The $USD may have finished its bounce and may be ready to resume its downtrend. How can this happen with QE ending? One would think with QE ending, the $USD would be more scarce and valuable. But there is an opposing force. If a foreign bondholder believes QE is ending, their reaction would be to sell their bonds. To sell their bonds, they will sell dollars. The charts and commercial bond positions say the selling will overwhelm the buying. But the commercial currency positions are more neutral and missing the last three critical days of the dollar rebound.

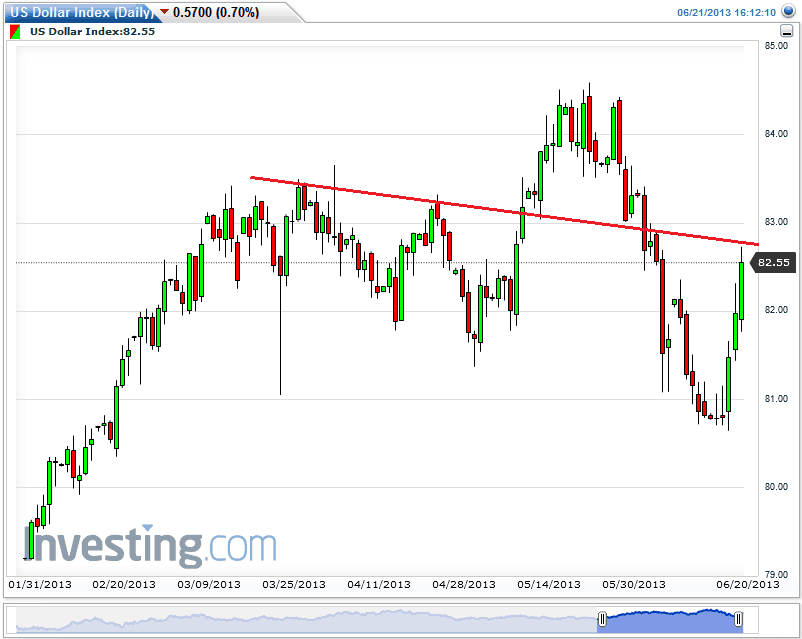

First let’s check the charts. Note how the $USD has reached a slanted resistance line. If it stops here, it will be forming a weak right shoulder to a slanted H&S with a target of 78.81. Now let’s check the individual component currencies.

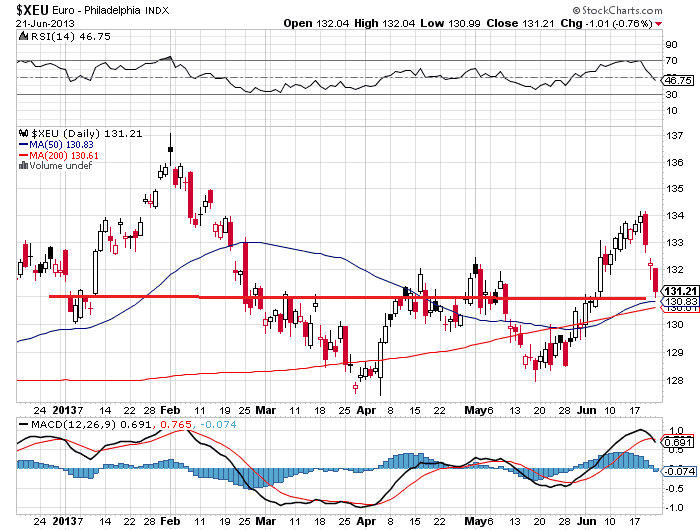

Here the Euro has reached a support line. The MACD is still showing strength despite the RSI having backed off to 50%.

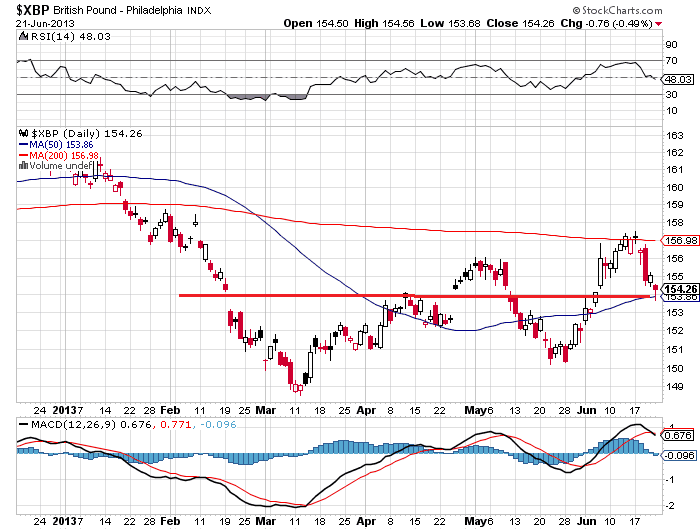

The Pound shows a similar configuration having reached a horizontal support line and a strong MACD despite the RSI having backed to 50%.

