One of the great ironies of Slope is that, in spite of it being formed as a charting/technical analysis discussion area, it has attracted a lot of folks who regard technical analysis as little better than astrology and palm-reading. All the same, in spite of near certain cat-calls and hoots from the crowd, I’d like to offer up a target low for 2015. I would add that this projection embraces my “scare the children” possibility laid out in this recent post.

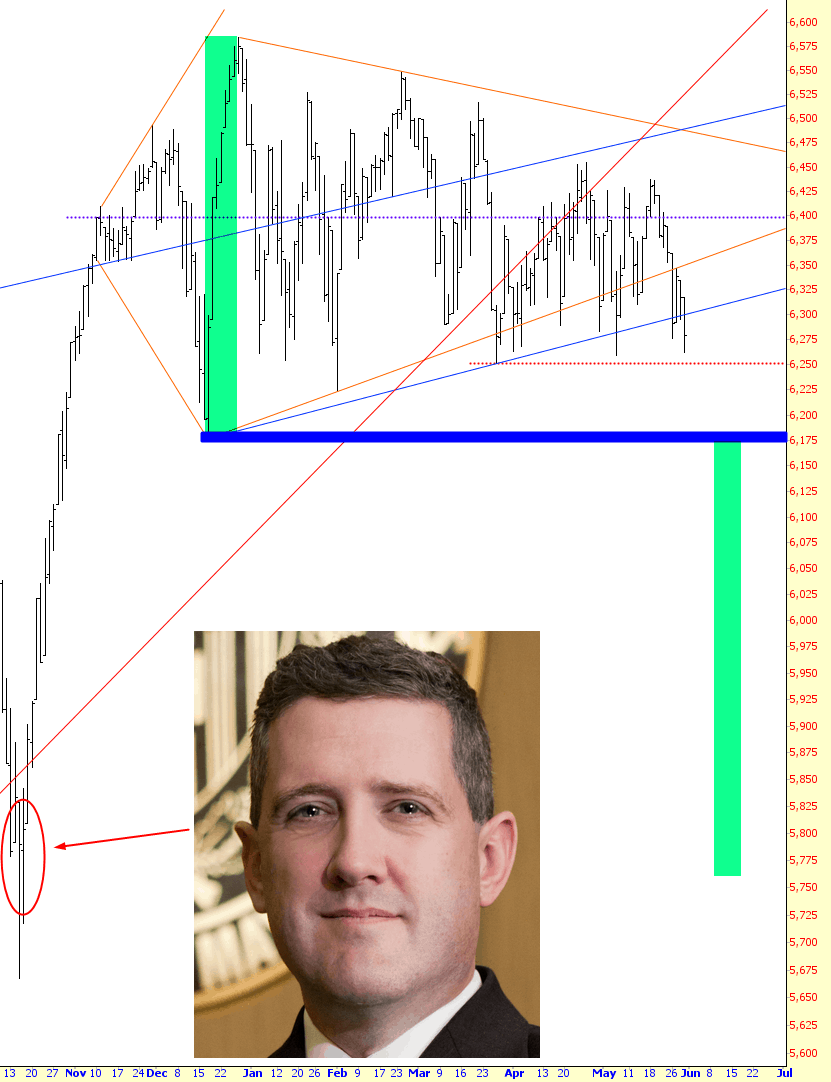

My focus is on the Dow Jones Composite, which is an index I hardly even knew existed when this year began but has become an obsession of mine. The Knight-original Ichthus pattern is one we’ve been tracking for months now, and if we can close below 6250 this week, I think it’s party time. The signs of the pattern failing are already before us.

Assuming the pattern genuinely fails (and “fails” is such a subjective, judgmental term, wouldn’t you agree?) my speculation is that the move from the pattern’s low will equal the pattern’s height, each of these denoted by the tinted green area below. Such a fall would put the index at about 5770 which, conveniently, helps it match the fabled Bullard Low of last October 15th, thus hammering in place a double bottom from which a strong rally could take place, creating badly-needed optimism for the Presidential election cycle.

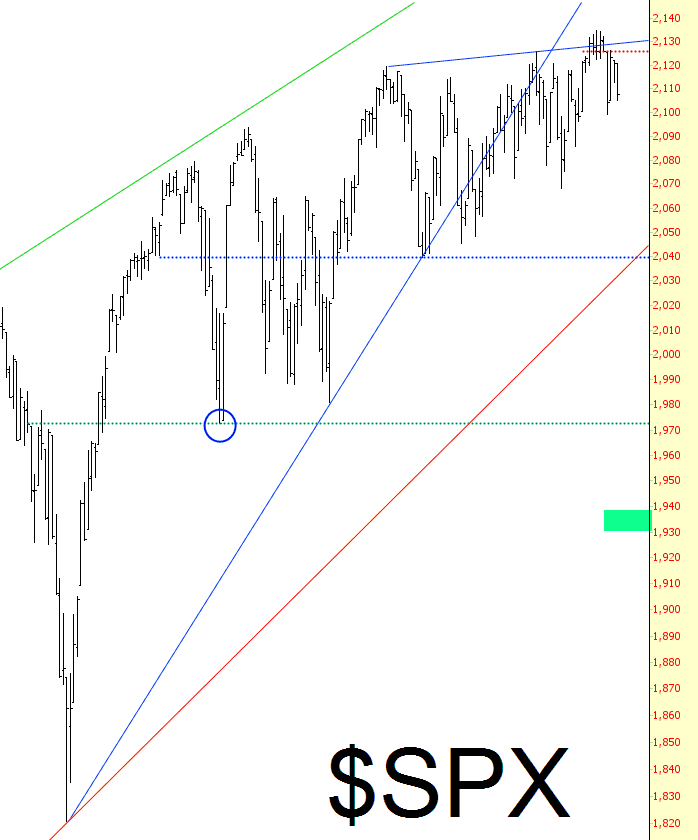

I was curious what a similar percentage drop would look like for the S&P 500, even though percentage changes from index to index definitely do not tend to match. In spite of this, I’ll say that a similar drop would put the S&P at about 1935, tinted below in green. My dumb guess is that we won’t get quite this far, instead probably stopping around the 1970 level or so, matching the lows we saw this year on February 2nd, circled below in blue. Let’s call it a truce and agree: somewhere between 1935 and 1975 (which, come to think of it, mark an era in US history of steadily-rising wages, a strong middle class, and a much more fair economy; but I digress).

Anyway, that’s it from me. Have a good Sunday, and I’ll see you when the new trading week (and new month) begins.