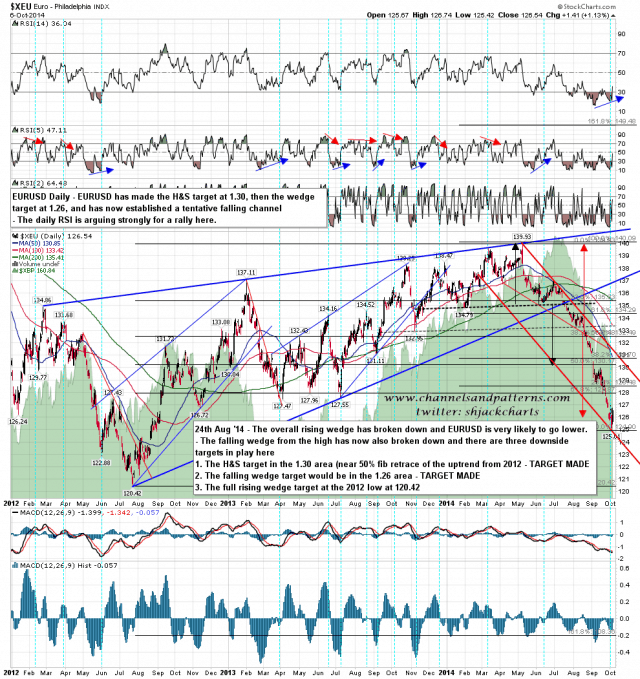

It has been a great run on EURUSD since I called this short in July. the H&S target at 1.30 was made, and then the falling wedge target at 1.26 was made as well. All good things come to an end though and EURUSD looks very ready to rally now. I’m expecting a low to be made here and then a rally with the obvious target in the 1.30 area or higher. EURUSD daily chart:

I am hoping that the rally high isn’t yet in but it could be. I’d suggest caution on the long side today, and if yesterday’s high should be retested, that should be a good short entry.