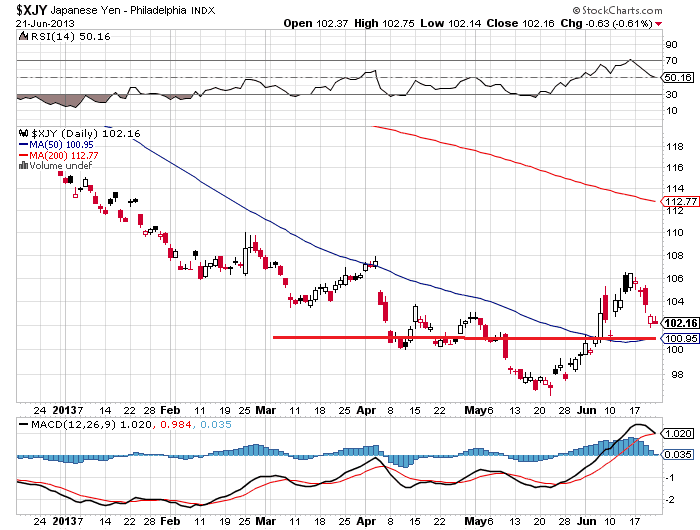

Lastly, the Yen has almost reached a support line with a strong MACD still in place. But it is possible the currencies will continue to fall and the $USD rise. Let’s check the commercial positions to see which way the trend will establish itself.

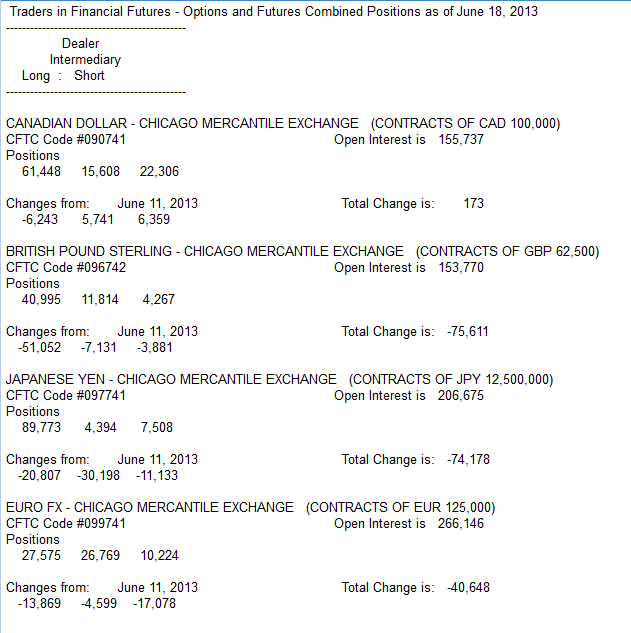

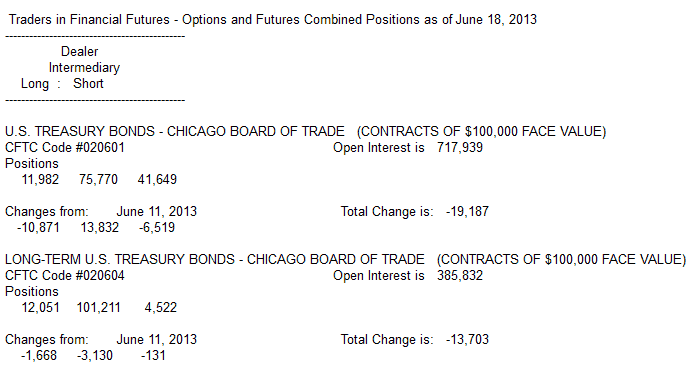

As one can see the commercials are long the Yen and Canadian Dollar, somewhat long the Pound and neutral on the Euro. The real problem is the data only covers up until Tuesday, missing the last three days which were the vicious dollar rebound days.

Now one shouldn’t make a trade based upon data that doesn’t exist. But for fun, let’s examine the situation. Either the commercials created the dollar rebound by selling their remaining positions or they took the other side of the trade from the hedge funds and rebuilt their positions. The facts won’t be known until next Friday, which by then will be too late to place a trade.

The consensus (hedge fund group think) on the FOMC meeting was to buy the dollar (sell the foreign currencies) because QE ending would make the dollar more scarce. Since it is unlikely the hedge funds and the commercials took the same side of the trade, it is likely the commercials rebuilt their long foreign currency positions. But that is just a guess.

