Last month, on July 13, I did an important post about an analog I was seeing with the market – – the Russell 2000 in particular – – which called for an explosive final move higher. The data points I was observing were labeled 17 and 18 (that is, with 18 being the final high), and in my post I wrote:

I do think, however, that the move from 17 to 18 is the final stage, and the scary part is, I think it could be a rocket-launch one. We are in the final move in which the few remaining bears either commit suicide or just quit trading for the rest of their lives, because the past 4.5 years have been so grinding and discouraging.

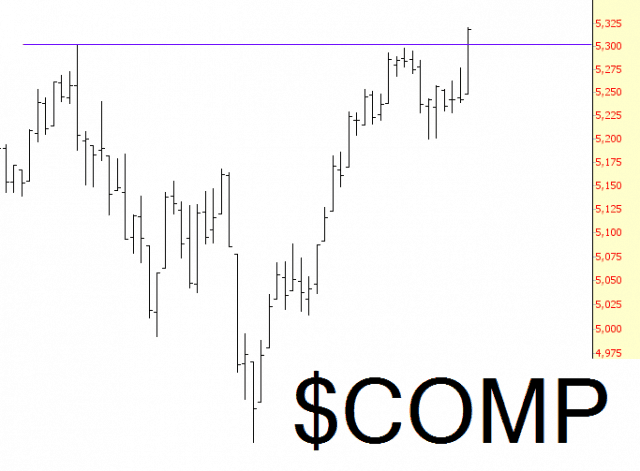

Well, we are definitely higher since I did that post (and this bear is definitely in a grim mindset, as alluded to above), and with lifetime highs (again) today on most indexes, the bulls are still firmly in control. Of course, the crossing of 1700 on the S&P 500 is great headline fodder, and looking at index charts, they don’t exactly scream “shorting opportunity”:

As I mentioned last night, I have resorted to cowering at a 50% commitment level. There are pieces of weakness here and there – gold and bonds, for example – but it’s quite obvious that the bid beneath stocks isn’t going away. It’ll be interesting to see if the specific target on the Russell I gave my Slope+ readers back on July 13 pans out. We’re not there yet.