About five blocks from my house is the residence of Marissa Mayer, the CEO of Yahoo who is famous for being employee #7 at Google, very smart, very vain, and (mildly) good-looking. At the midpoint between our two houses is a funeral home which, oddly, she decided to buy a couple of years ago………

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Swing Trading Watch-List: BBY, GNW, LPX, SUNE, JBL

Economic Snapshot

Excerpted from this week’s Notes From the Rabbit Hole, NFTRH 314:

Our view has been that a stronger US dollar would eventually start to eat away at corporate results, especially in the manufacturing sector and at US based companies with a global customer base. The decline in revenues thus far is something to be watched because where revenues go, earnings eventually follow.

[edit: the segment previous to this one reviewed a contrast between strong earnings and sagging revenues with companies that have reported earnings thus far]

An article by Doug Short published at Business Insider on Friday illustrates how the Economic Cycle Research Institute (ECRI) called for a recession in 2011 and was promptly made to eat that call first by Operation Twist and then by balls out QE3. All the while as ZIRP has quietly whirred along in the background for 6 years. (more…)

Is High Yield Telling Us Something?

The Dow Transports hit a lifetime high today (see, that little sell-off that happened earlier this month – – didn’t mean a thing). The NASDAQ is near its highest level since the Internet bubble. The VIX has lost over half its value in just a couple of weeks.

But in spite of all this, the high-yield market seems to have stalled out. Yes, it had a big bounce from October 15th, just like everything else, but it doesn’t seem as, shall we say, irrationally exuberant as everything else. (more…)

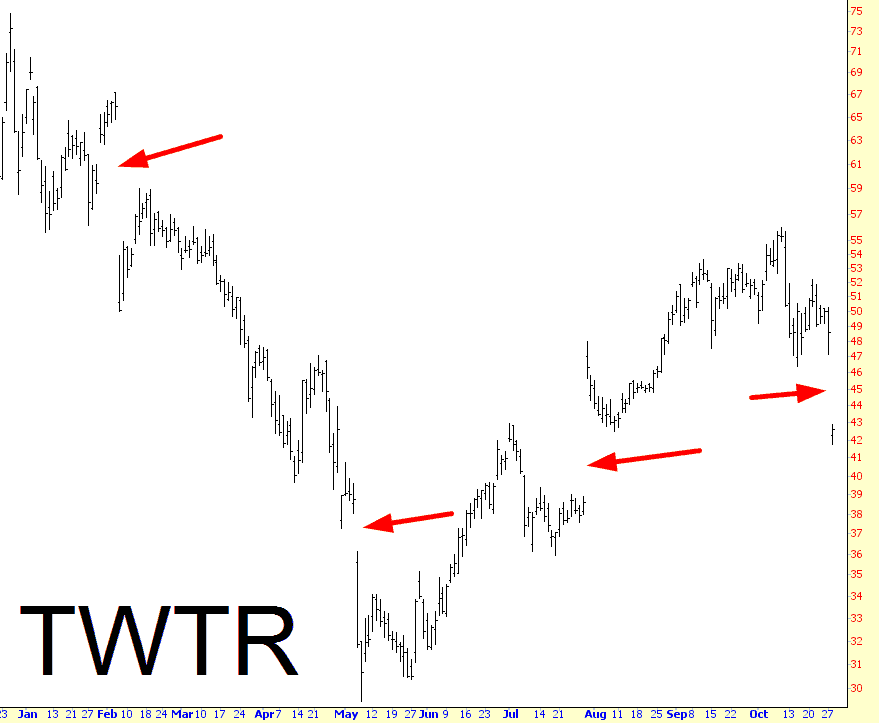

Batting One Thousand

In its entire history as a public entity, Twitter has had four earnings reports, and for all four of those, there has been a big price gap. Earnings yesterday after the close were no exception, and I was cheerfully short the stock (I thank Slopers for chattering so much about it, since it didn’t even occur to me to short the stock until you guys chimed in). One wonders if the day will come that Twitter’s earnings don’t shock the market in one direction or the other. I’ve covered.