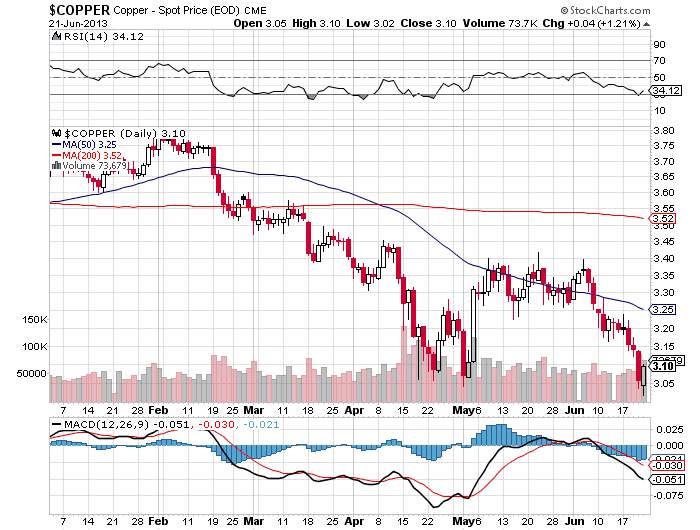

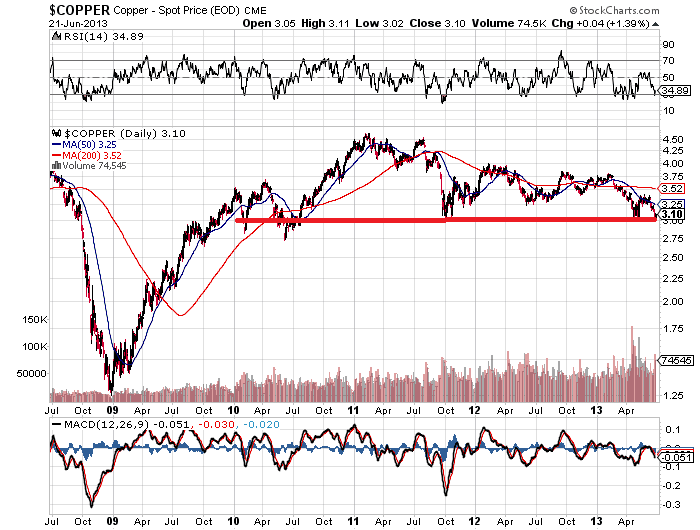

To recap, there is a chart case for an end to the dollar rebound, but the commercial data to support the charts will not be available until next Friday. Besides the extreme short bond commercial positions, are there other places to look for clues? Let’s look at the dollar sensitive commodities, copper for example. Copper is sporting a double (triple) bottom with the RSI oversold and the MACD showing a positive divergence.

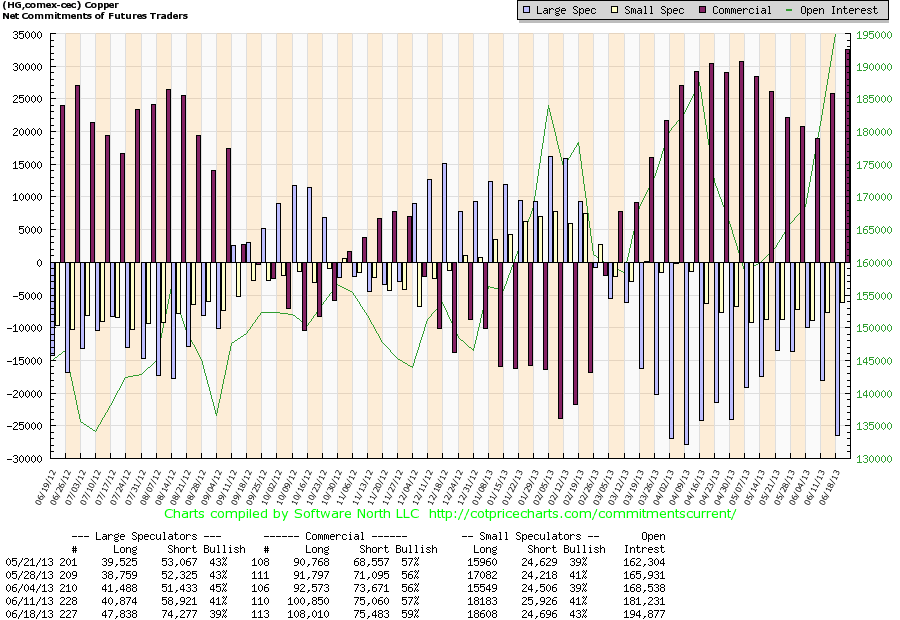

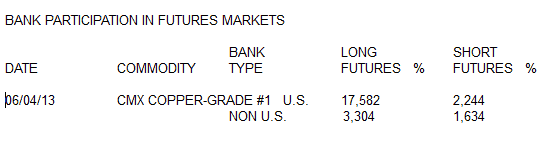

Plus the commercials are long and the Bank Participation report shows the banks are long. So the expectations are that copper will go up at least for an oversold bounce, which usually implies the dollar will go down.

One can also see that the support line for copper is a long term support line. If this line is broken, it would invite a fresh look at the economic macro factors at play.

Unfortunately, a better case cannot be made for the resumption of the $USD downtrend. It might be better to wait and see what other opportunities present themselves. Either that or use tight stops.