In a post earlier this week, we looked at hedging one widely-traded stock that was within a few cents of its 52-week high, ADM (“Downside Protection For ADM”). Another stock in a similar position Wednesday was Intel (INTC). Shares of Intel rose fractionally Wednesday, closing at 26.98, within a few cents of their 52-week high of $27.12.

Checking Slope for recent mentions of Intel, I found this post from NFTRH or Intel longs looking to add some downside protection, here are a couple of ways to do so.

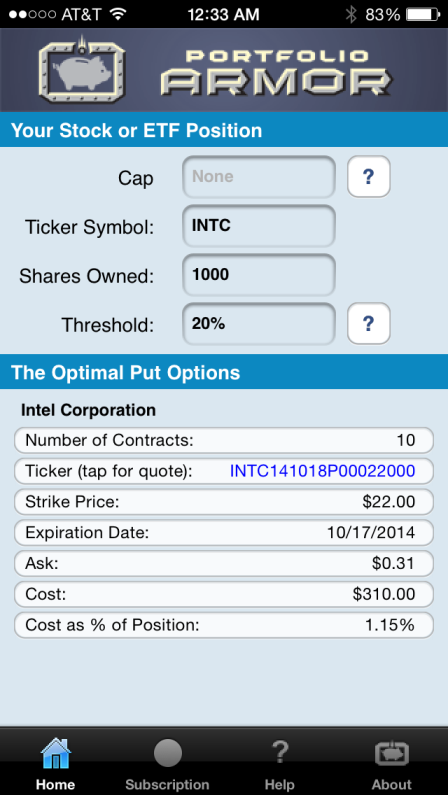

1) Hedging With Optimal Puts

1.15% cost. Uncapped upside.

As of Wednesday’s close, these were the optimal puts* to hedge 1000 shares of INTC against a greater-than-20% drop over the next several months.

As you can see at the bottom of the screen capture above, the cost of this protection, as a percentage of position value, was 1.15%.

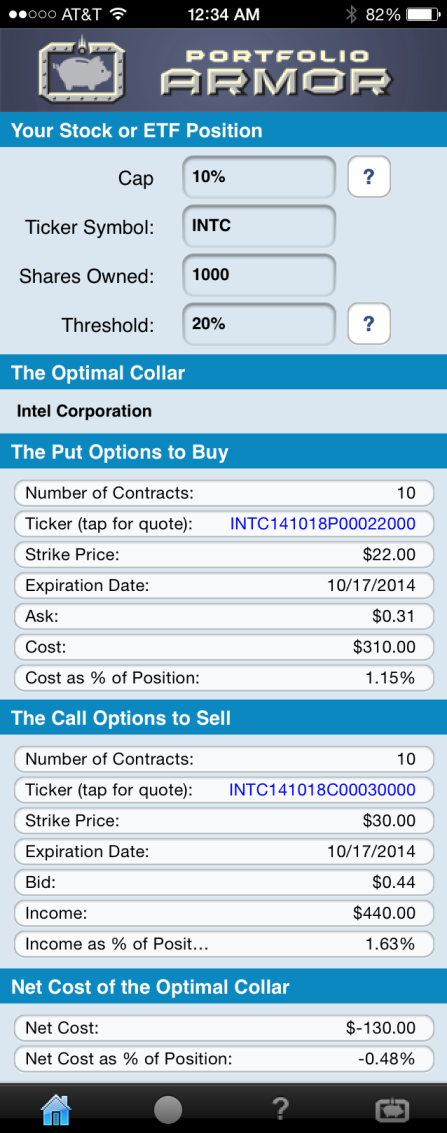

2) Hedging With An Optimal Collar

Pays you to hedge. 10% upside cap.

Intel was relatively cheap to hedge with puts, presumably because option market participants don’t think there’s a high chance of it tanking over the next several months. But they don’t seem to think there’s a high chance of it skyrocketing over the next several months either, which is why you’d need to cap your upside at 10% to fully offset the cost of hedging it against a greater-than-20% decline over the same time frame. If you were willing to make that tradeoff, this was the optimal collar** to hedge 1000 shares of INTC until October 17th.

As you can see at the bottom of the screen capture above, the net cost of this collar was negative, meaning you would collect more in income from selling the call leg than you’d pay to buy the put leg of this collar.

Note that, to be conservative, Portfolio Armor calculated the cost of this hedge by using the bid price of the call leg and the ask price of the put leg. In practice, you can often sell calls for more (at some price between the bid and ask) and buy puts for less (again, at some price between the bid and ask), so, in actuality, an investor opening the collar above may have collected more than $130 to do so.

Maximizing Return While Limiting Downside Risk

Optimal puts and optimal collars on securities with high expected returns can be used to build a hedged portfolio around a position, in order to maximize potential return while limiting downside. For an example of a hedged portfolio constructed around another tech stock – Microsoft (MSFT) – see this post.

*Optimal puts are the ones that will give you the level of protection you want at the lowest possible cost. Portfolio Armor uses an algorithm developed by a finance PhD to sort through and analyze all of the available puts for your stocks and ETFs, scanning for the optimal ones.

**Optimal collars are the ones that will give you the level of protection you want at the lowest net cost, while not limiting your potential upside by more than you specify. The algorithm to scan for optimal collars was developed in conjunction with a post-doctoral fellow in the financial engineering department at Princeton University. The screen captures above come from the Portfolio Armor iOS app.