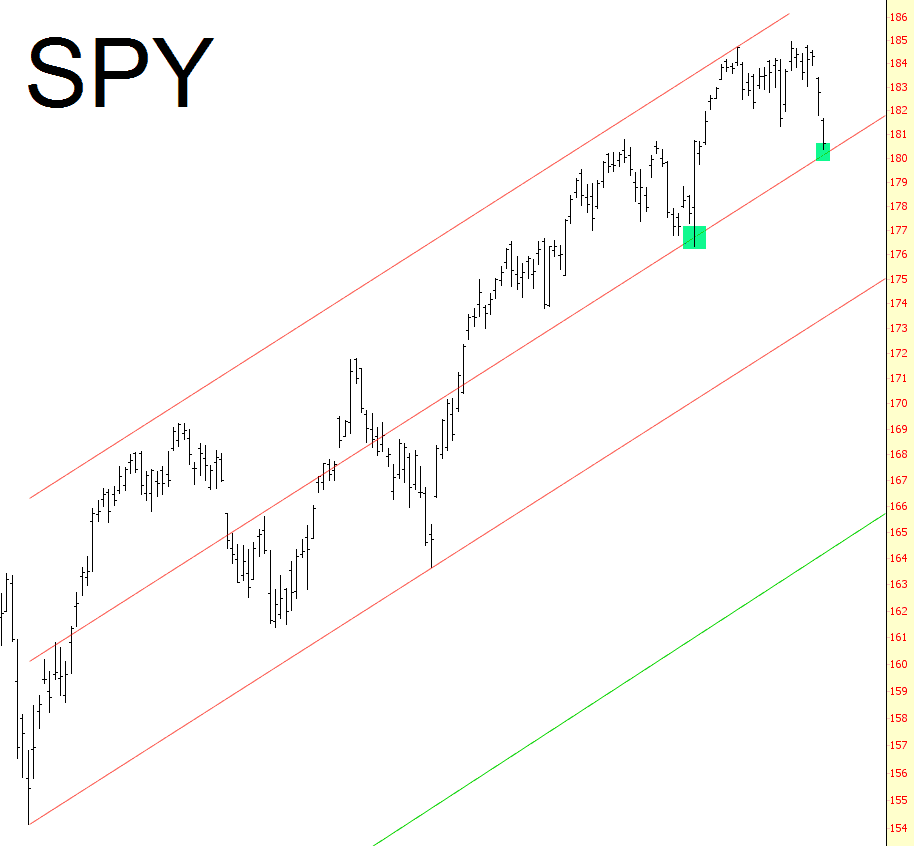

It’s all well and good that the market is falling to pieces, but I hate days like this, because I’m concerned we are nearing yet another bounce. I hate bounces. We’ve had five years of them, and they always wind up doing the worst thing possible: moving to new highs. I am seriously thinking of covering positions right now (not all, but some), but I’m going to do it on a stock-by-stock basis. Suffice it to say that my positions have done quite well, but five years of agony can break one’s will to stay firmly in position. Maybe it’s sensible. Maybe it’s foolish. But empirical data suggests our bullish friends might be getting into position soon. The median line of the channel below has to be broken. If it is, then we can start to break the spirit of those bastard bulls. Stay tuned.