As I’ve mentioned in the past, the two giant “long” investments in my life that have thrived (mainly because I’ve been stuck with them, and my dumb self hasn’t had the chance to dump them) are my house in Palo Alto and a venture investment I made in a thriving high-tech web business.

As for the house, its value doesn’t really give me any direct value (e.g. I couldn’t buy my Tesla by offering up 1/5th of a guest room), but it’s nice to know only nuclear war could be me in a losing position with it. Looking at real estate ads in town, I can tell you things have rarely been this frothy. People are clawing all over each other for the chance to overbid, and multi-million dollar houses sell the same week they are listed, often with a dozen bids.

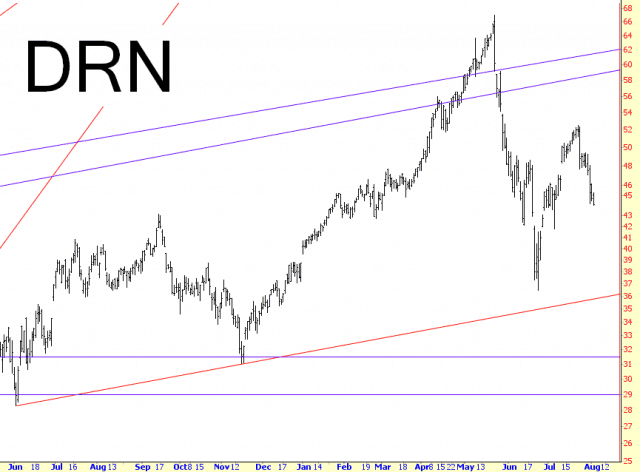

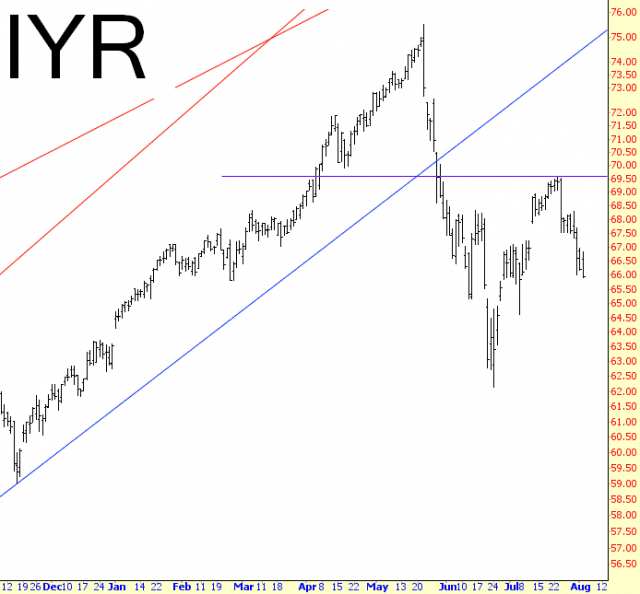

It’s funny how the monstrous financial disaster in real estate from six years ago seems to have been completely forgotten. Looking at the charts below, I’d say things are……vulnerable.

x

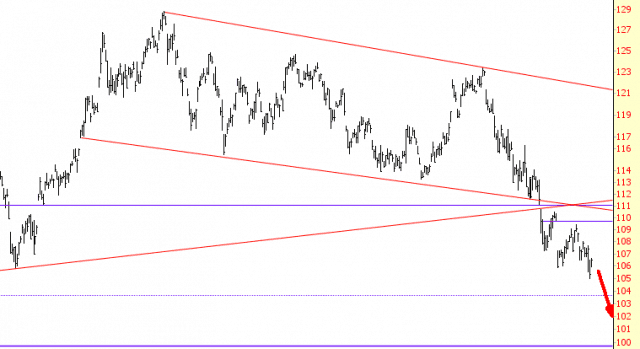

And the most important of all, bonds (TLT) which suggest highest interest rates ahead.